Waning foreign investment a wake-up call for policymakers

The inflow of foreign direct investment (FDI) into Bangladesh is facing critical challenges as a plethora of factors have caused it to stagnate to a mere 0.5 percent of the country's gross domestic product in recent years.

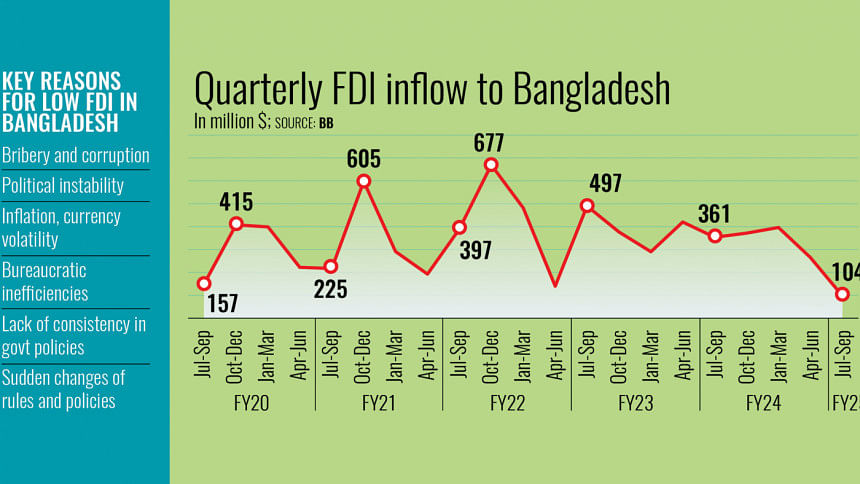

In the July-September quarter of FY25, the South Asian country received 71 percent less foreign investment year-on-year, down from $360.5 million in the July-September period of FY24, according to Bangladesh Bank data.

Even more concerning is the fact that a recent report by the Bangladesh Investment Development Authority (BIDA), styled 'The FDI Heatmap', emphasised the significant lack of structured investment promotion campaigns for domestic industries.

According to the report, only 45 percent of all foreign investments in Bangladesh qualify as actual FDI. The majority consists of intercompany loans or reinvestments.

This is an alarming development, especially as economists have cited the need to increase the amount of foreign investment in order to create jobs, spur business activities and put the economy back on track for years now.

This raises the question of why FDI has continued on a downward trend despite numerous authorities advocating measures to enhance inflows.

Experts identified several barriers, including political instability, economic uncertainty, bureaucratic inefficiencies, and inconsistent policies.

They also pointed to high inflation, currency volatility, and inter-agency misalignment, which collectively undermine investor confidence and hinder economic growth.

Bangladesh's political landscape took a tense turn in mid-2024 when monthslong protests against the then Awami League government culminated in a mass uprising that saw its ouster.

This shift disrupted the economy and created doubts about stability and governance -- key factors in attracting FDI.

The political unrest was further compounded by a deteriorating law-and-order situation, leaving investors in a "wait-and-see" mode.

Additionally, economic problems, including rising prices, an unstable local currency, and a lack of US dollars, continue to make it harder for foreigners to invest. Policy inconsistency is another major concern.

"Bangladesh is grappling with fundamental economic issues that significantly deter investment decisions," observed M Masrur Reaz, chairman of Policy Exchange Bangladesh.

According to him, restoring macroeconomic stability is essential for meaningful improvement in FDI inflow.

Over the last 15 years, corruption extended beyond bribery, hitting new heights, including manipulation during policy formulation, Reaz observed, adding that this rise in corruption significantly discouraged FDI.

Economic experts also point to deep-rooted problems such as structural inefficiencies, external shocks and policy gaps, which come about as there is a lack of coordination between regulatory bodies such as Bangladesh Bank, the National Board of Revenue, and ministries.

"Policy inconsistencies and bureaucratic hurdles significantly amplify investment risks," noted Rupali Chowdhury, a former FICCI president. She urged the government to ensure alignment among institutional policies to regain investor trust.

Professor Selim Raihan, executive director of the South Asian Network on Economic Modeling, characterised the current investment climate as hostile to FDI due to policy uncertainty.

He noted that frequent ad-hoc changes to policies, particularly those related to import duties and taxes, deter both existing and potential investors.

"There are lucrative policies on paper, but a lack of implementation undermines their effectiveness," Raihan added. He emphasised that macroeconomic stability and consistent policies are essential for any significant improvement in FDI inflow.

Raihan also highlighted that FDI inflows are often seen as an indicator of economic health.

Al Mamun Mridha,secretary general of the Bangladesh China Chamber of Commerce and Industry, said the prevailing unstable political situation is the primary reason for the decline in FDI.

He added that rising interest rates and the shortage of gas supplies to industries was another deterrent. "Investors monitor everything before making an investment. So, in this moment of crisis, no one will feel interested in investing here."

He also pointed out that the cost of doing business in Bangladesh is higher than in many other countries, despite relatively low labor costs, discouraging FDI.

Zaved Akhtar, president of the Foreign Investors' Chamber of Commerce and Industry, said earlier that political stability is paramount for any form of investment, adding that a lack thereof had created a palpable sense of hesitation among foreign investors.

Without stability, foreign investors hesitate due to risks like currency depreciation, sudden regulatory shifts, and an unstable business environment.

Ultimately, if political and economic uncertainties are not addressed quickly, Bangladesh may lose its competitive advantage in attracting global investment. This could harm the country's long-term economic goals and growth.

However, the recent decline in FDI should not be swept under the cloud of political uncertainty. It should serve as a wake-up call for policymakers.

For all latest news, follow The Daily Star's Google News channel.

For all latest news, follow The Daily Star's Google News channel.

Comments