Sonali proposes company to buy defaulters' assets

Sonali Bank's failure to sell the mortgaged assets of Hall-Mark Group despite 60 attempts in five years has prompted the state-run lender to propose forming a separate company to acquire assets of defaulted borrowers through auction.

As part of the move, Sonali has sent a proposal to the finance ministry requesting it to set up a company with an initial capital of Tk 500 crore.

The company will be owned by state-run Investment Corporation of Bangladesh, Sonali, Janata, Agrani and Rupali, with each contributing Tk 100 crore, according to a letter sent to the finance ministry on November 28.

The merchant bank ICB will be the lead owner. The proposed company will purchase the properties put up on auction by banks at the market price.

“This move can help banks reduce default loans,” the letter said.

Later, the company will sell the assets to intended buyers following rules and regulations.

“Lenders will be able to sell their mortgaged properties without any trouble if the finance ministry gives approval to forming the company,” Md Obayed Ullah Al Masud, managing director of Sonali Bank, told The Daily Star. In so doing, the default loans in the banking sector will come down too.

Sonali's plan to sell off mortgaged properties has been thwarted time and again as wily defaulters file writ petitions with the High Court to stop the auction process.

Clients also show unwillingness to purchase the mortgaged assets, fearing it may invite trouble for them in future.

For instance, between 2013 and 2017 Sonali had floated tenders 60 times to sell the mortgaged assets of Hall-Mark Group but got no takers.

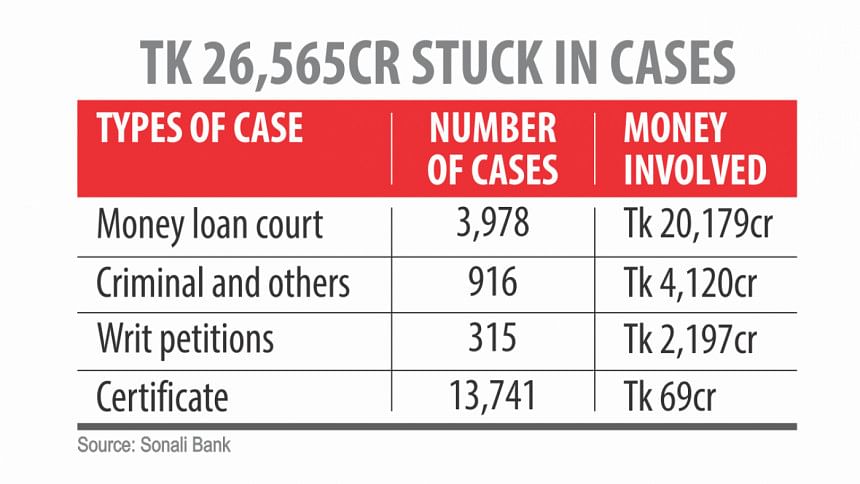

As of October, the state-run lender has properties amounting to Tk 26,565.21 crore stuck in legal cases, it said.

Of the amount, Tk 20,179 crore was stuck with the Artha Rin Adalat (also known as the money loan court) and Tk 4,120 crore with the criminal courts.

The bank has been fighting with 18,950 cases with both the High Court and the lower courts to recover the depositors' money.

Al Masud went on to call for a dedicated bench at the High Court to settle the pending cases related to default and write-off loans.

The government should amend the money loan court act as many habitual defaulters are still keeping themselves away from punishment using loopholes of the act, he added.

Banks have to float tenders in a short time to comply with the court order, which prevents them from getting the actual price of the mortgaged land, said the Sonali Bank letter.

The defaulters also take stay order from the High Court to adjourn the process of cases in the lower courts, which creates a legal tangle.

Typically, the defaulters have strong links with political parties and influential quarters.

Banks face difficulties in taking over the mortgaged lands in many cases even after securing the courts' verdict as the influential borrowers create obstacle using their 'muscle'.

The finance ministry should take initiative to form a committee in every upazila involving the local people's representatives and officials concerned of police to protect the assets. Manager of the bank's branch will coordinate the committee.

For all latest news, follow The Daily Star's Google News channel.

For all latest news, follow The Daily Star's Google News channel.

Comments