AnonTex seeks favour to reschedule loans

AnonTex Group, which was given Tk 5,500 crore in loans by Janata Bank breaching rules, has applied to the state-owned lender to reschedule its defaulted loans of Tk 3,742 crore.

The garment manufacturer sent a letter to the bank in the first week of December to reschedule the non-performing loans (NPL) by giving a lower down payment than the actual amount set by the central bank.

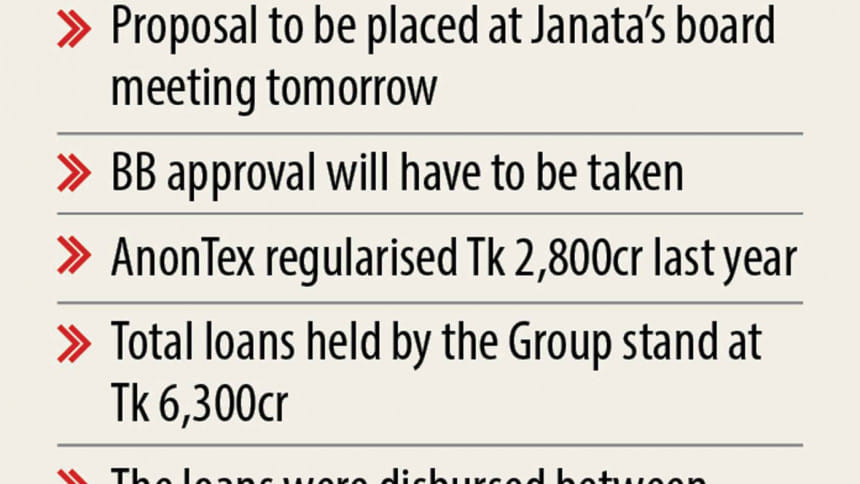

Janata's management will place the issue to its board of directors at a meeting tomorrow. If the board approves the proposal, the bank will send it to the central bank to avail the no-objection certificate.

AnonTex Group is seeking the rescheduling facility by paying 2 per cent down payment. As per the central bank rules, a defaulter has to pay a down payment of 10 per cent to 50 per cent.

Banks have to impose 10 per cent down payment of the outstanding classified loans if a defaulter regularises loans for the first time.

The down payment is set at 50 per cent for the NPLs that are rescheduled for a third time.

The defaulted loans of Tk 3,742 crore comprising a number of loan accounts had earlier been regularised several times.

Janata's management will set a repayment period of 10 years, including a one-year grace period if the proposal gets the nod.

"The management has accepted the rescheduling proposal positively given the feeble loan recovery trend because of the ongoing economic hardship caused by the coronavirus pandemic," said Md Abdus Salam Azad, managing director of Janata Bank.

The lender has given its all-out efforts to recover the defaulted loans from AnonTex Group in recent periods, he said.

The defaulter has already paid 1 per cent in down payment, or Tk 37 crore to reschedule the NPLs. The rest will be deposited when the central bank gives the final approval, Azad said.

This means the bank will recover a total of Tk 72 crore from AnonTex by granting the rescheduling facility.

The bank is going to reschedule the NPLs in exchange of the lower down payment as the loan recovery from both good borrowers and habitual defaulters has become difficult because of the ongoing economic hardship, according to the CEO.

"The rescheduling will help the bank recover a good portion of the fund from the group."

Fifteen out of 22 companies of AnonTex are now operational, and 20,000 workers and employees work for the group.

"A large amount of the defaulted loans is now stuck with the group. The rescheduling will pay off if the group can pay instalments regularly," he said.

AnonTex, set up in 2004, rescheduled its NPLs amounting to Tk 2,800 crore last year. Its total loans with the bank stand at Tk 6,300 crore.

The bank recovered Tk 388 crore from AnonTex in 2017, Tk 225 crore in 2018 and Tk 63 crore in 2019.

Md Younus Badal, managing director of AnonTex Group, said that his companies had been unable to take working capital loans from banks for the last three years.

"If the central bank allows rescheduling of the loans, we will take short-term loans to revive our business," he said.

The loans given to AnonTex were disbursed between 2010 and 2015 from the state lender's Janata Bhaban Corporate branch violating banking norms.

The loans accounted for more than 25 per cent of the lender's capital base, a violation of the single borrower exposure limit set in the Bank Company Act 1991.

The group became a defaulter and turned into a financial woe for the lender.

In September, defaulted loans at Janata Bank stood at Tk 13,125 crore, which is 25 per cent of the outstanding loans.

For all latest news, follow The Daily Star's Google News channel.

For all latest news, follow The Daily Star's Google News channel.

Comments