Bright prospects for Bangladesh despite short-term challenges

Bangladesh is going through some short-term challenges like the rest of the world largely for the external factors but the medium-term prospects for the country remain bright, said Standard Chartered Bank Group Chairman José Viñals.

"In order to materialise the prospects, Bangladesh needs to address the short-term challenges," he told The Daily Star in an interview in Dhaka on Thursday.

Last week, he was in the capital on a four-day visit, when he met regulators, senior government officials, economists, and clients, among others.

He praised the country's private sector for its determination to succeed in spite of Covid-19 and recent turbulence.

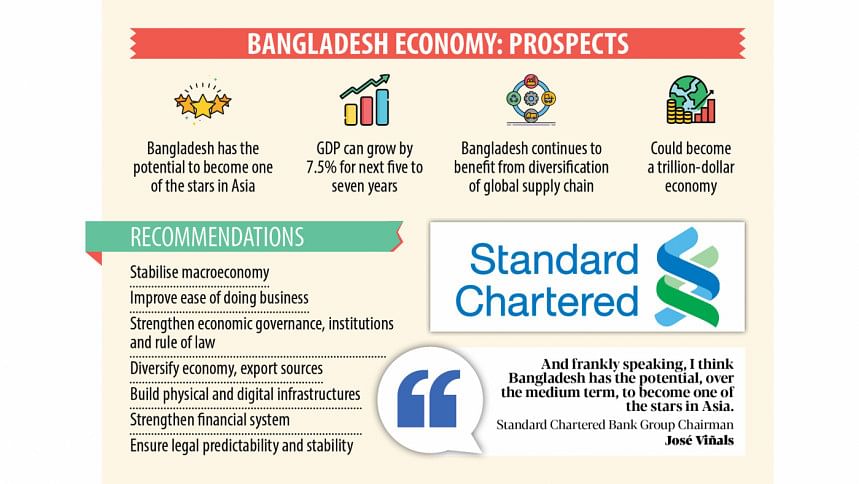

"It has a lot of vitality and sees the opportunities. And frankly speaking, I think Bangladesh has the potential, over the medium term, to become one of the stars in Asia."

"All in all, I am very positive about the medium-term prospect of Bangladesh," he said, citing the period of five to 10 years.

José was appointed to Standard Chartered PLC in October 2016 and became group chairman in December 2016.

Bangladesh witnessed a slowdown in economic growth, both during the Covid-19 pandemic and this year, due to some difficulties emanating from the Russia-Ukraine war.

But José is bullish.

"I believe the growth rate of Bangladesh can be significantly higher. It can be at least 7 or 7.5 per cent in the next five to seven years," he said.

In order to ensure higher economic growth, he said, there is a need to keep improving the ease of doing business, strengthening economic governance, institutions and rule of law, continuing diversification of the economy and export sources, and building both important physical and digital infrastructures and human capital.

A former financial counsellor and the director of the monetary and capital markets department at the International Monetary Fund (IMF), José said Bangladesh has the goal of graduating to a middle-income country by 2031 and then moving forward to attain the higher-income status.

"If Bangladesh can address the short-term challenges and pursue the growth agenda, it will be able to do very well in the medium term."

"Standard Chartered will be there to support Bangladesh's economic and financial development."

Governance is an issue in many countries.

And José said strengthening institutions and the financial system are also important. Ensuring legal predictability and stability is required to make sure both domestic and foreign investors come in.

Bangladesh is set to lose preferential market access once it becomes a developing nation in 2026 from a least-developed country.

"Once you graduate, you go and play in a higher league. You have to be competitive in order to sustain your permanence in that league and do very well," José said.

Bangladesh is already a factory of the world when it comes to manufacturing readymade garments and is the second largest producer of garments after China.

"If Bangladesh can play its cards wisely, Bangladesh can be a superstar in many other areas. And in overtime, those can take place by diversifying the export base," José said.

A lot of companies are also moving out of northern Asia, particularly China, and relocating to Southeast Asia and South Asia.

"I think Bangladesh has a unique opportunity in terms of having a very good labour force, which is competitive from the cost point of view."

"Bangladesh has a very significant opportunity to continue benefiting and benefiting even more from the diversification of the global supply chain thanks to several factors, including cost advantages, locational advantages, the US-China trade tension, and the broader geopolitical issues in the region.

One of the preconditions for the growth to be sustained is to make sure the rule of law is strong, institutions, both public and private, are strong, the financial institutions are strong, and there is governance, according to the group chairman of the London-headquartered multinational bank.

José, who has a Doctorate in Economics from Harvard and a Master's in Economics from the London School of Economics, thinks crises can be opportunities to solve deep-seated issues that under less difficult conditions may remain unresolved for a long time.

"Bangladesh has now the opportunity to move forward and advance a number of things that are important to ensure not only the stabilisation of the foreign currency market and the foreign exchange reserves but also establishing the basis for the medium-term growth."

During the interview, José described Bangladesh's efforts at reaching a staff-level agreement with the IMF as a timely move, saying if it is confirmed in the coming months it may help the country tackle its short-term balance of payments and currency issues.

"My view on this is that it is wise not to wait until the very last minute in order to approach the IMF because it may be too late and the troubles may have compounded."

Bangladesh is fortunately in a different situation and it does not have high external debt. Although foreign reserves have declined, they still can support imports for several months.

"I think this is a good time," he said.

Speaking about challenges in the banking sector, José said there are always issues in all banking systems and things can always be done to improve asset quality, clean up balance sheets, improve the capitalisation of banks, and enhance governance.

An advocate of globalisation, José thinks the world is moving towards a more fragmented system and globalisation is changing its form though it will continue to be there.

There is now a process of onshoring and reshoring and a number of countries are bringing part of the supply chain to their countries.

"It would be a big mistake if we all were to do that because we would go back to protectionism basically. There is a much better way to enhance the resilience of the global supply chain," he said.

"I think globalisation needs to be perfected rather than discarded because globalisation has led to improvements of income levels and the reduction of poverty around the world."

Bangladesh needs globalisation, he said.

"And the global economy needs countries like Bangladesh that can be factories of the world for quite a number of things."

He also spoke about sustainable financing, saying sustainability is the core pillar of prosperity.

"It is not just the right thing to do. It is also the smart thing to do from the business point of view because there are extraordinary commercial opportunities around sustainability."

Standard Chartered is committed to expanding the scale and reach of sustainable finance, with plans to mobilise $300 billion in green and transition finance by the end of the current decade.

"We do a lot of that in our footprint. But we want to up our game in sustainable finances by providing a suite of sustainable products to our clients and working with them to mobilise the finances."

He said Bangladesh's future is in its hands. External conditions may go one way or the other, and they may make life easier or more difficult here and there. But it is what Bangladesh does in the medium term that would make the difference.

He predicts that some of the headwinds the world has seen in 2022 would be moderating in 2023.

José praises Bangladesh.

"The current situation is better than the past and far better than in many other countries when it comes to how you have improved your per capita income and the size of the economy."

"You are on your way to becoming a half-a-trillion-dollar economy. This is a very significant achievement. It has the ability to become a trillion-dollar economy in the medium-term future."

Standard Chartered has already closely looked at various economic and non-economic variables that are important for the future of the country and it has its own assessment of the country.

"To me, the most important thing is to see indications that the country is going to address its internal challenges and then move forward in order to achieve a higher, sustained growth path."

"I am pretty confident that that would be there. For us, that is the most important thing," José added.

For all latest news, follow The Daily Star's Google News channel.

For all latest news, follow The Daily Star's Google News channel.

Comments