Bangladesh remains most optimistic market

Bangladeshi firms continue to be the most optimistic out of the 34 countries in which British banking giant HSBC operates, said one of its top officials.

“The reason for the optimism is favourable situation and stable political environment,” Md Mahbub-ur-Rahman, deputy chief executive officer of HSBC Bangladesh, told The Daily Star in an interview recently.

Rahman was quoting the latest edition of the HSBC Navigator survey, which was conducted in 34 countries, including the US, the UK, Canada, Brazil, Mexico, France, Germany, Italy, Spain, Russia, Switzerland, Turkey, Australia, China, Malaysia, Singapore and Vietnam.

“Bangladeshi firms are overwhelmingly positive on global trade prospects over the next couple of years and see their businesses benefitting from potential relocation of supply chains in the wake of global trade frictions,” he said quoting the survey report.

In the previous edition of the survey that was carried out in late 2017 in 25 countries, Bangladesh had come out on top.

The latest HSBC Navigator survey, which is conducted by Kantar TNS, is a compilation of responses by decision makers at more than 8,650 businesses -- from small and mid-market to large corporations -- across a broad range of industry sectors in 34 markets.

In Bangladesh, 200 businesses surveyed over a six-week period from July to September.

Over the past year, the global recovery has clearly benefited the twin engines of Bangladeshi economy -- remittance and apparel export.

“Looking forward, strong remittances and accommodative macro policies should continue to support domestic demand, even as rising trade tensions lead to a slowdown in global trade.”

Risks of a significant disruption to economic activity in the run up to the elections appear much lower compared to 2014, the report said.

As many as 94 percent of the respondents said they have a positive outlook on global trade and a slightly higher proportion are confident of succeeding in the current international trading environment.

China and India were most frequently cited by respondents as key markets where they are looking to expand their businesses. Japan has replaced third-placed Germany.

Bangladesh's trade relations with the two big economies are at its peak and growing, said Rahman, also the country head of HSBC's wholesale banking.

“The two countries are also in geographical proximity to Bangladesh.”

Asked whether industries will relocate from China to Bangladesh because of increased tariffs and lingering trade conflict, he replied in the affirmative.

“The opportunity will be there in certain sectors that are relevant to China as well as we can add value if they come here.”

Some Chinese firms have shown interest in relocating their operations to Bangladesh although they are not significantly scalable, according to Rahman. “They are making queries.”

If the international buyers of Bangladesh's apparel items look to make further inroads in China and India, the country will benefit even more.

Bangladesh not only has abundant workers, the supply chain has also grown in the apparel sector, said Rahman.

“We have improved our performance in case of fast fashion and lead-time. Our front-end has given rise to the backend.”

The extent of value addition has improved hugely than in the past.

“Bangladesh may have concentrated on one sector, but product diversification, value addition and buyers' diversification have taken place in it,” said Rahman.

Today, 30 percent of Bangladesh's export goods are going to the markets other than the EU and the US.

About the potential to benefit from China's Belt and Road Initiative (BRI), Rahman said Bangladesh is included in the overall direction of the programme.

“China is already the largest trading partner of Bangladesh, has been always a good market for Bangladesh, and is involved in many infrastructure projects in Bangladesh.”

Rahman said he was in China a couple of months ago when he saw very positive and strong willingness to understand the Bangladesh market.

Chinese investors may also want to make equity investment in Bangladesh particularly in the public-private partnership projects, said Rahman, without elaborating further.

Rahman, who obtained an executive MBA from Kellog-HKUST Executive MBA programme, played down the concerns of Bangladesh falling to a debt trap because of a flurry of loans from China, saying Bangladesh's debt-to-GDP ratio is low.

“Debt is required for an economy to grow and Bangladesh has room to borrow.”

And Bangladesh is taking loans to meet infrastructure requirement with a view to improving the country's business environment, connectivity and import substitution.

If that is the case, the macroeconomy will be benefited, which will ultimately benefit businesses, he said.

“But we have to have a conscious and coordinated strategy to see how these are going to benefit us.”

Bangladesh has been witnessing a huge growth in imports, but Rahman is looking at it positively.

“This is a sign of a growing economy where imports for infrastructure and raw materials for industries are flowing in.”

About the economy, Rahman said: “It is on a constant rise -- there is no zigzag. It is not that our economy has grown in a year only to take a steep plunge the next year. We have a very consistent growth.”

HSBC is the only bank in Bangladesh with offices in all the export processing zones, facilitating about 10 percent of the country's international trade.

The bank introduced innovative solutions for the private sector such as long-term funding and dollar funding in 2018.

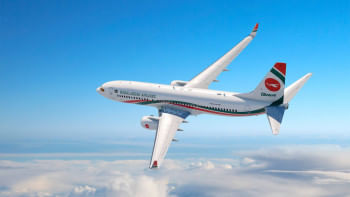

Equally, it is major lender to the government, the latest being the financing of the first two Boeing 787 Dreamliners for state-run Biman Bangladesh Airlines.

The bank has made possible Bangladesh's first commercial import of liquefied natural gas.

Its contribution to the power sector includes more than $1 billion of financing to implement four new power projects for Bangladesh Power Development Board.

The bank is supporting the country's first cross-border electricity import of 250 megawatt from India.

In the telecom sector, it arranged €155 million credit to implement the country's first satellite project, the Bangabandhu-1.

For all latest news, follow The Daily Star's Google News channel.

For all latest news, follow The Daily Star's Google News channel.

Comments