Bangladesh lowers cash incentive for exporters to prepare for post-LDC era

The government has cut the export subsidy for almost all sectors to reduce the pressures on Bangladesh's coffers and bring down the rates gradually since the country can't provide such subsidies once it becomes a developing nation.

In their immediate reactions, economists welcomed the move while exporters expressed sheer disappointment, saying the export will be hit hard.

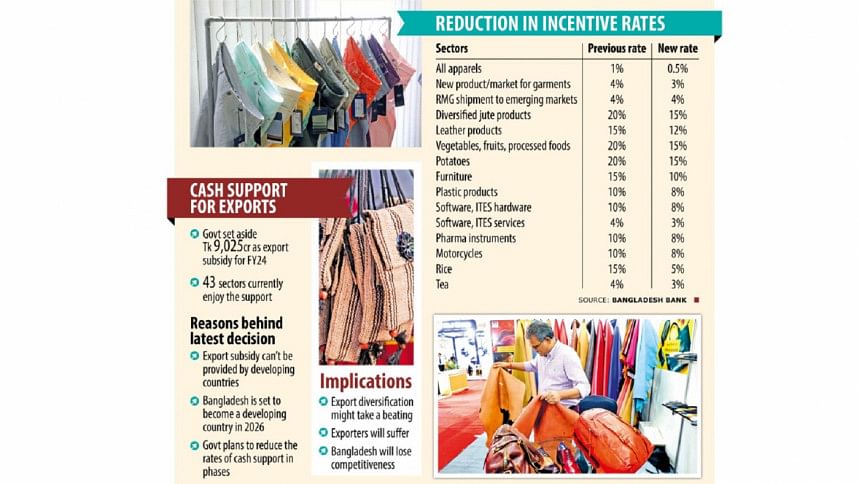

Bangladesh used to give cash assistance ranging from 1 percent to 20 percent on export earnings in order to encourage exporters and make them more competitive in international markets, with a view to raising the income from the biggest foreign currency earning sector.

Now, the maximum rate has been set at 15 percent and the minimum at 0.5 percent and it would be applicable for January 1 to June 30 this year, the central bank said in a notice yesterday.

Currently, 43 sectors are eligible for the aid, with the government spending about Tk 9,025 crore annually in the past three years.

Yesterday's change comes as the World Trade Organisation (WTO) considers cash incentives as export subsidies. But when a least-developed country (LDC) becomes a developing nation, it can't continue the cash assistance as per the agreement on subsidies and countervailing measures of the global body.

Bangladesh is set to become a developing nation in 2026.

If the cash support is withdrawn completely in one-go when the graduation takes place, the export sector might face challenges in the post-LDC period. So, the government has decided to reduce the direct cash assistance in phases from January 1 this year, the BB said.

Only four sectors – diversified jute products, vegetables, fruits and products in the agro-processing sector, potatoes, and halal meat and processed meat exporters -- will qualify for the highest rate. It was 20 percent for them previously.

The cash assistance on the export earnings of apparel makers in all markets has halved to 0.50 percent from 1 percent. The rate, however, has been kept unchanged at 4 percent for the shipment to emerging markets.

The support on furniture exports was lowered from 15 percent to 10 percent, for plastic products from 10 percent to 8 percent, for software and information technology-enabled services from 10 percent to 8 percent, and for motorcycles shipment from 10 percent to 8 percent, the BB circular showed.

Exporters were not happy.

Faruque Hassan, president of the Bangladesh Garment Manufacturers and Exporters Association, said the cash incentive has been cut over the years.

He categorically cited the cases of promising emerging markets such as Japan, India and Australia. The annual shipment of garments to the three nations has risen to about $2 billion, $1.5 billion and $1 billion, respectively, recently.

"Reducing incentive for such promising markets is one kind of punishment, whereas there should have been rewards for the garment exporters for exploring opportunities in those destinations."

He said the incentive has been reduced for the top five garment items that contribute 80 percent to the total earnings from the apparel sector.

Hassan said the budget has allowed the incentive up to June this year. But now the government said the decision about the new incentive scheme came into force on January 1.

"So, garment suppliers will be affected as they have already estimated their costs and revenue based on the old incentive package."

The BGMEA chief demanded the government continue the incentive up to 2026 and rename the incentive in the post-LDC era as has been done by other countries.

"It is a total disaster," said Shaheen Ahamed, chairman of the Bangladesh Tanners Association.

"The government should not have taken such a decision at this time. We will lose the market."

"When the government is talking about increasing exports, the reduction will have a negative impact on the sector. Exports will decrease due to reduced incentives."

Masum Miah, executive director of Superex Leather Limited, which is located in Jashore, says reducing incentives will definitely create difficulty.

"The government should reconsider this decision."

"Already the price of chemicals has climbed and the shipping cost has gone up. As a result, I am already in a tight situation."

Russell T Ahmed, president of the Bangladesh Association of Software and Information Services, said the government should continue incentive for the IT sector as it has great potential.

SM Jahangir Hossain, president of the Bangladesh Fruits, Vegetables and Allied Products Exporters' Association, does not think that there would be much impact of the cut in cash incentive from 20 percent to 15 percent.

Shamim Ahmed, president of the Bangladesh Plastic Goods Manufacturers and Exporters Association, said: "Because of the reduced incentives, we will no longer be able to sell products at competitive prices in the export markets. As a result, it will have a negative impact on our business."

"We are already in trouble because of the difficult business environment. If the situation worsens, jobs will not be created at the expected pace."

Analysts lauded the government's move.

"It will be prudent to prepare for the LDC graduation gradually," said Prof Mustafizur Rahman, a distinguished fellow at the Centre for Policy Dialogue.

He said the significant depreciation of the taka should help exporters face the change.

The local currency has lost its value by about 30 percent in the past two years against the US dollar.

"Also, the cut in cash support will help the government save money at a time when there is a cash crunch," Prof Rahman said.

He urged the government to take other measures to help exporters beef up their competitiveness through better institutional support, less harassment, improvement in the business environment, and the reduction in the cost of doing business.

Zahid Hussain, a former lead economist of the World Bank, describes the government move as a step in the right direction since the incentives did not bring about desired benefits in many sectors.

"But there has to be a proper direction about this in the upcoming budget speech."

MA Razzaque, chairman of the Research and Policy Integration for Development, said the export subsidies would not be compatible with the WTO rules once Bangladesh graduates.

"The gradual nature of adjustments as evident from the circular is prudent."

However, he added, due consideration should now be given to tariff rationalisation, which is the single most important factor in pushing export diversification.

"If cash assistance is being reduced solely because of the tight fiscal space, and if for the same reason, restructuring of tariff rates is not getting the desired pace, then it's not the right approach."

"Subsidies and incentives can't go on endlessly for all sectors," said M Masrur Reaz, chairman of the Policy Exchange of Bangladesh.

He said many firms have been receiving the support for a long time and they have become bigger and the sector's capability has grown.

"Therefore, they don't require such subsidies. The reduction in the rates will also help reduce unnecessary drag on public finance."

Our reporters Refayet Ullah Mirdah and Mahmudul Hasan also contributed to this report.

For all latest news, follow The Daily Star's Google News channel.

For all latest news, follow The Daily Star's Google News channel.

Comments