Businesses decry turnover tax hike

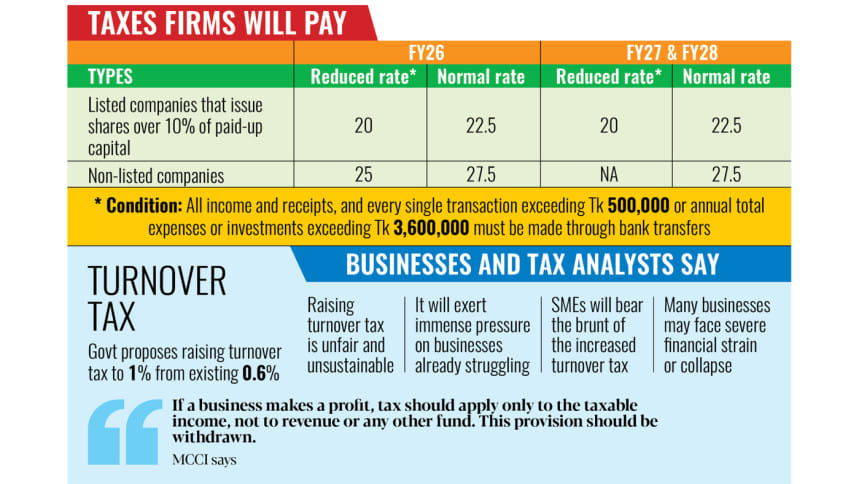

The interim government's proposal to raise the turnover tax from 0.6 percent to 1 percent from the next fiscal year has sparked an outcry among business leaders, who said the measure could deal a fresh blow to firms already struggling to stay afloat.

While presenting the budget for the fiscal year 2025-26 on Monday, Finance Adviser Salehuddin Ahmed announced that the turnover tax for all business taxpayers would be set at 1 percent.

It will apply regardless of whether a company turns a profit or not. However, mobile phone operators, tobacco manufacturers and carbonated beverage producers will not fall under this rule.

Turnover tax, often referred to as minimum tax, is levied on a company's total sales rather than its profits. For example, if a firm records Tk 100 in sales but ends the year in the red, it must still pay Tk 1 in tax.

The tax raise has drawn criticism not only from business chambers but also from tax analysts, who say it could cripple struggling and marginal enterprises.

In response, revenue officials said businesses were provided with numerous facilities earlier. But now the authorities are in a rush to mobilise more resources amid the International Monetary Fund's (IMF) push under its ongoing $4.7 billion loan package.

"A minimum tax levied on turnover is contrary to sound tax policy," the Metropolitan Chamber of Commerce and Industry, Dhaka (MCCI), said in its budget reaction.

MCCI voiced disappointment over the finance bill, saying that turnover tax could be raised as high as 3 percent for some sectors, without any corresponding reduction in the corporate tax rate.

"If a business makes a profit, tax should apply only to the taxable income, not to revenue or any other fund. This provision should be withdrawn," the MCCI said.

The Dhaka Chamber of Commerce and Industry (DCCI) also voiced concern.

"The government has proposed the provision when businesses, especially those in the SME sector, are already under immense pressure," DCCI President Taskeen Ahmed said yesterday.

"For the past two and a half years, we have endured relentless shocks from currency devaluation and the post-Covid slowdown to a prolonged domestic crisis," he said.

"Genuine businesses are now paying salaries out of their own capital. This is not a sign of a healthy economy."

Ahmed questioned the logic behind taxing revenue regardless of profitability.

"If I run a business worth Tk 100 crore and make a loss, the government still demands Tk 1 crore in turnover tax. How is that reasonable? Whether I profit or not, I am being forced to pay from my capital. Why punish those who already comply?"

Instead of repeatedly targeting the same set of taxpayers, the DCCI president urged the government to broaden the tax base.

More than 80 percent of the country's taxpayers are concentrated in Dhaka and Chattogram, he said.

The Bangladesh Chamber of Industries (BCI) echoed similar concerns, saying the proposed hike would disproportionately affect the country's industries, especially the Cottage, Micro, Small and Medium Enterprises (CMSME) sector.

"We urge a reconsideration of this decision to increase the turnover tax," the chamber said.

Fahmida Khatun, executive director of the local think tank Centre for Policy Dialogue (CPD), said the government should adopt a more rational approach.

"It must be imposed rationally. Why should a company that incurs losses still be liable to pay turnover tax?"

Meanwhile, Snehasish Barua, managing director of SMAC Advisory Services Limited, said, "The 1 percent turnover tax is a big blow for companies that run on thin margins or are in the red."

The tax expert said some businesses may be forced to pay this tax from their capital. "Such arbitrary policies may incentivise tax evasion and punish law-abiding companies."

The budget also includes a proposal to offer a reduced corporate tax rate of 22.5 percent to listed companies that raise more than 10 percent of their paid-up capital through an Initial Public Offering (IPO). Firms failing to meet this requirement would remain subject to the standard 27.5 percent rate.

In response, the MCCI said the benefit should not be confined to IPOs alone.

"It would be more reasonable to include transfers through Public Offerings (POs) as well," the chamber noted.

However, the provision has sparked concern among businesses listed on the stock exchange with less than 10 percent of their shares floated through IPOs.

These firms face an additional 7.5 percent corporate tax, according to the Foreign Investors' Chamber of Commerce and Industry (FICCI).

In a separate move, the government has relaxed the previous requirement for business transactions to be conducted through banking channels.

"To discourage cash transactions among taxpayers doing business and to simplify tax compliance, the previous provision requiring transactions to be made via banking channels has been relaxed," said the finance adviser.

"The impact of this tax at a significantly increased rate appears to be discriminatory," the FICCI said. "Equally concerning is that the benefit of a reduced tax rate for transactions made via banking channels has also been withdrawn."

This step, according to the foreign investors' chamber, runs counter to Bangladesh's push towards a cashless economy and puts the country at a disadvantage compared to regional peers such as Vietnam and Indonesia.

For all latest news, follow The Daily Star's Google News channel.

For all latest news, follow The Daily Star's Google News channel.

Comments