Banks on loan write-off spree

Loans written off by banks surged 20 percent last year as efforts to rein in default loans did not pay off.

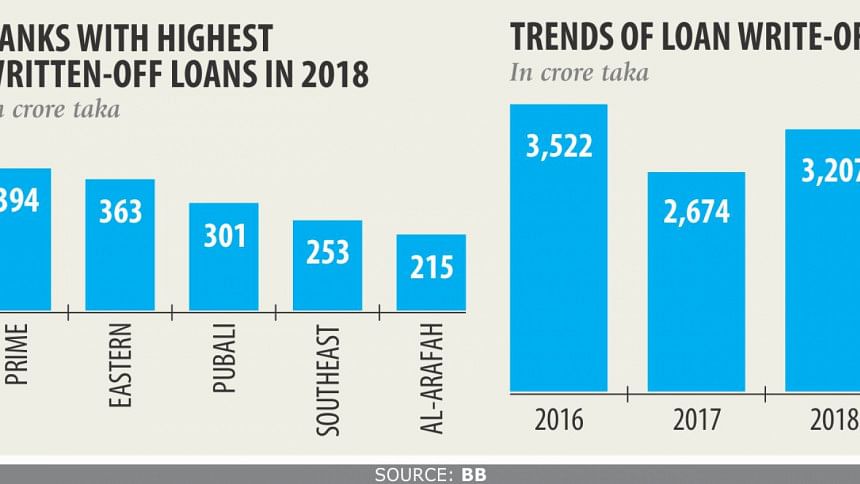

In 2018 loans amounting to Tk 3,207 crore were written-off, up 19.93 percent from a year earlier -- thanks to rising default loans.

This has raised the lenders' cost of funds, which, in turn, has left good borrowers footing higher interest rates for their loans.

Ensuring corporate governance is the solution to tackling the upturn in written-off loans, according to analysts.

Of the banks that took the facility to clean up their balance sheets, Prime Bank topped the chart, writing off Tk 394 crore.

It was followed by Eastern Bank (Tk 363 crore) and Pubali Bank (Tk 301 crore).

With the latest round, a total of Tk 52,884 crore has been written-off since the facility was introduced in January 2003 by the central bank to show lower amounts of default loans on banks' balance sheets.

Of the amount, 76 percent has remained outstanding to date, meaning banks' efforts to recover the loans did not yield much.

As of December last year, state-owned banks have written off Tk 23,186 crore and private banks Tk 28,042 crore.

Two state-run specialised banks, Bangladesh Krishi Bank and Rajshahi Krishi Unnayan Bank, have written off Tk 555 crore and foreign banks Tk 1,101 crore.

As per the Bangladesh Bank norms, loans are written off after making 100 percent provisioning. Banks though are obligated to continue with their recovery efforts.

For writing off loans, banks have to file law suits with the money loan court (Artha Rin Adalat) against the defaulters to recover the loans.

Lenders opt for write-offs when all avenues for recovering the default loans have been exhausted, said Khondkar Ibrahim Khaled, a former deputy governor of the central bank.

Loan write-offs have gradually been rising in recent years and the trend reflects the ongoing crisis in the banking sector. “Written-off loans are like uncollectible loans -- the recovery of such loans is highly difficult.”

Subsequently, he urged banks to check corruption such that vested quarters cannot take loans banking on this unethical process.

The amount of written-off loans will increase significantly in the months to come as the central bank has recently relaxed its write-off policy, said a BB official.

Banks are now allowed to write off default loans that have been hovering in the bad category for three years, down from five years previously, according to a notice issued by the central bank earlier in February. Furthermore, lenders do not have to file any case with the money loan court to write off delinquent loans worth Tk 2 lakh, up from Tk 50,000 previously.

Banks are facing difficulties in recovering the written-off loans as it takes much time to settle the cases with the courts, said Syed Mahbubur Rahman, chairman of the Association of Bankers, Bangladesh, a platform of private banks' managing directors.

In many cases, some unscrupulous borrowers kept the same property as collateral in different banks.

“The disbursed loans have subsequently become defaulted and were written off,” said Rahman, also the managing director of Dhaka Bank. But a strong judicial system will help banks recover the written-off loans from defaulters, he added.

For all latest news, follow The Daily Star's Google News channel.

For all latest news, follow The Daily Star's Google News channel.

Comments