Banks phasing out ATMs as focus shifts to both deposit and withdrawal

Automated teller machines (ATMs) were once a symbol of modern electronic banking for facilitating quick and easy cash withdrawals alongside other banking solutions, including credit card payments and balance confirmation.

However, banks in Bangladesh are now switching to cash recycling machines (CRMs) as they provide customers the added convenience of being able to deposit or withdraw funds from a single location.

Besides, CRM usage is helping banks reduce their operational expenses associated with having to load the machines with cash for withdrawals by recycling deposited funds.

At the same time, people are increasingly turning toward electronic solutions for fund transfers, bill payments and other transactions in a trend that is gradually reducing the need for cash handling.

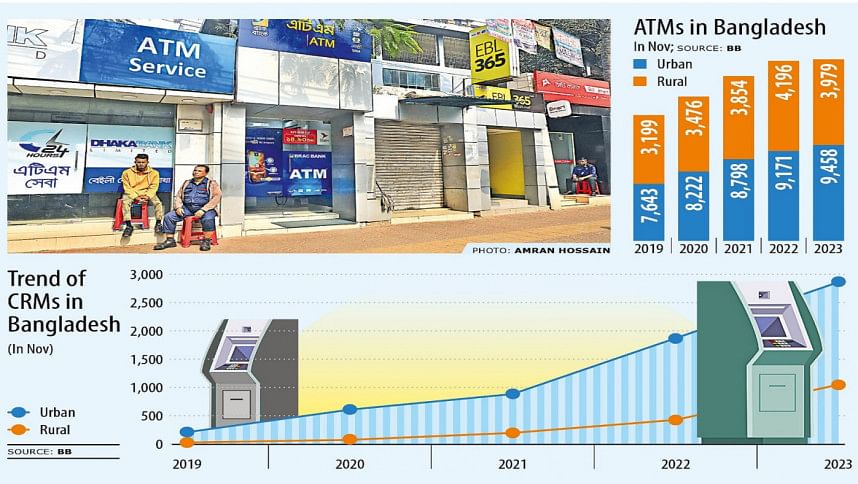

Data of Bangladesh Bank showed there were about 13,732 ATMs in the country as of August 2023.

However, the number fell to 13,437 by the end of November that year as banks started reducing their ATMs in rural areas.

On the other hand, CRMs were first introduced in Bangladesh just seven years ago, but their usage has steadily risen with banks having installed 3,897 units as of last November.

Arup Haider, head of retail banking at City Bank PLC, agreed that electronic solutions are becoming exceedingly popular payment methods.

For example, Mobile Financial Services (MFS) are now a major medium for conducting transactions, thereby reducing the need for cash withdrawals and furthering the country's move towards a cashless society.

Additionally, banks are gradually replacing ATMs with CRMs as the latter enables customers to deposit or withdraw money on a real-time basis from a single spot, he said.

Haider also informed that like ATMs, which mainly facilitate cash withdrawals, banks are gradually phasing out cash deposit machines (CDMs) as these too have little purpose other than taking deposits.

Moreover, the money deposited through CDMs does not show in the customer's account until after the bank's cash officers register the transaction, he added.

And although installing CRMs required more investment compared to ATMs and CDMs, banks are preferring CRMs as they reduce the cost of cash replenishment.

"A lot of cost goes into loading cash in ATMs both in terms of money and time. But when it comes to CRMs, it is actually reducing the operating cost," Haider said.

Md Shafquat Hossain, deputy managing director and head of retail banking at Mutual Trust Bank PLC, said the number of CRMs will grow as they facilitate both deposits and withdrawals.

"These are benefiting banks too. They can bring down the queue of clients in branches," he added.

Meanwhile, as the cost of operating ATMs is high, some banks are depending on the ATMs of other banks to serve their customers instead of establishing their own.

Md Mahiul Islam, deputy managing director of BRAC Bank, said some big banks are downsizing the number of their ATMs.

"We did not close any ATMs recently. Instead, we are opening subbranches featuring ATMs," he added.

In May 2023, Standard Chartered Bank (SCB) Bangladesh began to restrict access to ATMs at its branches to encourage cashless transactions.

As such, it eventually closed down several of its ATM outlets.

In an email response regarding the closure of ATMs in May last year, SCB said as cash and ATMs lose relevance and Bangladesh Bank charts a course to become cashless by 2027, it was following suit.

"We started promoting cashless lifestyle through campaigns that we started in March 2023," SCB said.

"We believe in having separate ATM networks for each bank but having them at the same locations is redundant not only in terms of investment for installation, but the use of electricity and carbon emissions associated with the operation of these networks," it added.

The SCB also said that since almost all of the ATMS were connected through Visa/Mastercard/National Payment Switch Bangladesh (NPSB) network, it Is only a matter of time before there is a convergence of these networks.

However, Abul Kashem Md Shirin, managing director and CEO at Dutch-Bank PLC, said demand for cash withdrawal through ATMs/CRMs will persist for some time in the future.

"This is because people in Bangladesh are still not ready to go fully cashless. But the growth of ATMs will not be that high anymore as CRM usage will grow," Shirin added.

At present, Dutch-Bangla Bank PLC has 5,500 ATMs and 2,000 CRMs across the country.

The private bank recently placed work orders to buy another 3,000 CRMs as a part of its effort to install the device at all branches.

For all latest news, follow The Daily Star's Google News channel.

For all latest news, follow The Daily Star's Google News channel.

Comments