Consumer sales slow as inflation bites

Grocery shelves are not clearing as quickly for fast-moving consumer goods (FMCG), while many are switching to mini-packs of food and toiletries -- indicating that people are losing ground in their prolonged battle against inflation.

Take the case of Abul Bashar, a grocery shop owner in Dhaka's upscale Uttara area with customers from at least five dozen neighbouring buildings.

Bashar says there are fewer buyers of mega and jumbo packs of toothpaste or shampoo. Instead, most of his customers are now spending mainly on essential food items like potato, onion, garlic and lentil -- even in smaller quantities.

"People who used to buy an item three kilogrammes at a time are now asking for only half a kilogramme or one kilogramme maximum," the grocer said.

He attributed this consumer behaviour to rising prices and people's incomes failing to keep pace.

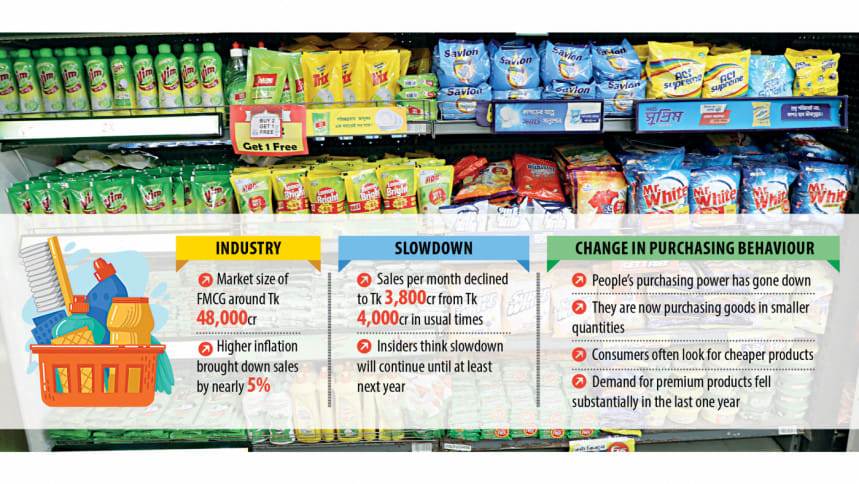

Zooming out from the small Uttara area to the nationwide scale, Zaved Akhtar, managing director of Unilever Bangladesh, said their monthly FMCG sales have declined 5 percent in recent months.

Despite several interest rate hikes by the central bank to blunt the brutal price pressure, the Consumer Price Index (CPI) has been hovering around 10 percent since March last year.

In September, the CPI stood at 9.92 percent, down from 10.49 percent in August, according to the Bangladesh Bureau of Statistics (BBS).

Unilever Bangladesh MD said the prolonged price pressure has badly impacted people's purchasing power.

"The impact is largely evident on our sales of premium and semi-essential products like shampoo. However, highly essential items like soap or detergent are still showing some degree of immunity from inflation," he told The Daily Star.

According to Akhtar, around 10 percent of Unilever's FMCG basket consists of premium items like Surf Excel and Rin Washing Powder.

"People are not purchasing these products as they have shifted to more affordable alternatives like Wheel Washing Powder, also an FMCG item by Unilever," Akhtar added.

He said the local monthly FMCG sales, which were usually Tk 4,000 crore, have declined to around Tk 3,800 crore since July, marking a 5 percent decrease.

Now, consumers are opting for smaller quantity packs instead of larger ones due to their declining spending capacity, the Unilever Bangladesh MD said.

From October every year, local FMCG manufacturers usually increase production of winter products like petroleum jelly, body lotion and skincare products for winter supply.

"However, this season is different. Almost all companies are not making too much for now," said the Unilever Bangladesh MD.

He said it is difficult to predict how long this situation will continue, but unfortunately, uncomfortably high inflation may persist for another year.

Malik Mohammed Sayeed, chief operating officer of Square Toiletries Limited, said they have avoided increasing prices on essential hygiene and toiletries items by sacrificing profit margins.

"We did not increase the price of some products despite their production costs increasing by 15 percent due to pricier raw materials," he said.

Echoing Sayeed, Kamruzzaman Kamal, marketing director of PRAN-RFL Group, said prices of their FMCG items have not increased, but consumption has declined substantially.

For this, he blamed both the declining purchasing power of consumers and rising inflation.

Kamal too said that people are now opting for smaller quantities instead of larger items.

SM Mujibur Rahman, head of accounts at Meghna Group of Industries (MGI), said their sales of FMCG products have declined since July.

The lower-income to middle-class consumers are under pressure as their purchasing power has decreased due to rising prices of daily essentials, said Rahman, adding that this has forced them to reduce consumption as a part of the belt-tightening measure.

Overall, FMGC sales have declined by around 5 percent, but in some cases, the decline has been up to 12 percent depending on the products, Rahman said.

MGI supplies 17 FMCG products under 15 categories.

For all latest news, follow The Daily Star's Google News channel.

For all latest news, follow The Daily Star's Google News channel.

Comments