Yarn imports rise, India dominates supply

Bangladesh imported more yarn in 2024 than in the previous year, with the lion's share of the key raw material for readymade garments (RMG) coming from India.

Local apparel exporters said the country imported more yarn as RMG exports to Western markets increased last year.

Instead of sourcing the raw material locally, garment manufacturers opted for yarn imports from India due to several factors, including the neighbouring country's competitive rates, its capacity to deliver larger consignments on time, and local yarn mills struggling with inconsistent gas and power supply.

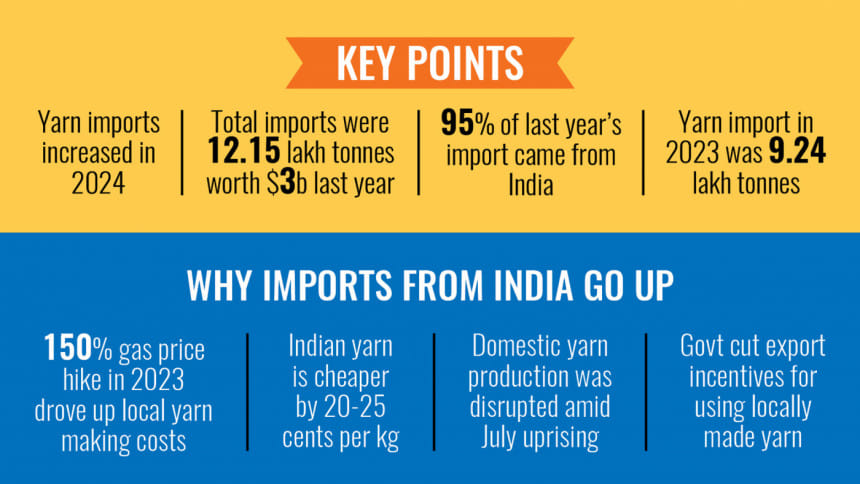

Last year, Bangladesh imported 12.15 lakh tonnes of yarn—mainly cotton yarn—up 31.45 percent from 9.24 lakh tonnes in 2023, according to the Bangladesh Textile Mills Association (BTMA).

The imports totalled $3 billion, with around 95 percent coming from India.

Last year, the local textile sector faced mill closures during mass uprisings, political instability, and labour unrest after the August changeover.

The price difference between locally spun yarn and imported yarn from India varies between 20-25 cents per kilogramme, which encourages local garment exporters to rely more on imported yarn from India than on locally manufactured items.

Matin Chowdhury, managing director of Malek Spinning Mills Limited, said, "The import price is lower than that of locally spun yarn."

Moreover, the local spinning sector has suffered from an inconsistent gas supply for several years, which has eventually reduced production capacity.

Even amid this situation, the government in February 2023 increased the gas price by 150 percent, which drove up production costs in the local spinning sector.

"Last year's political and labour unrest forced the spinners to shut their units for more than a month," Chowdhury added.

The Bangladesh government's reduction of incentives on textiles and garments also affected yarn production, while the Indian government increased several kinds of cash incentives for textile and garment entrepreneurs.

So, India can supply yarn at a much lower price than Bangladesh, Chowdhury said, adding, "The cost of production matters a lot."

Mohammad Ali Khokon, former president of the Bangladesh Textile Mills Association (BTMA), said many Indian spinners have already opened warehouses near four Indo-Bangla land ports so they can supply an adequate amount of yarn swiftly, as the demand for yarn is rising in Bangladesh.

"The Indian government has been giving several kinds of incentives to the textile and garment industries, and their exporters are performing well," he said. "So, the Indian spinners can supply yarn at a much lower price," said Khokon.

Faruque Hassan, former president of the Bangladesh Garment Manufacturers and Exporters Association (BGMEA), said yarn imports have increased in Bangladesh mainly for four reasons, although local spinners are well capable of supplying the raw materials.

First, the government last year reduced the cash incentive on the use of local yarn to 1.5 percent from 4 percent, said Hassan.

It was a measure in preparation for the country's graduation from the group of least developed countries (LDCs) to a developing nation by 2026.

As a result, local garment exporters prefer imported yarn to remain competitive, as the price difference varies between 20-25 cents per kg, he added.

The former BGMEA president said that before the cash incentive cut, apparel exporters used to use local yarn even at 20-30 cents higher prices because of the 4 percent cash incentive, which was more lucrative for them.

As the second reason, he said that Bangladesh needs a lot of finer count yarn as the volume of the country's high-value-added garment items is rising gradually.

However, local spinners can hardly supply the required yarn in sufficient quantities and on time, he said. Usually, China and India are major producers and suppliers of such finer count yarn.

Thirdly, the use of man-made fibre has been rising in the country to meet the growing demand and to secure better prices from international clothing retailers and brands.

Bangladesh still has insufficient capacity for man-made fibre and therefore depends on India and China to import it. Hassan also said that the price gap between local man-made yarn and Chinese non-cotton yarn varies between 50-60 cents per kg.

Fourthly, price is a big issue for all kinds of yarn, as India can supply it at much lower prices, adequately and swiftly, he said.

Meanwhile, BTMA President Showkat Aziz Russell complained about the illegal smuggling of yarn from India as the demand for yarn in Bangladesh is rising. "The government should provide policy support to the $25 billion invested in the primary textile sector."

For all latest news, follow The Daily Star's Google News channel.

For all latest news, follow The Daily Star's Google News channel.

Comments