Will BB’s lending rate-setting formula yield expected results?

The Bangladesh Bank has decided to implement a market-based interest rate from July, moving away from the 9 per cent interest rate cap on loans, an initiative that may help the central bank uses its policy rates effectively in its fight against higher inflation.

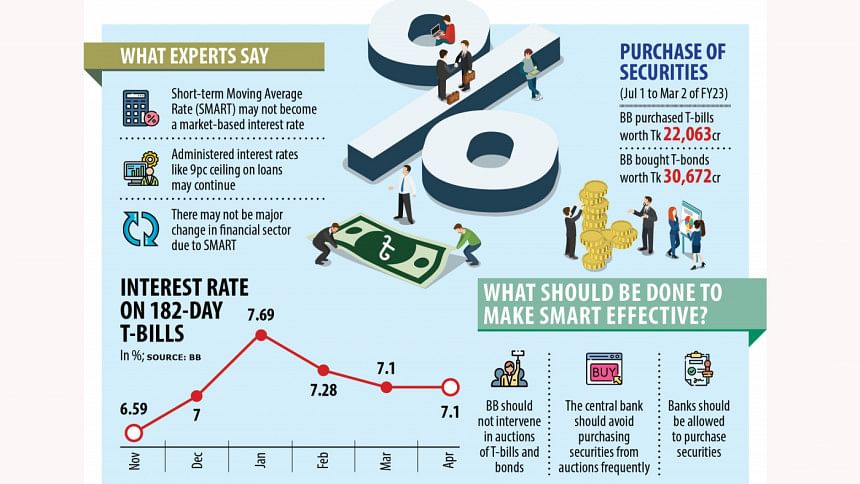

Bankers have welcomed the move in their initial reactions but analysts are doubtful whether the upcoming rate-setting method will give a market-determined lending rate in a true sense.

Earlier this month, the central bank said the market-based interest rate will be set by calculating the yield rates of treasury bills, the securities through which the government borrows from both commercial banks and the BB to meet its budget deficit.

The interest rates of both Treasury bills and bonds are controlled by the central bank. The BB frequently purchases the securities by bidding at a lower rate compared to commercial banks, said Ahsan H Mansur, executive director of the Policy Research Institute of Bangladesh.

"If the central bank continues to intervene in the auctions in the same way in the coming days, the interest rate will not be market-based at all."

Banks have been following the interest rate ceiling since April 2020 in line with the government's instruction, which aims to keep the cost of funds for entrepreneurs low.

The ceiling has already created a major distortion in the financial sector as interest rates should be determined by the market on the basis of demand and supply, according to analysts.

As per the reform actions attached to the $4.7 billion loan programme, the International Monetary Fund also suggested the government put in place a market-based interest rate mechanism by July this year.

"We have been calling for the withdrawal of the interest rate ceiling for long. The central bank has recently taken the initiative to change it. But its stance may not help change the situation as the new one may be administered as well," said Mansur, also a former official of the IMF.

On April 2, Md Mezbaul Haque, the spokesperson of the central bank, told reporters that the BB had already fixed a structure to set a market-based interest rate, and it would be unveiled in the next monetary policy due in June.

As per plans, the central bank will initially set a monthly reference rate based on the weighted average rate, which is calculated on the basis of the interest rates of the short-term treasury bills.

The BB will also set another weighted average rate every six months based on the monthly weighted average rates. The BB primarily calculated a six-month reference rate of 6.98 per cent.

The rate will be called the Short-term Moving Average Rate (SMART). It will be adjusted every month considering the interest rates of treasury bills.

"We have initially thought of keeping a range of 3 per cent that can be added to the weighted average rate," Haque said earlier this month.

"We are examining the issue. Banks will be allowed to set interest rates on loans within the SMART."

A BB official yesterday said that they had almost prepared the method of SMART and a notice would be issued to this end soon.

He says that the SMART will be calculated as per the interest rates of 182-day treasury bills.

Syed Mahbubur Rahman, managing director of Mutual Trust Bank, welcomed the central bank's initiative to get out of the present fixed rate regime.

"However, the economy will reap the real benefits if we can ensure the real interest rates in our treasury bills. Let's see how it goes," he said.

Selim RF Hussain, chairman of the Association of Bankers, Bangladesh, a platform for managing directors of banks in Bangladesh, described the BB move as a positive development.

"But we will understand fully about the matter after the central bank rolls out the SMART," he said.

Mansur says that if the central bank does not intervene in the auction of government securities, the SMART may be considered a "partial" market-based interest rate.

"If the central bank controls the interest rates of T-bills in the days ahead like it is doing now, the SMART will be considered as a fully administered interest rate."

"We know that the ceiling of the interest rate has already put an adverse impact on the country's foreign exchange market."

Zahid Hussain, a former lead economist of the World Bank's Dhaka office, says that the SMART may not bring about any major change in the financial sector as it may be controlled by the central bank as well.

"If the central bank fixes the interest of the government securities, there will be no scope to set a market-based interest rate."

Recently, the World Bank said the continued use of a lending interest rate cap introduced in April 2020 has impaired the effectiveness of policy rates.

The central bank has raised its benchmark lending rate, also known as the policy rate, four times since May last year to rein in runaway consumer prices, fuelled by a surge in global commodity prices.

But the inflationary pressures have not cooled down to the expected level as the hikes in the policy rates did not have much impact owing to the availability of cheap funds for the cap in the lending rates.

The external factors behind the higher inflation in Bangladesh have also remained almost unchanged as the Russian war in Ukraine persists and the impacts of the coronavirus pandemic have not receded fully.

"The introduction of a benchmark lending rate or reference rate for commercial banks could provide a transition path from rate caps toward market-determined rates. This policy could see a shift from reserve money-based monetary policy transmission towards a policy rate-based transmission mechanism," said the WB.

"The reference rate could be anchored on the treasury rates of government securities or interbank rates."

The WB said monetary policy needs to be fully dedicated to reining in inflation through the interest rate channels. "Enhancing monetary policy would enable inflation targeting and support financial stability."

For all latest news, follow The Daily Star's Google News channel.

For all latest news, follow The Daily Star's Google News channel.

Comments