Amid liquidity crunch, banks offer high rates to lure depositors

Amid a persistent liquidity crunch, some lenders are desperately trying to increase their deposit base by offering higher interest rates to attract customers.

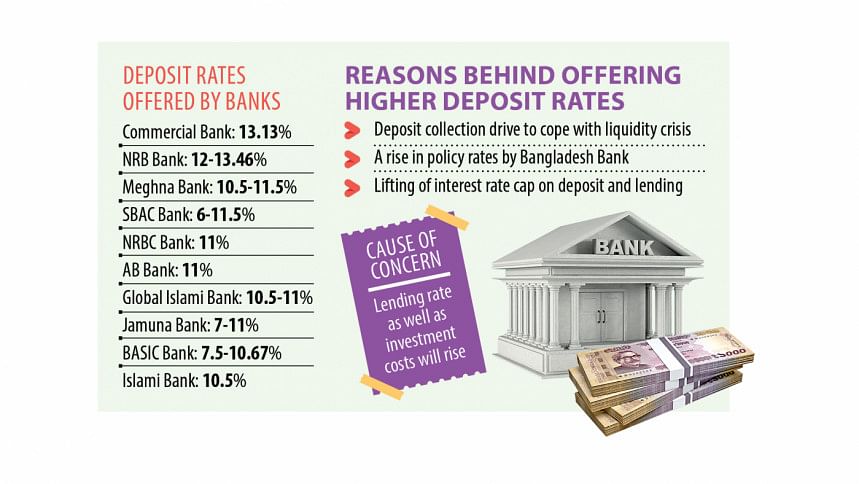

As of September, some banks were offering above 13 percent interest on deposits, nearly double the average rate of 6 to 8 percent before the ceiling on the interest rate of deposits was withdrawn, according to data from the Bangladesh Bank.

NRB Bank is offering the highest interest rate on deposits at 13.46 percent followed by Commercial Bank of Ceylon at 13.13 percent, and Meghna Bank and South Bangla Agriculture and Commerce Bank at 11.50 percent each.

Besides, NRBC Bank, AB Bank, Global Islami Bank and Jamuna Bank are offering as much as 11 percent interest on deposits while Basic Bank is providing 10.67 percent and Islami Bank 10.50 percent.

According to industry insiders, some banks are currently struggling to maintain adequate cashflow to meet their short-term obligations, with severely ailing lenders even unable to return depositor's funds.

This is why some of them are now desperate to increase their deposit base, they said.

Besides, as some banks are finding it difficult to meet the mandated Cash Reserve Ratio (CRR) and Statutory Liquidity Ratio (SLR), they are compelled to attract deposits by offering high interest rates, they said.

Some Islami banks already have a deficit in their current accounts with the central bank. They have failed to maintain the CRR and are paying a 9 percent penalty levied by the central bank.

Besides, the interest rates for deposits, loans and bonds increased after the Bangladesh Bank hiked the policy rate to 9.5 percent in late September.

Apart from that, the withdrawal of the lending rate cap and the interest rate spread limit, which controlled the difference between lending and deposit rates, has allowed banks to set interest rates as they please.

Mohammad Abdul Mannan, chairman of First Security Islami Bank, said some banks, including Islamic banks, have been facing acute liquidity crises due to the overwhelming amount of non-performing loans, something that has cast a shadow over the entire banking sector.

Although crisis-hit banks have been allowed to secure liquidity support from the interbank money market, it is not enough to meet the current demand, Mannan said.

"I think this is not unusual considering the present context," he said.

Any bank that takes support from the interbank money market will have to pay high rates and this loan will have to be repaid within three months, he said.

"In contrast, banks will get a long time to repay money collected from depositors, which will help them cope with the current cash crunch."

According to the banker, the sudden increase in deposit interest rates to as much as 13 percent may seem too high.

"But if the current inflation rate, which is hovering over 10 percent, is taken into consideration, it is normal from the perspective of depositors," Mannan said, explaining that if the inflation rate outpaces the deposit rate, people will lose money by storing it in banks.

According to economists, as a consequence of higher deposit rates, lending costs will also increase, fuelling the investment costs.

They also warned that the lucrative rates may land depositors in further trouble.

If those banks cannot maintain the high rates due to lingering financial stress, the sufferings of the depositors, who are already facing trouble withdrawing money, may deepen, they said.

Apart from that, offering high deposit rates will also narrow the interest rate spread and reduce the income of the banks.

Khondaker Golam Moazzem, research director at the Centre for Policy Dialogue (CPD), said depositors should be cautious about accepting offers of high interest rates as some banks are facing huge challenges.

The central bank should look into the matter and analyse whether it is viable for banks to offer such high rates for deposits.

Moazzem said it is better for the banks to increase their deposits by recovering bad loans instead of collecting deposits by offering sky-high rates.

For all latest news, follow The Daily Star's Google News channel.

For all latest news, follow The Daily Star's Google News channel.

Comments