Yield on treasury bills climbs to a record 12% as govt borrowing intensifies

The interest rate of treasury bills has jumped to a record high of 12 percent days after the central bank reinstated the market-based lending rate, an indication that funds will become costlier in the months ahead.

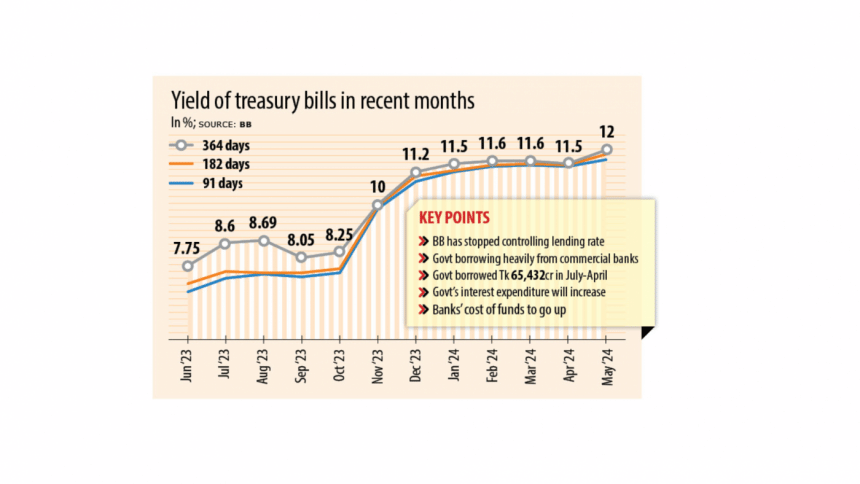

Known as the yield, the interest rate of treasury bills now ranges from 11.60 percent to 12 percent whereas it was 6.75 percent to 7.75 percent in June last year, Bangladesh Bank data showed.

The spike came during the auctions for the securities on Monday when the yield was quoted 12 percent, said a senior official of the central bank.

On Wednesday, the BB scrapped the SMART (Six-month Moving Average Rate of Treasury bills) formula, which had been used by banks since July last year to set the interest rate of loans.

The cost of funds for banks has increased after the announcement of the market-based lending rate system. As a result, they have been forced to quote the higher yield, the official pointed out.

Currently, the government is borrowing heavily from commercial banks using the tool as the central bank has suspended injecting fresh money into the economy to avoid fuelling inflation, which has stayed above 9 percent for the past 20 months.

From July last year to April 22 this year, the government's borrowing from the banking sector amounted to Tk 65,432 crore, according to the BB. It was Tk 5,334 crore in the identical 10 months of the last financial year. Finally, it shot to Tk 98,000 crore at the end of 2022-23.

Separate auctions were also held on Monday for treasury bills that mature in 91 days, 182 days, and 364 days. The yield of the three bills was 11.60 percent, 11.80 percent, and 12 percent, respectively.

The government raised Tk 3,038 crore through the sales of the treasury bills on the day.

Mohammed Nurul Amin, a former chairman of the Association of Bankers Bangladesh, a platform of the chief executives of banks in the country, said the money market is facing pressure owing to the government's tight fiscal situation.

Since the country's revenue earnings are not growing in line with the expenditure, it has become fully dependent on the banking system for funds in order to meet the budget deficit, he said.

"The higher bank borrowing at an elevated interest rate will increase the interest expenditure of the government."

The government had set a borrowing target of Tk 132,395 crore from the banking sector for 2023-24. It also aims to mobilise Tk 23,000 crore from the non-banking sector.

The CEO of a private commercial bank told this newspaper that a record increase in the yields of treasury bills and bonds has encouraged banks to invest in the securities instead of lending to the private sector.

Ahsan H Mansur, executive director of the Policy Research Institute of Bangladesh, said recently that he didn't consider the government's increased borrowing from commercial banks instead of the central bank as bad.

"Had the government continued to borrow from the central bank, inflation would have been fuelled further."

He said the borrowing from banks would accelerate in the remaining two months of the fiscal year because the government's expenses usually go up in May and June.

"The interest payments of the government will also increase," he said, adding that the higher bank borrowing will crowd out the private sector.

For all latest news, follow The Daily Star's Google News channel.

For all latest news, follow The Daily Star's Google News channel.

Comments