Bangladesh losing out to Pakistan in home textile exports

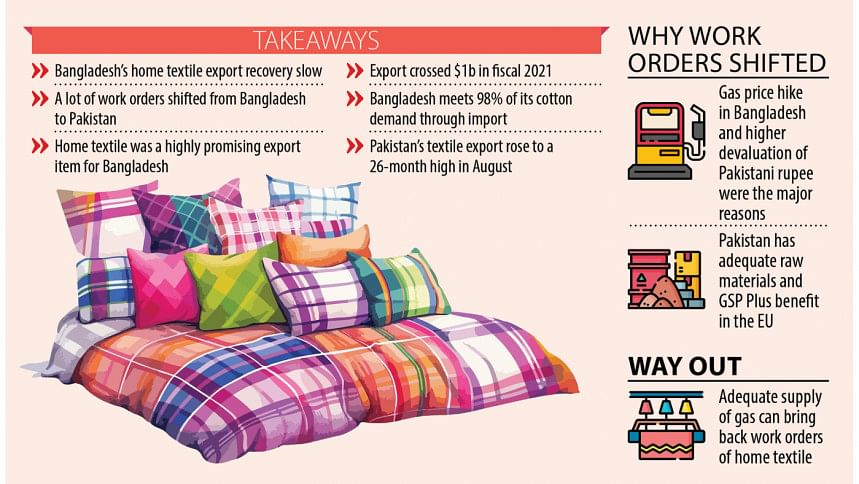

Bangladesh has been struggling to recover lost work orders in the home textile segment, a significant volume of which shifted to Pakistan nearly two years ago.

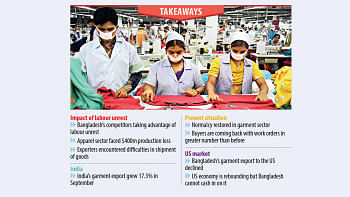

This shift occurred mainly due to the sudden doubling of gas prices in Bangladesh and significant devaluation of the Pakistani rupee against the US dollar. More recently, labour unrest in industrial belts and months of political unrest in Bangladesh have contributed to lower receipts.

Moreover, Pakistan possesses some inherent advantages. For example, it is the world's seventh-largest producer of cotton, according to Statista.

Pakistan also enjoys benefits under the European Union's Generalised Scheme of Preferences Plus (GSP+), while Bangladesh only enjoys standard GSP facilities.

When Bangladesh's government suddenly hiked gas prices by 150.41 percent in February 2023, from Tk 11.98 per unit to Tk 30 per unit, major home textile exporters refrained from booking work orders due to the abnormal surge in expenses in production and a good volume of work orders shifted to Pakistan.

Khorshed Alam, chairman of Little Group, a textile miller, added that this move caused local home textile exporters to incur huge losses since work orders were based on lower prices before the hike in gas prices.

For instance, if a big local company paid Tk 68 crore in monthly gas bill prior to the hike, it would cost Tk 126 crore after, he added.

As a result, local millers did not book new work orders for some time.

"However, the export of home textile is gradually recovering," Alam said.

Another major advantage of Pakistan is that it has readily available cotton while Bangladesh relies on imports to meet more than 98 percent of the demand for cotton in the country.

Pakistan's performance in the home textiles segment is also noticeable in the country's export figures.

Pakistan's textile exports surged to a 26-month high in August, reaching $1.64 billion -- a 13 percent year-on-year increase -- due to government policies and facilitation by the Special Investment Facilitation Council (SIFC), according to a report by SAMAA TV, a private television channel.

According to the Pakistan Bureau of Statistics, textile exports stood at $1.46 billion last August.

Significant growth was recorded across various sectors, with knitwear and bedwear exports increasing by 15 percent, and ready-made garment exports up 28 percent compared to last year.

"Analysts attribute the rise to Pakistan's strategic positioning in the global textile market, especially in light of political instability in Bangladesh and international sanctions on China, which have led global importers to seek alternatives," the SAMAA TV report also said.

On the other hand, Bangladesh's exports of home textiles, which include bedsheets, tents and rugs, declined 2.05 percent to $851.01 million in the fiscal year 2023-24, according to data from the state-owned Export Promotion Bureau (EPB).

The country's home textile exports had crossed the $1-billion mark in FY21, registering a whopping 49.17 percent year-over-year growth. That momentum continued into the following year, with exports rising by another 40-odd percent to $1.62 billion.

However, the gas crisis upended that trend the following year, with home textiles fetching $1.09 billion, down by almost a third.

"As per our previous plan, we were supposed to export $30 million worth of home textiles each month. But we are now exporting $25 million a month," said Md Shahidullah Chowdhury, executive director of Noman Group, which accounts for which accounts for more than 70 percent of Bangladesh's home textile exports.

"This is even less than the previous monthly amount, which was supposed to increase," he said.

Of the exported amount, $15 million comes from home textiles and $10 million comes from the shipment of terry towels, Chowdhury said.

"We are trying to recover the lost business but some factors like low gas pressure and labour unrest are posing major barriers at present," Chowdhury said.

Monsoor Ahmed, former chief executive officer of the Bangladesh Textile Mills Association, echoed Chowdhury's views.

Ahmed said five to seven major home textile makers are currently exporting while a few big companies faced closures a few years ago for various reasons.

Textile mills cannot run at full capacity due to low gas pressure and they cannot produce the goods adequately to be more competitive, he said.

Furthermore, Pakistan has enjoyed zero-rated or preferential tariffs on nearly 66 percent of tariff lines, enhancing the country's ability to export to the EU market under the GSP+ since 2014.

From 2014 to 2022, Pakistan's exports to the EU increased by 108 percent whereas imports from the EU increased by 65 percent. The total trade volume increased from 8.3 billion euros in 2013 to 14.85 billion euros.

For all latest news, follow The Daily Star's Google News channel.

For all latest news, follow The Daily Star's Google News channel.

Comments