More rich to face wealth surcharge

The rich who have been out of the wealth surcharge net in the past several years will be brought under it from fiscal 2018-19 as the revenue authority looks to bring in equity in the system.

As per the new measure, which seeks to levy owners of more than 8,000 square feet residential property, will come under the surcharge net.

The tax authority proposed the changes as it finds that in the absence of valuation of properties based on current market prices, many wealthy persons stay out of the surcharge net by showing the transaction value of their assets acquired decades ago.

In contrast, those who bought flats in recent years had to pay wealth surcharge owing to asset price hike.

“There was a huge discrepancy in this area as valuation of wealth was linked with purchase prices or transaction value,” said a senior official of the National Board of Revenue.

Moreover, as zero value is shown in gift properties, a number of people have remained out of the surcharge net despite having huge wealth.

The new measure of collecting surcharge tax on the basis of location of the property will plug in the loophole, he said. The NBR imposed 10 percent surcharge tax, or a minimum of Tk 3,000, on those who have 8,000sft property registered in his/her own name in any city corporation.

The move is expected to yield an additional Tk 300 crore, the official added. “It is a good initiative,” said Ahsan H Mansur, executive director at the Policy Research Institute.

Those who bought properties in Dhaka's upscale areas such as Gulshan and Banani 50 years ago would be super rich today. But they remain out of the surcharge net as valuation of wealth is not done based on market rate.

He, however, said the prospect of a good amount of tax is unlikely as the number of people owning more than 8,000sft house or apartment in city corporations would not be high. The NBR should lower the slab to 3,000sft home or apartment and bring land ownership in cities under the wealth surcharge net.

“Wealth is wealth, be it land or cash,” he said, adding that inherited properties should also be brought under the system.

On Friday, the Centre for Policy Dialogue welcomed the measure, saying it will boost revenue and help ensure equity.

The NBR introduced wealth surcharge in fiscal 2011-12 as an alternative to wealth tax in a bid to ensure equity in the society, taxmen said.

Over the last six years, the tax authority has brought in changes to wealth ownership slabs and surcharge rates. It also registered increasing collection of surcharge.

Some 11,661 wealthy persons paid Tk 355 crore in wealth surcharge in fiscal 2016-17. The collection was Tk 65 crore in fiscal 2011-12, according to data from the NBR.

Economists said the number of well-off persons would be much higher than reported. And the main problem is the absence of valuation of assets at market prices.

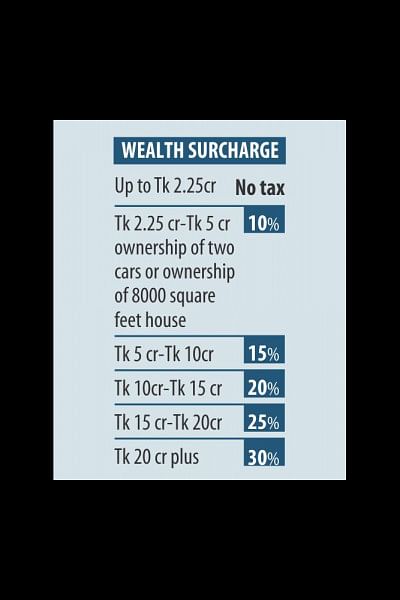

Currently, surcharge on wealth is collected through five slabs with 10 percent or minimum Tk 3,000 being the lowest and 30 percent the highest.

For all latest news, follow The Daily Star's Google News channel.

For all latest news, follow The Daily Star's Google News channel.

Comments