Vehicle insurance business going thru tough times

The vehicle insurance business in Bangladesh is passing hard times as people are not interested in insuring automobiles in the absence of legal obligation as well as a lack of trust in insurers and promotional activities.

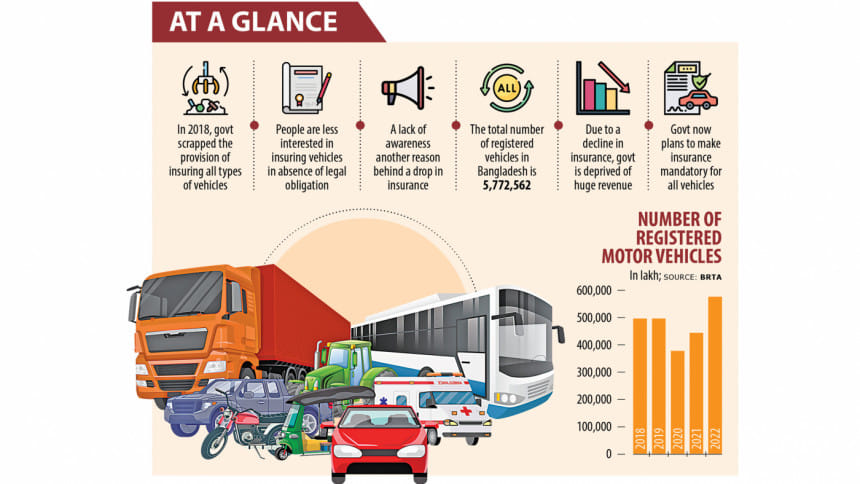

In the past, insurance was mandatory for all types of vehicles such as motorcycles, cars, buses and trucks. The government abolished the system in 2018, taking a toll on the insurance business.

Pioneer Insurance Company opened policies for 47,224 vehicles in 2020. It sharply fell to 11,747 in 2021 and 9,951 in 2022.

SM Mizanur Rahman, company secretary of the insurer, said when the government scrapped the law, people were not also giving much heed to the issue.

"If people don't buy vehicles on the basis of loans from banks or non-banks, very few of them would go for insurance. There are some corporate houses and compliant businesses that insure vehicles."

Insurance is mandatory for vehicles purchased using loans.

According to Rahman, many people don't trust insurance companies due to various reasons. "So, many don't insure their vehicles. If the government does not make it mandatory, the vehicle insurance business will lose its significance."

When vehicle insurance was mandatory, a large part of a company's income used to come from the segment, said Md Sarfaraz Hossain, company secretary of Peoples Insurance Company.

The company earned Tk 16.20 crore in premiums from vehicle insurance in 2017 and this increased to Tk 19.46 crore in the following year before coming down to Tk 7.94 crore in 2022.

"People don't understand the importance of insurance. It's sad," he said.

Another blow for insurers came in 2020 when the Insurance Development and Regulatory Authority abolished the motor third-party insurance, which is car insurance designed to protect the policyholder against the claims of other drivers in case of an accident.

In 2019, Reliance Insurance opened 40,000 third-party insurance policies and earned around Tk 20 crore as premiums.

After the abolishment of the rule, the number of policy openings fell to zero while premiums plummeted 50 percent, said Ramzanul Quadar Billah, vice-president of Reliance Insurance.

He blames the lack of awareness as one of the most notable factors for customers not buying motor insurance.

Mainly multinational companies and some local companies that have prioritised risk management are availing comprehensive motor insurance, Billah added.

Abdullah Al Maruf, a resident in the capital's Pallabi area, said he has been riding a motorcycle for the past several years without any insurance.

He did not purchase any policy despite the risks because of the confusion about whether he would get adequate support from the insurance company if he faces any accidents.

Ashrafuz Zaman, another resident in Dhaka, bought a private car four years ago but it hasn't been insured yet.

He is also confused like Maruf about whether he would reap any benefits if he purchases any policy.

"I have not seen many examples of people receiving benefits from insurance policies. Insurance companies also don't promote their products much."

Shahidul Islam Zahid, a professor of banking and insurance at the University of Dhaka, said vehicle insurance is important as it helps policyholders reduce liabilities and pay for the damage caused during unfortunate incidents.

"Most people are not insuring their vehicles due to a lack of trust in most insurance companies. The companies can't avoid their responsibility."

Prof Zahid added that there are conditions that prospective policyholders can't meet.

Recently, the government has moved to make insurance mandatory for vehicles again.

If not insured, owners will have to pay a fine of up to Tk 3,000 for each vehicle and if the law is not followed, police will file a case, according to the draft law.

An official of the Financial Institutions Division said a proposal to make insurance mandatory was sent to the finance ministry in April.

The division also sent a letter to the Road Transport and Highways Division in May, the official said, adding that the government loses revenue of Tk 878 crore every year since vehicle insurance is not mandatory.

The number of vehicles such as motorcycles, cars, buses and trucks that ply on the road in Bangladesh stood at 56,61,418 in February this year.

For all latest news, follow The Daily Star's Google News channel.

For all latest news, follow The Daily Star's Google News channel.

Comments