Aviation industry is in coma. Only the govt can help it wake up.

Known Unknown. A term that the airline industry is all too familiar with. It means sudden devastating happenings that periodically hit the industry. But the global coronavirus pandemic has spawned another new term: unknown unknown.

Airlines across the world are passing through a perfect storm and the world has never witnessed such devastation in its history.

One could rightly compare the current situation of the global aviation industry with the plot of the George Clooney-starrer "Perfect Storm".

The film was set on a small fishing boat, helmed by Clooney, caught up in a notoriously devastating Caribbean cyclonic storm. Clooney's desperate efforts to save the boat and the crew is depicted in a heart-wrenching saga.

Like a true captain, he saved his crew with the ultimate sacrifice of his own life. To salvage the airline industry from this dreaded storm, perhaps scores of Clooneys would be an eventual sacrificial lamb.

A BOLT FROM THE BLUE

It was all blue and serene sky, with aircraft manufacturers Airbus and Boeing forecasting needs for thousands of aircraft in the years ahead, creating demand for millions of pilots and technicians with trillions of dollars in revenue.

But everything was upended after the outburst of the deadly disease, christened as COVID-19, at the turn of the year.

From January, airlines everywhere started to face the strong headwinds and by February it became bumpy. By April, airlines fell into deep uncertainty, with one entering into bankruptcy and liquidation after another.

A plethora of layoffs followed, putting airline employees under a running bus, while the cancellation of new aircraft orders left manufacturers out in the cold.

By now, an estimated 17,000 commercial aircraft are in storage in the deserts of Arizona and the Australian outback, places otherwise known as aircraft graveyards in the aviation community.

Bangladesh's domestic airline industry, which has a reputation of infantile mortality even when times are good, is also dealing with the wrath of coronavirus that came with the devastation of an unprecedented scale and magnitude.

NAVIGATING THE STORMY SKIES

History of commercial aviation goes back merely a little more than a century. In Bangladesh, private operators entered this space just two decades back.

Airlines had always been navigating through stormy skies not so much so as the weather phenomenon is concerned. Their fortunes are contingent on the vagaries of the economy.

The world airline body, International Air Transport Association (IATA), was forecasting billions of dollars in profit for 2020.

It now predicts $314 billion in losses for the year and the loss is being revised upwards with each passing day. How the table has turned!

It is predicted that half of the airlines in the world will vanish from the sky if no lifeline is thrown from governments. And with that, jobs of millions of pilots, engineers and aviation professionals.

MOTHER OF ALL STORMS

The outbreak of coronavirus from Wuhan, China has dwarfed every other previous event combined, affecting the airlines globally.

The first victim was Flybe, the largest European regional carrier from the UK, which filed for bankruptcy.

By now, more than a dozen airlines have filed for bankruptcy, including giants like Virgin Australia, Thai Airways and Avianca, the world's second-oldest airline.

The IATA predicts that half of the world's airlines will perish from the sky if governments do not come forward with direct financial aid and rescue the airlines.

This is a situation beyond comprehension.

RESCUE EFFORT FOR AVIATION SECTOR ACROSS COUNTRIES

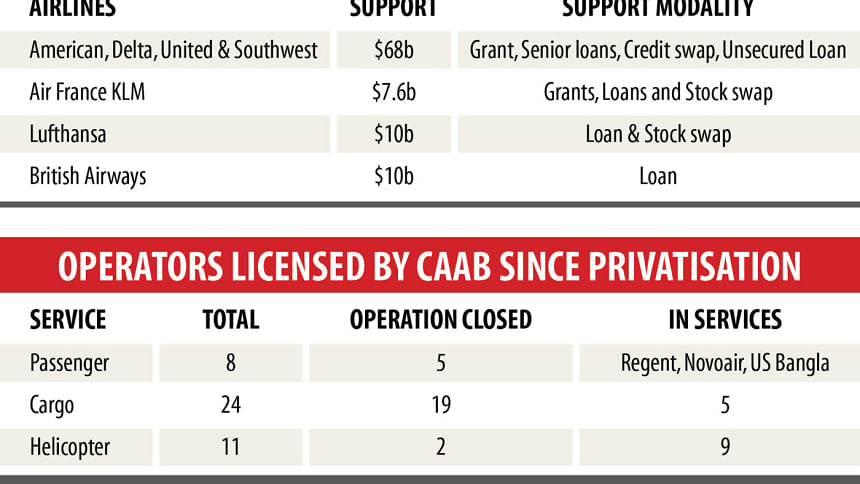

Many governments came forward with financial rescue packages in the form of grants and loans with full comprehension.

The reason being, the policymakers are very well aware that during the post-COVID economic recovery phase, the service of airlines will be central for a turnaround.

The behemoth airlines like American, Delta, United, Southwest in the US, Air France, KLM, BA, Norwegian and Austrian in Europe, Emirates, Qatar, Etihad and Qantas in the Asia-Pacific would have been in the graveyard by now without the billions of dollars from their governments.

The US came up with $68 billion grant or loans while Air France received $7.6 billion and Lufthansa $9.7 billion in state aid. Whether state-owned or private, the governments came up generously to save the airlines.

China has not only declared financial aid for its native airlines but also for the foreign carriers that operate to China.

RESURGENCE OF AN OLD DEBATE

There has always been a debate about the efficacy of pumping public money to keep state-owned airlines afloat.

Whether it is a rich country like Italy trying to bail out Alitalia or a sub-Saharan country Namibia saving Air Namibia, the picture is identical across the globe.

A paranoia exists when it comes to saving national carriers with poor taxpayers' money to serve the rich.

Some poor nation states drain incomprehensible amounts of public money for having the vanity of national carriers.

The US did not have a national carrier designated from 1992 to 2014. Before 1992, defunct Pan AM and currently American Airlines is the flag carrier of the US although none of them is government undertaking.

The national airline of Switzerland sold Swissair to Lufthansa, a German airline.

The world's very first commercial airline KLM, bearing the Royal Dutch flag, is under the ownership of Air France. The Dutch are reportedly sitting on a $3 trillion future generation fund.

Switzerland and the Netherlands did not spend a single dime to save flag carriers in the name of phoney national pride.

What compels poor nations, which include Bangladesh, to spend public money to save historically corrupt and structurally inefficient airlines, one must ponder!

PRIVATE AIRLINES IN BANGLADESH IN DOUBLE JEOPARDY

Airlines in Bangladesh are caught up in the severe vortex of the coronavirus pandemic in the same way that the foreign airlines are.

But for the private carriers, the situation went from worse to worst: it was not all well before coronavirus struck.

The backbone of our airlines was already fragile due to multi-faceted problems and they were on the verge of collapse. In the past, more than dozens of airlines were lost from the Bangladesh sky.

But with the pandemic, the existing airlines have just gone into a deep coma.

BANGLADESHI AIRLINES: AN AUTOPSY REPORT

The private airline sector is in a nascent state. In true sense, the doors of the private airline industry were opened by Prime Minister Sheikh Hasina in her first term in office with a vision to break the monopoly of state-owned Biman and benefit the common mass.

She also dreamed of making Bangladesh a regional aviation hub.

Many jumped in to set up airlines, some thrilled by the prestige it carried, some with pure business foresight and some with the ulterior motive to make a quick buck and run away.

The entrepreneurs soon found the path is not laid with flower petals. Rather, it is an agonising ride through a dangerous minefield of red tapes.

Some dropped dead in a sinkhole even before they could operate a single flight. Some were stuck up in quicksand after starting with the constant fear of drowning.

Some diehards were in desperation to climb over the dunes only to find earth shifting below their feet with the looming prospect of a sandy grave.

As per the Civil Aviation Authority Bangladesh (Caab) and sources, eight passengers and 19 cargo service licences were given since privatisation began. And we have already lost the 19 cargo and five passenger airlines.

I would request Bangladesh's existing and aspiring airline entrepreneurs to pay heed to a famous quote from Sir Adam Thomson, the legendary founder of defunct British Caledonian Airways, which went: "A recession is when you tighten your belt; depression is when you have no belt to tighten. When you have lost your trousers, you are in the airline business."

Many airline entrepreneurs not only lost their trousers but walked naked without shirts and ties. If you are an aspiring one, welcome to the world of the bottomless party!

COST, COST AND SKY-HIGH COSTS

A prohibitive and backbreaking cost element makes the aviation industry in Bangladesh untenable and unsustainable.

First, the cost of finance is not just high but prohibitive.

The cost involved with setting up and running an airline operation is multi-fold.

When the cost of finance for the aviation industry worldwide is just 1-3 per cent, in Bangladesh one needs to count it in double digits.

Airlines being a highly capital-intensive business with the highest investment and the lowest return, one must be living in a fool's paradise to make a profit in the first place with such a sky-high rate of interest, let alone survive.

Second, the cost of fuel makes an airline's sustainability in Bangladesh very rickety.

Typically, fuel bill accounts for 40 per cent of the total operating cost of an airline. And here in Bangladesh, the fuel cost is one of the highest in the world, particularly for the domestic sector. It is currently 23 per cent (previously 42 per cent).

When there is a price escalation globally, immediately we find a jump in the fuel price. But when the price tanks, it stays at the same higher level.

Airlines are simply captive to a single supplier Padma Oil's monopoly.

Third, the expenses on spare is another major driver of cost.

Theoretically, as per taxation rule, spares for aircraft are set at zero where airlines pay anything between 15 per cent and 150 per cent in tax during imports.

Globally, airline spares are costly and adding such exorbitant duty in Bangladesh is another killing factor.

Airlines buy thousands of spares to maintain aircraft in airworthy state, mostly on short notices to avoid grounding.

The only means of payment for the import of aircraft spares is a letter of credit, which is not accepted worldwide in spares trading.

Fourth, the cost in the form of civil aviation charges (aeronautical and non-aeronautical) is exorbitant.

In Bangladesh, some charges for airlines are 7-10 times more than in neighbouring countries.

There are instances when the CAAB hiked fees 1,000 times without any consultation with operators and stakeholders.

In contrast, there is a public hearing before hiking of any price of gas, utility or whatsoever.

With such high cost involved vis-a-vis the very low fare prevailing in the market, one needs to wonder why one dares to venture into the airline business.

POLICY AND ADMINISTRATIVE REGIME

The quasi-administrative and regulatory framework is an area that gags the growth prospect of the airline industry.

First, there is a fundamental deformity in the regulatory and administrative structure.

The CAAB is putting on the hats of a regulator, airport operator and air navigation service provider. This raises a serious conflict of interest.

Airlines are bound to answer to the CAAB but airports are supposed to be answering to airlines for the standard of service provided.

With the CAAB playing the role of the airport operator, how can a regulated airline under the same authority have the guts to raise the question for poor service delivered by the airport?

Separation of service providers' role is imperative and that is achieved by setting up independent airport authority.

Second, rules, policy and regulation lack consistency and clarity. An operator often falls prey to opaque, confusing and conflicting orders.

Third, the CAAB is also the de facto organisation for setting aviation tariffs. The finance ministry just gives its seal of approval to whatever the CAAB suggests.

Elsewhere, the regulators fight in favour of airlines and against the tariff authorities if they impose excess charges for the services.

LIGHT AT THE END OF THE TUNNEL

Domestic flights have resumed after a long break of 69 days from June 1. The initial passenger response is not very encouraging, leaving us agonising as to how long the recovery would take.

We also see a ray of hope for the positive mindset in the politico-bureaucratic segment, which matters in the long-run.

The civil aviation ministry has made a reassuring pledge of all-out support to salvage the airline industry.

The airlines are now waiting with bated breath to see the pledges in black and white.

WAY FORWARD

The dismal state of our private airlines stated above is just the tip of the iceberg.

The attack of the coronavirus, an elephant in the room, came along with a magnitude of tectonic destruction.

To salvage the last remaining soldiers (airlines) fighting the battle of survival, a lifeline must be thrown.

We may revisit the steps being taken to save the airlines across the globe and then make a comprehensive must-do list that our government may undertake to salvage the private airlines.

The cost of finance must be on par with the world average.

Airlines may be allowed to secure funds from external sources, which are available at very competitive rates.

The fuel price has to be adjusted in line with the world market without forcing an airline to buy at an exorbitant price.

Airlines deserve to be free from the whims of Bangladesh Petroleum Corporation or Padma Oil Company.

No tax should be levied on the import of spares.

The import process should be streamlined and there should be provision for payment of spares through bank transfer.

Civil aviation charges have to be brought down. Stakeholders must be consulted before increasing any charges. Owing to the pandemic, all CAAB charges should be waived for at least three years.

Structural deformity must be corrected. It has to be done by placing aviation service providing functions under an independent airport authority.

Clear and unambiguous policy, regulation and orders have to be formulated adapting to changing times.

Pandemic-specific lifeline is a must for the airlines to survive in the first place.

Airlines will need a huge sum of money to re-start the operation and continue, and the government needs to come forward with liquidity for airlines with a very nominal rate of interest.

The term to repay the loan should be very soft, carry more than five years in tenure with a grace period of at least one year.

Airlines are the umbilical cord of the aviation industry feeding a whole value chain of maintenance, repair and overhaul organisations, aviation training establishments, travel agents, hotel, motels and guest houses.

If the mother ship (airline) kicks the bucket, the rest tied up by the very umbilical cord has the same fait accompli.

Unless a holistic discourse is undertaken to salvage the airlines, doomsday lurks ahead for the aviation industry.

With the rough patchwork support so far visible here and there, a few sailors (airline employees) could be saved like the movie of Perfect Storm, but both ship (airlines) and the skipper (airline entrepreneurs) will be buried deep beneath the ocean floor.

The writer is the managing director of Novoair

For all latest news, follow The Daily Star's Google News channel.

For all latest news, follow The Daily Star's Google News channel.

Comments