Worker outflow hits record high but remittance falls

Bangladesh sent the highest number of migrant workers in its history in 2022 thanks to a surge in demand for labourers in the Middle Eastern countries but remittance receipts did not go up proportionately.

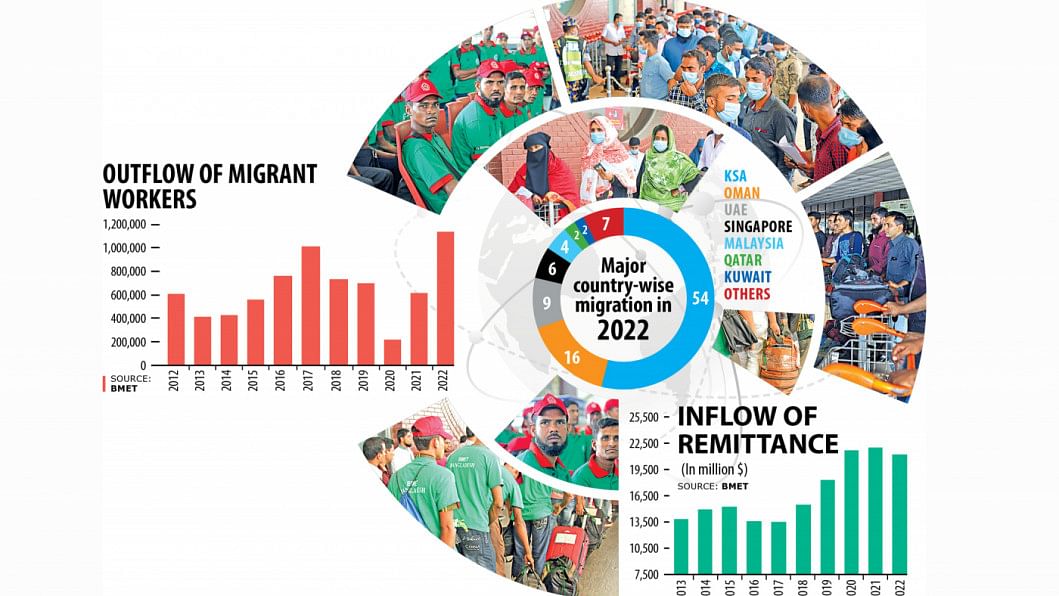

More than 11.35 lakh Bangladeshis left the country for jobs abroad last year, nearly doubling from 6.17 lakh migrant workers who flew abroad the previous year, data released by the Bureau of Manpower Employment and Training (BMET) showed.

Despite the surge, the country did not see a higher inflow of remittances, the cheapest source of foreign currencies for Bangladesh, and a vital source of household income for the lower-income groups in the country.

Rather, money transferred by workers through the official channel dropped 6.65 per cent to $21.28 billion in 2022 from $22 billion a year earlier.

The discrepancy – a record outflow of migrant workers and a fall in remittance inflow – comes at a time when Bangladesh faces a dollar crisis to pay for higher trade costs.

Analysts and recruiting agents blame the growing use of informal channels, also known as hundi, by migrant workers for the decline in remittances.

Shameem Ahmed Chowdhury Noman, secretary general of the Bangladesh Association of International Recruiting Agencies (Baira), said fresh Bangladeshi migrant workers usually undergo a three-month probation period after being employed in a host country. As a result, it takes three to six months for them to start sending money home.

He blamed the yawning gap in the dollar rates between the informal market and the banking channel for the slowdown in remittance flow.

"Bangladeshi migrant workers mostly earn $200 to $400 a month. So, if they find that the unofficial market offers Tk 10 to Tk 15 per USD more compared to the official platform, then they are most likely to take the service from the unofficial platform," he said.

The proprietor of Sadia International said the government should strike a balance of the dollar rate between the unofficial channel and the banking channel and suggested increasing the 2.5 per cent incentive to 5 per cent on remittance transfers.

"Otherwise, remittance inflow through formal channels will not see the expected jump."

In 2022, two-thirds of the migrant workers got jobs in the Middle East, with Saudi Arabia being the biggest employer as it hired 54 per cent of Bangladeshis who left the country in the year. Oman, the United Arab Emirates, Singapore, Malaysia, Qatar and Kuwait were among the top employers.

Workers were mainly hired in the service, construction and agriculture sectors last year.

On average, the country sent five lakh to six lakh workers per year in the past one decade and the number was around 7 lakh before the pandemic hit the country, BMET data showed.

Noman attributed the improving economic scenario from the lows of the pandemic for the rise in outbound migration.

"Normalcy has returned to most countries, so there will be more job opportunities for Bangladeshi workers," he said.

Prof Mustafizur Rahman, a distinguished fellow of the Centre for Policy Dialogue, a think-tank, says although Saudi Arabia is the main destination for migrant workers, the rate of remittance from the Middle Eastern country is falling. The situation is the same in the case of the UAE as well.

"It gives a clear picture that remittances are sent through informal channels such as hundi. As per my analysis, a vast vicious cycle is working in these two countries."

In fact, hundi cartels account for half of the remittances that flowed to Bangladesh even before the pandemic. The dollar rate gap between formal and informal channels has driven the migrant workers towards the cross-border illegal money transfer system.

Although a lower number of workers went to Kuwait, the trend of remittance from the country is higher, according to Prof Rahman.

"The government should think about the matter seriously as the country's households are receiving the money, but the funds are not added to the foreign currency reserves."

Owing to lower remittance and moderate export earnings against escalated imports, the reserves declined from $44.95 billion in early January of 2021 to $32.52 billion this week.

Prof Rahman suggested the central bank allow a market-oriented exchange rate and beef up surveillance and monitoring to rein in the transfer of remittances via informal channels.

The government should also break hundi cartels and raise awareness among the people at home and abroad by running campaigns about the importance of sending money through formal channels, added Rahman.

Tasneem Siddiqui, founding chair of the Refugee and Migratory Movements Research Unit, a think-tank focused on migration workers, says the labour market has always had ups and downs.

"This year, the outflow of migrant workers grew as their demand rose. It's not such a way that we have developed a system or ensured technical assistance."

Siddiqui, also the chairperson of the political sciences department at the University of Dhaka, credited increased access to information and people's aspiration to elevate their social and economic status for the higher outflow of migrant workers.

"Bangladesh would reap the benefit of the higher outflow of migrant workers in the coming years."

She urged the government to raise the incentive to at least 10 per cent at least for a few months.

The overall lack of skills for Bangladesh's workers is posing a threat to remittance earnings, said Sayema Haque Bidisha, research director of the South Asian Network on Economic Modeling.

"We need at least moderate skilled manpower to raise earnings," she said, adding that steps should be taken against hundi operators as they facilitate the illicit outflow of black money.

Prof Bidisha called for steps so that workers can send money to their beneficiaries directly through the mobile financial service.

For all latest news, follow The Daily Star's Google News channel.

For all latest news, follow The Daily Star's Google News channel.

Comments