Cement sector struggles amid political, economic challenges

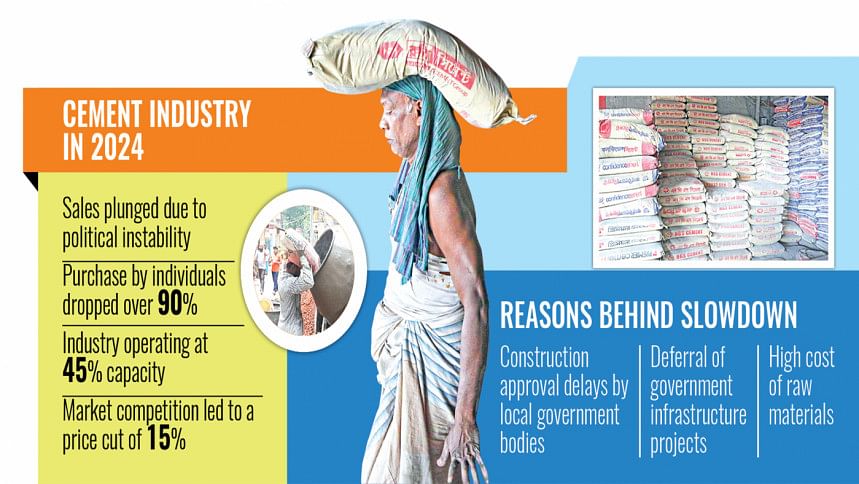

Cement sales in Bangladesh plunged in 2024 due to political instability, rising production costs, and the deferment of the implementation of government infrastructure projects, leaving the industry operating at less than half its capacity.

"The cement sales in 2024 declined due to political instability, macroeconomic challenges, inflation, and the suspension of government infrastructure projects," said Mohammad Iqbal Chowdhury, chief executive officer (CEO) of LafargeHolcim Bangladesh PLC.

Industry experts echoed similar concerns, emphasising that these factors have led to significant disruptions in the construction sector.

Mohammed Amirul Haque, managing director and CEO of Premier Cement Mills Limited, highlighted that the suspension of major infrastructure projects, a key customer of the cement industry, has exacerbated the downturn.

Despite these hurdles, Haque expressed optimism, emphasising that political stability and economic recovery could enable a rebound.

"The cement sector has weathered crises before and stands resilient," he said, underscoring the industry's potential for recovery in the coming years.

Haque further said the cement industry in Bangladesh, a critical driver of the construction sector, is grappling with declining demand and rising production costs.

"Traditionally, around 60 percent of the country's cement consumption is through individual initiatives," said Md Moshiur Rahman Dalim, head of business at Akij Cement Company Limited.

"…the remaining 40 percent is used in government development projects and infrastructure of other organisations," he said.

However, the dynamics have shifted drastically, painting a bleak picture for the sector.

He said cement consumption at the individual level has dropped by over 90 percent.

According to him, this decline can be largely attributed to delays in the issuance of approvals from local government bodies, including city corporations, municipalities, and urban development authorities, which are crucial for construction projects.

People also face hurdles in obtaining necessary clearances due to the absence of elected public representatives in the local government bodies, further stalling individual construction projects, he said.

Bangladesh boasts 42 cement factories with a combined production capacity of 84 lakh tonnes per month, according to the Bangladesh Cement Manufacturers Association.

However, Dalim said sales have plummeted to just 34 lakh tonnes per month, leaving the industry operating at a mere 45 percent of its capacity.

This sector, where annual growth in consumption typically ranges from 9 to 10 percent, saw an unprecedented decline in sales of around 1.2 percent in 2024, he said.

The industry's woes are compounded by soaring costs of production, driven by hikes in electricity and fuel prices, he added.

"We are now in a difficult situation. The same manpower required to produce 10 lakh tonnes of cement is being utilised for just one lakh tonne. Despite the downturn, we have not resorted to layoffs," said Dalim.

Adding to the burden is a discrepancy in import duties on raw materials, he said.

"Although the international price of cement clinker has dropped to $44 per tonne, the government continues to calculate import duty based on a rate of $62 per tonne," he said.

Dalim said this disparity results in an additional cost of nearly Tk 2,000 per tonne. Meanwhile, a 10 percent hike in supplementary duty on limestone has further raised costs.

He said winter, usually the peak season for cement sales, has also failed to deliver relief.

The combined impact of declining demand and increasing costs has taken a toll on the overall construction sector, leaving businesses and stakeholders in a risky position, he explained.

Mohammed Khurshed Alam, executive director of Fresh Cement, a concern of the Meghna Group of Industries, highlighted the severe challenges faced by the cement sector due to declining demand.

Despite rising production costs, manufacturers have been compelled to slash prices by at least 15 percent to survive in an increasingly competitive market, he said.

Alam noted that the manufacturers had turned hypercompetitive, which was a significant factor behind the price drop.

"The sector has been struggling since 2022, with consistent de-growth each year, despite averaging at an 8 percent annual growth since 2010," he said.

Alam attributed the sector's ongoing uncertainties to the absence of an elected government, which has hindered consumer confidence and construction activity.

"People are hesitant to spend money or start new projects, given the prevailing political uncertainties," he remarked.

He expressed hope that the situation would improve once an elected government assumes power and begins implementing large-scale development projects.

"When development projects are launched, and people regain confidence to construct buildings, the demand for cement will naturally rebound," he added.

Until then, the cement and other construction-related industries are likely to remain subdued, he said.

For all latest news, follow The Daily Star's Google News channel.

For all latest news, follow The Daily Star's Google News channel.

Comments