Card-based transactions soar 228% in five years

Card-based transactions in Bangladesh grew by 228 percent over the last five years amid a growing shift towards the use of plastic money for convenience.

Transactions through cards surged to Tk 41,407 crore at the end of April this year from Tk 12,643 crore five years ago, according to Bangladesh Bank (BB) data.

During this period, banks issued 5.17 crore cards, which was 140 percent higher than the 2.16 crore issued as of May 2020.

"This surge highlights the significant demand for card-based transactions among both consumers and merchants," the BB said in a report released yesterday on card usage patterns within and outside Bangladesh.

The BB said cards are one of the most popular means of transactions worldwide, and most countries use cards as plastic money.

"A considerable segment of Bangladesh's population enjoys the facilities and advantages offered by cards, though many people express reluctance to use cards despite having the qualifications, due to fear and lack of knowledge about them," it said.

The central bank introduced plastic money or debit and credit cards in 2012 with the goal of establishing a cashless banking system.

It framed a law last year to provide a legal foundation for the payment and settlement system and to protect consumers' interests.

To complement this effort, the BB's Payment Systems Department has developed essential guidelines, including a legal framework.

As a result, the number of card users, as well as the volume and variety of card-based transactions, has been steadily rising across the country.

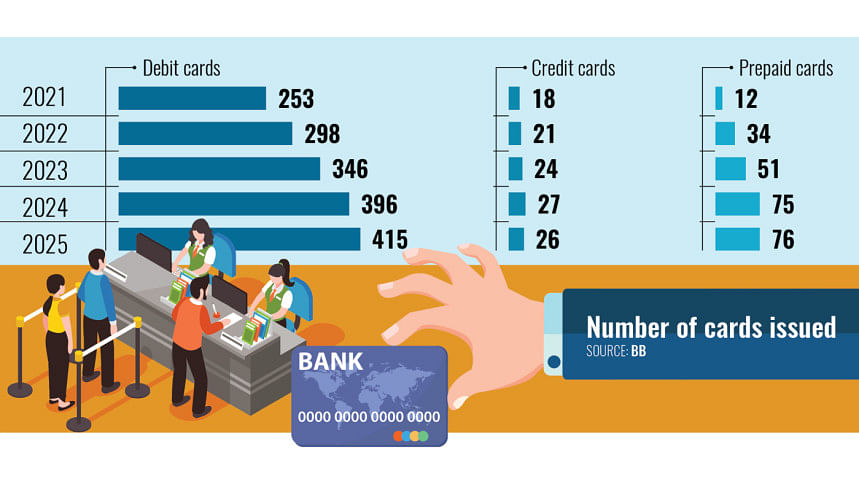

BB data showed that the highest growth was recorded in the issuance of prepaid cards, followed by debit cards.

Prepaid card issuance soared 1,283 percent in five years to 76 lakh in April 2025. Debit cards grew by 113 percent to 4.15 crore during this period, while net issuance of credit cards rose by 65 percent to 26 lakh.

In terms of transactions, credit cards were in the lead, recording a 361 percent growth to Tk 3,288 crore in April 2025 from that five years ago.

Meanwhile, cash withdrawals through debit cards jumped 220 percent to Tk 37,735 crore.

"The rising use of plastic money is playing a big role in digital transactions. So, cash transactions will go down," said Mahiul Islam, deputy managing director and head of retail banking at BRAC Bank.

Over the last couple of years, several large private and Islamic banks aggressively issued debit and prepaid cards, he said.

However, the number of unique cardholders would be lower than the number of cards in the market, especially credit cards. "Actually, a large portion of bank customers use cards from multiple banks," he said.

The BB said cash transactions have dominated Bangladesh's consumer payment ecosystem for many years, but their prevalence has been in consistent decline in recent years.

To accelerate the adoption of electronic payment methods, the government and the BB have implemented a series of targeted policy measures and regulatory reforms, it added.

"This strategic focus on digitalisation has yielded significant results, with card-based transactions experiencing exponential growth as businesses and consumers increasingly shift toward digital financial instruments," said the BB.

For all latest news, follow The Daily Star's Google News channel.

For all latest news, follow The Daily Star's Google News channel.

Comments