Bangladesh Bank plans mergers of troubled banks, NBFIs

The Bangladesh Bank (BB) is preparing to roll out a large-scale merger initiative involving financially weak banks and non-bank financial institutions (NBFIs) under the Bank Resolution Ordinance.

Six Islamic banks are likely to be merged initially, said central bank officials on condition of anonymity.

The banks are Social Islami Bank, Global Islami Bank, ICB Islamic Bank, EXIM Bank, First Security Islami Bank, and Union Bank, according to BB officials.

They said that global audit firms Ernst & Young and KPMG have already completed asset quality reviews of these commercial lenders. Based on their findings, the central bank is expected to proceed with the merger.

Except for ICB Islamic Bank, the boards of the five commercial lenders were reconstituted after the fall of the Awami League-led government on August 5 last year.

These banks are now struggling to repay depositors due to widespread irregularities and a spate of financial scandals.

To stabilise the banking sector, the BB governor said the banks would be temporarily placed under state ownership.

Speaking at a press conference on Tuesday, Mansur also said that the merger process would be lengthy and would begin with several Islamic banks. They would be brought under the Bank Resolution Ordinance 2025 and nationalised for an interim period.

He assured depositors that their funds would remain safe during the transition, as the government would take over the merged banks.

The new ordinance gives the central bank authority to supervise mergers and acquisitions in the banking sector, according to the governor.

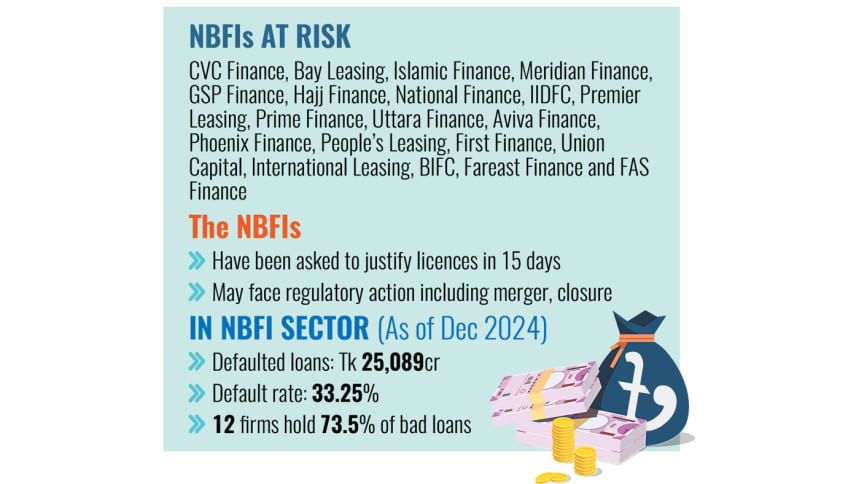

In a parallel move, BB is also tightening its grip on troubled NBFIs.

Twenty such institutions have been served notices, asking them to explain why their licences should not be revoked.

They have been given 15 working days to respond, BB officials said, adding that based on the replies, the central bank may begin mergers or proceed with liquidation.

The NBFIs are CVC Finance, Bay Leasing, Islamic Finance, Meridian Finance, GSP Finance, Hajj Finance, National Finance, IIDFC, Premier Leasing, Prime Finance, Uttara Finance, Aviva Finance, Phoenix Finance, Peoples Leasing, First Finance, Union Capital, International Leasing, BIFC, Fareast Finance, and FAS Finance.

As of December last year, defaulted loans at 35 NBFIs stood at Tk 25,089 crore, making up 33.25 percent of their total disbursed loans, according to central bank data.

The figures also show that 12 institutions accounted for nearly 73.5 percent of all bad loans in the sector.

Seven NBFIs had default rates of more than 90 percent.

FAS Finance topped the list with a 99 percent default loan, followed by Fareast Finance at 98 percent, BIFC and Peoples Leasing at 97 percent, International Leasing at 96 percent, Union Capital at 95 percent, and Aviva Finance at 90 percent, according to BB data.

For all latest news, follow The Daily Star's Google News channel.

For all latest news, follow The Daily Star's Google News channel.

Comments