Agri-loan disbursement falls, recovery rises

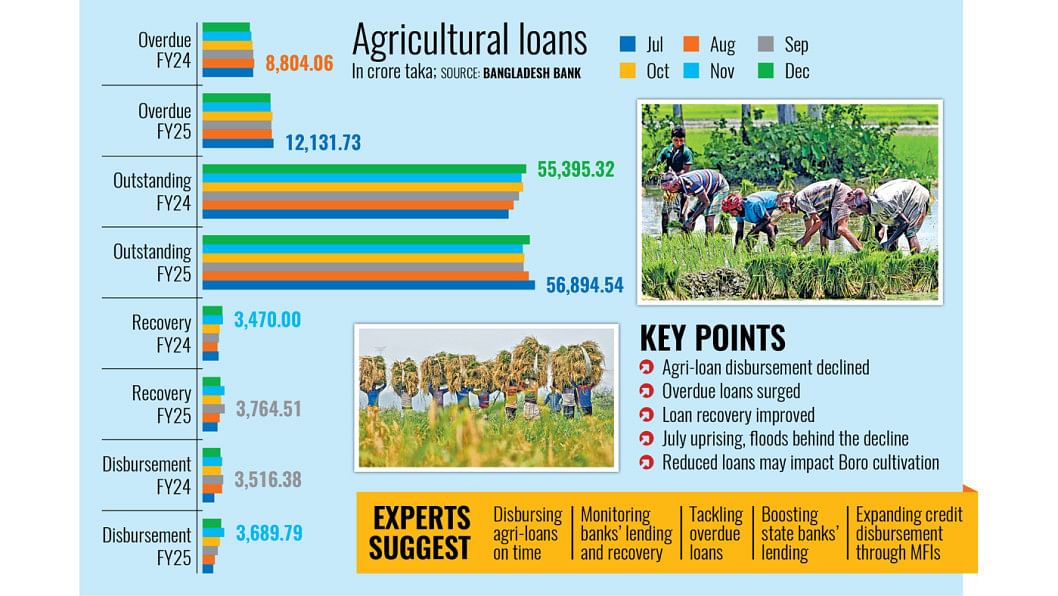

Agricultural loan disbursement declined, but recovery increased in Bangladesh in the six months to December last year compared to the same period of the previous year.

Outstanding loans remained stable, but in the meantime, overdue loans surged sharply.

Reduced lending from private and foreign commercial banks, which disburse most agri-loans, led to an 11.28 percent year-on-year drop in total agri-loan disbursement to Tk 16,259.11 crore in the last six months of FY25.

The sharpest decline was seen in late summer, particularly in August and September, according to the December 2024 report on agriculture and rural finance of Bangladesh Bank.

The trend shifted in November and December when disbursement showed signs of recovery.

For the 2024-25 fiscal year, the government targeted disbursing Tk 38,000 crore in agricultural loans, which was 2.28 percent higher than the previous year's actual disbursement of Tk 37,153.9 crore.

Reduced lending from private and foreign commercial banks, which disburse most agri-loans, led to an 11.28 percent year-on-year drop in total agri-loan disbursement

The highest disbursement target was set for private commercial banks—over two-thirds of the total.

The lowest target of Tk 1,264 crore was set for foreign commercial banks.

In the first six months of FY25, foreign commercial banks reduced agri-loan disbursement by 67.16 percent year-on-year, while private commercial banks also cut lending by a fifth.

State-owned specialised banks followed suit by reducing disbursement by 7.58 percent.

On the other hand, state-owned commercial banks increased their disbursement by 58.86 percent, but that was not enough to reverse the overall drop.

"The July uprising of 2024, along with the floods, might have played a significant role in the fall in agri-loan disbursement, which is very concerning for farmers," said Mustafa K Mujeri, executive director of the Institute for Inclusive Finance and Development (InM).

Farmers will need agri-loans during the Boro season, which accounts for over 50 percent of the country's rice production, he said.

However, Mohammad Shafruzzaman Khan, vice-president of Mercantile Bank, noted that disbursement has been improving since November and showed a positive trend from December to March.

"The slowdown was due to the political changeover and floods, but things are getting better," he said.

Compared to disbursement, banks showed better performance in recovering loans than in the previous year.

State-owned and private commercial banks led the rise, while specialised and foreign banks saw a decline in repayments.

Mujeri of InM credited the rise in loan recovery to the strong network of microfinance institutions and nongovernmental organisations through which banks disburse such credit in remote areas.

The BB report showed that last September saw the highest jump in recoveries, while July recorded the lowest.

Scheduled banks recovered Tk 19,117.26 crore in the last six months of FY25, up 7.52 percent year-on-year.

State-owned commercial banks improved recovery by 56.08 percent, while private commercial banks saw a 16.18 percent increase.

However, state-owned specialised banks and foreign commercial banks recorded declines of 10.14 percent and 50.34 percent, respectively.

The highest recovery of Tk 3,764.51 crore was made in September last year, while the lowest, Tk 2,553.79 crore, was recorded in July, showing uneven repayment behaviour among borrowers.

A good thing happened in the total outstanding agricultural credit balance, which remained almost unchanged from the previous year.

But the most concerning trend was seen in overdue loans, which jumped significantly compared to the previous year.

A growing portion of outstanding credit now remains unpaid, creating risks for future lending.

Overdue agricultural loans saw a 43.49 percent year-on-year rise, reaching Tk 11,600.25 crore in December last year.

It is worth mentioning that overdue loans made up 20.71 percent of the outstanding credit balance in FY25, compared to 14.59 percent in FY24.

Crop damage from floods hit farmers in the last half of 2024, while the July uprising disrupted the entire value chain of marketing and sales of the goods already produced, the InM executive director said.

"Those who took loans earlier could not repay on time, as the production, marketing, and sales of their produce were facing difficulties."

State-owned and private commercial banks saw the highest increase in overdue loans, while foreign banks maintained a clean record, according to BB data.

Foreign commercial banks maintained zero overdue loans.

Mujeri thinks the decline in disbursement and the surge in overdue loans pose challenges for agricultural credit.

The government should strongly monitor to ensure that small growers are provided with more agricultural credit, he said.

"If they (farmers) don't get loans on time, the country's food production will suffer."

For all latest news, follow The Daily Star's Google News channel.

For all latest news, follow The Daily Star's Google News channel.

Comments