Small-cap, low-performing firms send stocks higher

All indices of the Dhaka Stock Exchange (DSE) yesterday rose, snapping a two-day losing streak even though it was mostly low-performing companies that propelled the rise.

The DSEX, the benchmark index of the Dhaka bourse, gained 36 points, or 0.58 per cent, to close the day at 6,250 points.

Similarly, the DS30, which represents blue-chip stocks, advanced 0.43 per cent to 2,225 while the DSES, an index comprised of shariah-compliant companies, edged up 0.41 per cent to 1,362.

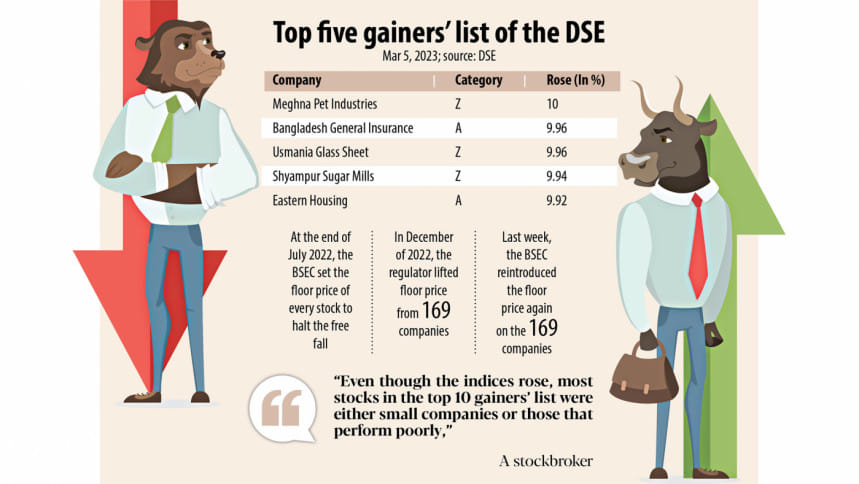

"Even though the indices rose, most stocks in the top 10 gainers' list were either small companies or those that perform poorly," a stockbroker said.

Meghna Pet Industries, a junk stock that failed to provide any dividend since its listing in 2001, registered the highest appreciation by soaring 10 per cent.

Bangladesh General Insurance Company surged 9.96 per cent while two other junk stocks -- Usmania Glass Sheet Factory and Shyampur Sugar Mills – rose 9.96 per cent and 9.94 per cent, respectively.

"When junk stocks mostly make up the top gainers' list, it shows that there are people working behind the scene to drive up the shares," the stockbroker said, adding that this does not give a good impression to institutional and foreign investors.

He went on to say that investor confidence will not return until fundamentally sound and well-performing companies lead the market.

"But as the regulator has reinstated the floor price, some investors think their funds will now be safe from further erosion."

At the end of July 2022, the Bangladesh Securities and Exchange Commission (BSEC) set a floor price for every stock in a bid to halt the freefall of market indices. The floor prices were determined based on the stocks' average closing price on July 28 and the preceding four days.

The commission lifted the floor prices on 169 companies last December. However, it brought back the regulatory measure once again last week.

"Bargain hunters showed buying interest on sector-specific stocks with lucrative prices as the BSEC is continuously encouraging investors to increase the flow of funds in the market," International Leasing Securities Ltd said in its daily market review.

The market opened on an upbeat note that continued until closure despite some sales pressures during the second hour of the session.

Investors increased their participation in major sectors such as pharmaceuticals, travel and food, helping the DSE achieve a 54.9 per cent higher turnover of Tk 662.4 crore compared to the previous session.

Gainers were strong in the market as out of the 340 issues traded, 152 advanced, 14 declined, and 174 remained unchanged.

All the sectors achieved price appreciation except mutual funds, which dropped 0.2 per cent. The travel sector rose by 5.8 per cent and the jute sector increased by 4.8 per cent.

Investor activity was mainly focused on the IT sector, capturing 15.3 per cent of the day's total turnover, followed by the travel sector with 13.7 per cent.

Union Capital shed the most, losing 10 per cent. ICB Third NRB Mutual Fund, AIBL 1st Islamic Mutual Fund, Fas Finance and Investment, and Monno Agro and General Machinery were also on the list of significant losers.

Bangladesh Shipping Corporation was the most-traded stock with issues worth Tk 48 crore being transacted. Genex Infosys, ADN Telecom, Sea Pearl Cox's Bazar Beach Resort and Spa, and Eastern Housing witnessed significant turnover as well.

The Caspi, the all-share price index of the Chittagong Stock Exchange, went up 120 points, or 0.65 per cent, to close at 18,402. Of the issues traded, 108 rose, 27 retreated and 14 did not see any price swing. Turnover on the bourse in the port city surged 104 per cent to Tk 16.61 crore.

For all latest news, follow The Daily Star's Google News channel.

For all latest news, follow The Daily Star's Google News channel.

Comments