BB tightens loan classification rules to meet IMF conditions

Payment failure for three months or 90 days after the due date will now lead to classification of loans regardless of type, according to new rules announced by the central bank yesterday, aligning with international best practices prescribed by the International Monetary Fund (IMF).

The new rules will be effective from April next year, replacing current different non-performing loan (NPL) labelling tenures for different types of bank loans.

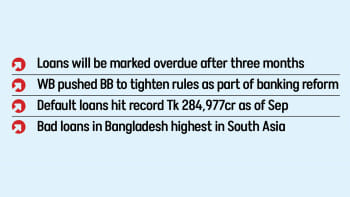

This stokes fears about a surge in toxic loans within the banking sector, which stood at a record Tk 284,977 crore at the end of September this year.

While approving the ongoing $4.7 billion loan package for Bangladesh in January last year, multilateral lender IMF set several targets, including reworking loan classification rules.

The Bangladesh Bank (BB) issued a detailed circular yesterday regarding the loan classification.

As per the new rules, a loan will be classified as substandard when the overdue tenure is three to six months. It will be classified as doubtful when the overdue tenure is six to 12 months.

When the overdue tenure is 12 months and above, loans will be classified as bad and loss.

Currently, a loan is classified as substandard when the overdue tenure is three to nine months. It turns doubtful when the overdue tenure is nine to 12 months.

Under the new rules, the overdue tenure for bad and loss category remains the same as now -- which is 12 months and above.

The cottage, micro, small and medium enterprises (CMSME) currently enjoy different loan classification tenures, which have been revoked under the new rules.

CMSME loans are classified as sub-standard when the overdue tenure is six to 18 months. Those turn doubtful when the overdue tenure is 18 to 30 months. When the overdue tenure is 30 months and above, those loans are labelled as bad and loss.

In the new rules, there is no change in provisioning against loans.

Banks now have to keep 1 to 5 percent as a provision against general category loans. This provisioning rises to 20 percent against sub-standard loans, 50 percent against doubtful loans and 100 percent against bad loans.

In the notification, the central bank said a strong financial sector is necessary to support the growing economy in Bangladesh.

According to the BB, timely steps are necessary to reduce the rate of classified loans for financial stability. The government and the Bangladesh Bank have taken various initiatives to reform the banking sector.

As part of those steps, the BB said the instructions have been issued in light of international best practices.

The loan classification and provisioning policy was first introduced in 1989 under the financial sector reform programme in Bangladesh.

Later, various changes were made to the policy to align it with international best practices and methods. Two major changes were brought in 1998 and 2006.

However, the latest major revision of the loan policy was made in 2012, central bank officials said.

Loans disbursed through irregularities to Awami League-affiliated businesses turned sour at an alarming pace after the ouster of the Sheikh Hasina-led government on August 5.

Between July and September, bad loans soared 34.8 percent or by a staggering Tk 73,586 crore, according to BB data.

Bangladesh now has the highest ratio of defaulted loans in South Asia, with nearly 17 percent of the total disbursed loans having gone bad.

Bankers said bad loans will increase further in the upcoming days thanks to the tightening loan classification rules.

"Bad loans will surpass Tk 300,000 crore by December," said Mohammed Nurul Amin, a former chairman of the Association of Bankers Bangladesh (ABB), the forum of bank managing directors and chief executives.

"If the loan classification rules are tightened, this number will jump," said Amin, the chairman of Global Islami Bank.

A World Bank (WB) team is now in talks with the central bank to support banking sector reforms. They urged the BB to implement the international standard loan classification rules immediately.

For all latest news, follow The Daily Star's Google News channel.

For all latest news, follow The Daily Star's Google News channel.

Comments