Allow black money in housing: REHAB

Real estate companies have urged the government to allow black money to be invested in the housing sector through the upcoming budget without prying into the sources as it would help the vulnerable industry survive the ongoing coronavirus pandemic.

The government needs to allow it without asking any questions about where the money came from, said Alamgir Shamsul Alamin, president of the Real Estate and Housing Association of Bangladesh (REHAB).

"Then both the industry and economy would benefit sizably from the generation of relevant value added tax and registration fees," he said.

The REHAB has already placed a budget proposal in this regard to the government in the latter part of May.

Considering the emergency situation, the government should make the money whitening scheme more enticing so that untaxed income can be used to further the country's real estate industry and economic development, according to REHAB.

There are many instances of people legally earning money abroad but sending it home through unofficial channels to evade paying a higher amount in government taxes, said Liakat Ali Bhuiyan, first vice president of the REHAB.

If the government does not provide the scope to invest black money in the real estate sector and refrain from prying into the source, then people will simply spend the money abroad, he said.

The value for undisclosed income, generated legally, in Bangladesh is huge and so that money should be invested in developing the economy, Bhuiyan added.

The association of real estate developers also demanded the deduction of flat and land registration fees from 12 per cent to 5 per cent in a bid to ease the burden on potential investors and the allocation of a special fund to provide long term home loans to encourage property purchasing.

Government officials are allowed to avail home loans at 5 per cent interest. Therefore, the same facility should be given to the general public ensure housing for all, which is a part of the government's development plans, Alamin said.

"If the government fulfills our demands, it will lead to a direct fall in the price for apartments," he added.

For many reasons, Bangladesh's real estate industry witnessed sluggish sales for the past few years but it will likely see a drastic decline if the demand for housing drops due to the unprecedented economic uncertainty brought on by the pandemic, according to the REHAB president.

The demand for apartments fell this year despite showing some improvement last year.

"This is because of client psychology, no one wants to spend money on property during a difficult time," Alamin said.

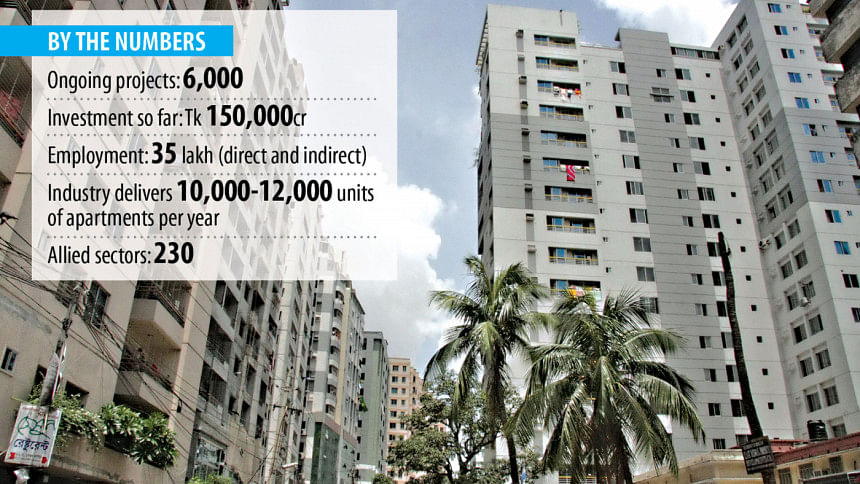

There are about 6,000 projects of the REHAB members that are currently lost in limbo following the prolonged nationwide lockdown that began on March 26 as the employees are unable to return to work due to the social distancing and other health guidelines in place.

Both banks and non-banking financial institutions are being directly affected by the ongoing crisis as people continue to either cancel or hold their loan applications, which is a potentially devastating change in consumer behaviour, said Alamin.

Allied sectors of the industry, of which there are 230, are also suffering because of the two-month shutdown, added Liakat Ali.

For all latest news, follow The Daily Star's Google News channel.

For all latest news, follow The Daily Star's Google News channel.

Comments