BRAC Bank’s profit surged 69% on strong investment, fee income

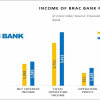

BRAC Bank Ltd reported an impressive 69 percent year-on-year profit increase, making Tk 419.62 crore in the July-September period.

This positive performance was primarily driven by incremental investment income alongside strong growth in commission and fee-based revenue streams, the bank said in its unaudited financial statements.

Its consolidated earnings per share rose to Tk 1.97 from Tk 1.22 the previous year, reflecting higher profitability during the July-September quarter, BRAC Bank noted.

Additionally, net operating cash flow per share surged to Tk 49.51 for the first nine months, nearly doubling from Tk 25.10 in the prior year.

The bank attributed this increase to elevated deposit mobilisation from customers and other banks, while loan portfolio growth remained more modest compared to previous periods.

The bank's net asset value per share also saw an uptick, which the bank said was bolstered by net profit growth and a revaluation reserve on government securities.

BRAC Bank was founded in 2001 and initially aimed at providing banking services for the underserved small and medium enterprises.

At present, it has expanded its reach with 329 ATMs, 68 recyclable cash deposit machines, and 52 CRMs across Bangladesh.

For all latest news, follow The Daily Star's Google News channel.

For all latest news, follow The Daily Star's Google News channel.

Comments