Foreign funds in stocks soar

Net foreign investments in the capital market recorded a sevenfold jump year-on-year in the first nine months of the year as overseas investors consider the Bangladesh stockmarket lucrative for long-term investment.

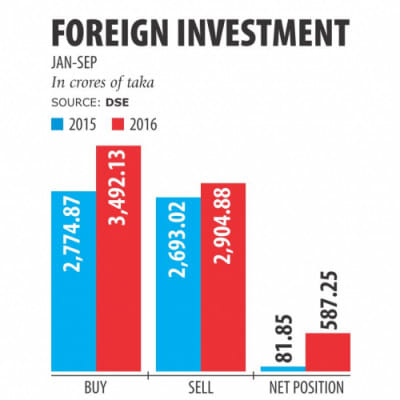

Foreign investors bought shares worth Tk 3,492.13 crore and sold shares worth Tk 2,904.88 crore to take their net investment for the January-September period to Tk 587.25 crore.

Net investment by foreigners in the first nine months of 2015 stood at Tk 81.85 crore, according to Dhaka Stock Exchange data.

An analyst said favourable macroeconomic indicators coupled with political stability increased the foreign investors' confidence to take positions in securities in the Bangladesh stockmarket, which is an emerging market for them.

“While global growth is almost zero, Bangladesh showed outstanding and intact performance in different macro and social indicators this year among the frontier and emerging markets,” said Md Ashaduzaman Riadh, strategic portfolio manager of LankaBangla Securities, which provides services to foreign fund managers.

He said Bangladesh was also one of the biggest beneficiaries of the declining global commodity and oil prices.

“Declining interest rate, resilient export growth, benign commodity prices, strong currency, massive infrastructure deals, rising income and consumption of around 66 percent working age population and easing political tension have increased the foreign appetite for Bangladesh equities,” he added.

Also known as portfolio investment, foreign investment accounts for around only 1 percent of the premier bourse's total market capitalisation, which stood at Tk 328,358 crore at the end of yesterday's trading.

Banks are the foreign investors' preferred sector, but non-bank financial institutions, power and energy, pharmaceuticals, multinationals, telecoms and IT also draw their attention. Foreign investors include global investment banks like Morgan Stanley, JPMorgan, Goldman Sachs and BlackRock.

Net foreign investment in 2015 was Tk 185.5 crore, which was a 93 percent increase over the previous year, according to DSE data.

For all latest news, follow The Daily Star's Google News channel.

For all latest news, follow The Daily Star's Google News channel.

Comments