India’s currency crisis wreaks havoc

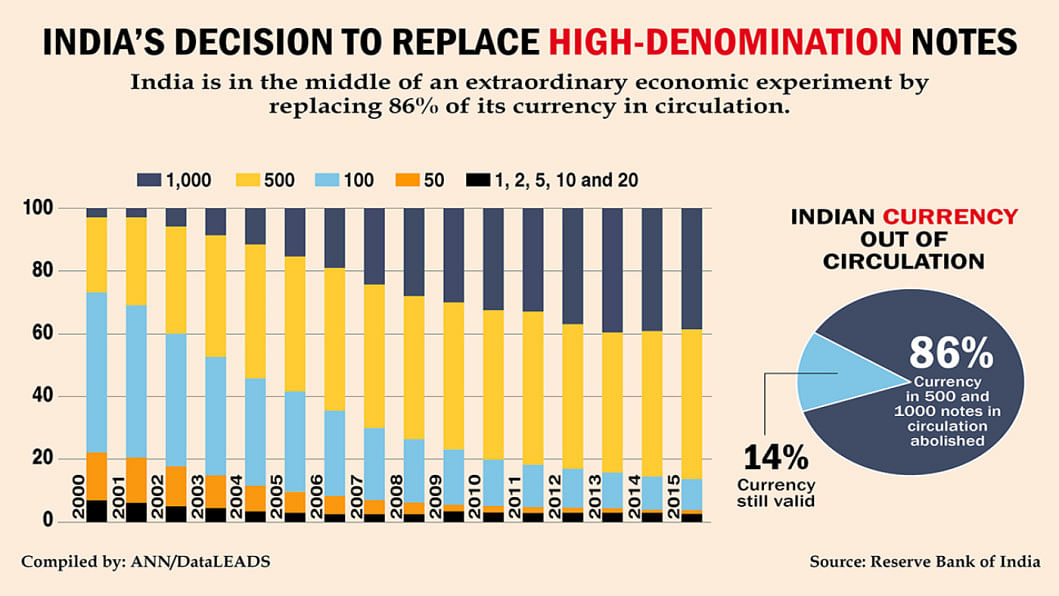

On November 8, Indian Prime Minister Narendra Modi surprised his country with an announcement banning 500- and 1,000-rupee notes-worth about $7 and $15 respectively - in a move to crack down on tax evasion, black money, corruption and terrorism funding.

Watch Reuters video: As currency crisis bites, India's biggest vegetable market crumbles

The unexpected move stunned the country, with over 23 billion notes -- or 86% of the country's cash -- suddenly rendered worthless. The government has given people until Dec 30 to trade their old currency for the new cash, or deposit them in into a bank account. But as the supply of new banknotes is far smaller than the supply of old ones, the government placed strict regulations on the quantity of new banknotes that people can withdraw at any given moment.

Also READ: India's currency move leaves visiting Bangladeshis in trouble

Many blame poor planning for the currency crisis.

More than half of Indians still don't have a bank account, and some millions have no government identification. People are short of cash to buy daily use essentials. Small businesses which mainly deal in cash are worst hit.

READ more: India central bank says enough cash available as crowds throng banks

Others, however, say the move will boost the economy because banks will be flush with money. After the ban, in the first four days alone, Indian banks had received three trillion rupees ($44.4bn) in cash. By this, the Indian government expects to bring billions of dollars of unaccounted cash into the economy. The government has urged the people to give it until the end of the year to get things back on track.

Copyright: DataLEADS/ Asia News Network

For all latest news, follow The Daily Star's Google News channel.

For all latest news, follow The Daily Star's Google News channel.

Comments