Govt’s foreign loans: Weak taka makes repayment costlier

The government's foreign debt repayment has become costlier owing to the sharp depreciation of the taka against the US dollar in recent months.

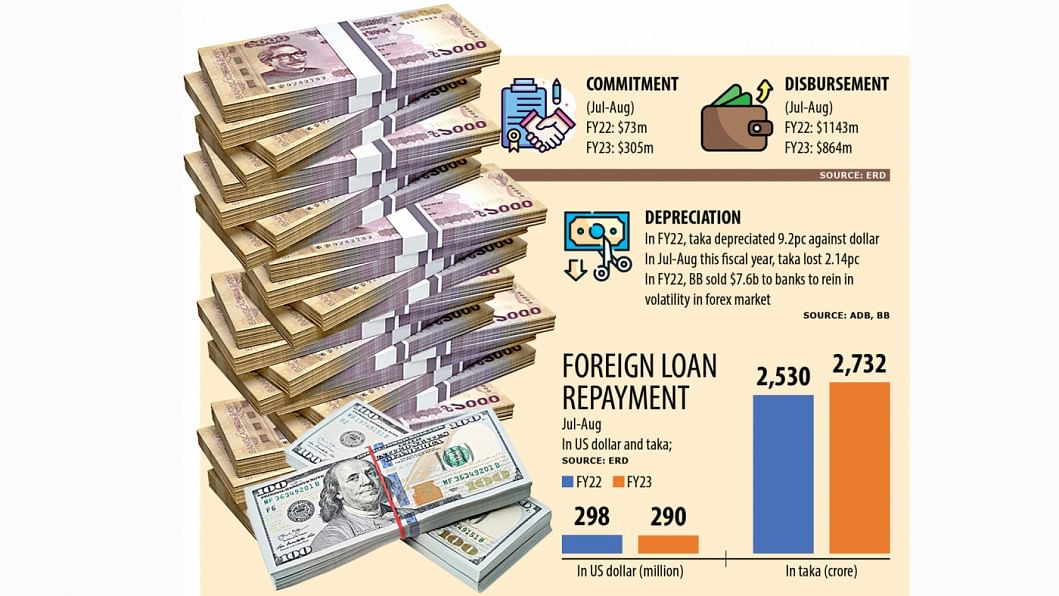

Bangladesh repaid foreign debts amounting to $289.78 million in July and August, down 2.83 per cent from $298.22 million during the identical two-month period a year ago, data from the Economic Relations Division (ERD) showed.

Of the sum, the principal amount was $196.98 million and the interest was $92.80 million.

In terms of the taka, the spending stood at Tk 2,731 crore, versus Tk 2,530 crore last year, an increase of 7.95 per cent.

The higher expenditure to service foreign debts came as the taka has lost value by 9.2 per cent against the dollar in the past one year. It fell 2.15 per cent in July and August.

The taka has weakened amid a dollar shortage caused by the volatile foreign currency market following the outbreak of the Russia-Ukraine war, which has sent import payments rocketing.

The depleting of foreign currency reserves forced the central bank to pump dollars into the market on a regular basis with a view to helping importers clear bills.

Zahid Hussain, a former lead economist of the World Bank's Dhaka office, attributed the fall in the total debt service payment in US dollars to a decline in principal repayments.

"This looks like a timing issue," he said.

The economist argued that the size of Bangladesh's external debt is increasing, so there is no reason for the principal repayment to decline over the entire year.

"It is likely to exceed the level of repayment in the US dollar relative to last year."

The impact of exchange rate depreciation is evident in the taka amounts of both interest and principal.

The exchange rate used for the conversion of the USD into the taka for July-August of 2021 and July-August of 2022 respectively was Tk 84.8 and Tk 94.3, according to Hussain's calculation.

"This 11.2 per cent depreciation increased the interest payments burden by Tk 86.98 crore. This shows the impact of the depreciation on government expenditures."

How this additional spending, aimed at foreign debt repayment, affects the budget deficit will depend on the impact of the depreciation on revenues, said Hussain.

Collection of import duties in July-August was the major contributor to the 22 per cent growth in revenues of the National Board of Revenue, compared to 14.5 per cent growth in July-August of 2021.

Hussain said the principal repayment increased by Tk 187.03 crore due to the depreciation.

He thinks the impact of the increase in the principal repayment in the taka will be offset by the impact on disbursements.

"The extent of the offset will depend on the relative percentage increases of principal repayments and disbursement. If the net disbursement in the US dollar rises, the net disbursement in the taka will rise even more because of the depreciation effect."

The economist points out that the ERD seems to be using the BB rate for conversion.

"This is okay if the dollars are purchased from the BB at this rate. However, since the market rate is higher, it implies the central bank is subsidising the external debt servicing of the government."

"Going forward, the depreciation effect will be large because the BB rate has increased to Tk 96 per USD."

The finance costs have also risen for the private-sector firms that have taken on dollar-denominated loans from external sources owing to the currency depreciation.

In July and August, the use of foreign aid plummeted by 24.38 per cent.

Foreign aid disbursement dropped to $864.29 million in July and August from $1.14 billion a year ago.

During the same period last year, there was a higher inflow of foreign aid through budgetary support and vaccination-related loans. Such assistance was absent this time, leading to a fall in the utilisation of foreign aid.

Development partners committed to lending $304.92 million during the two months, a surge of 315.88 per cent from $73.32 million last year.

For all latest news, follow The Daily Star's Google News channel.

For all latest news, follow The Daily Star's Google News channel.

Comments