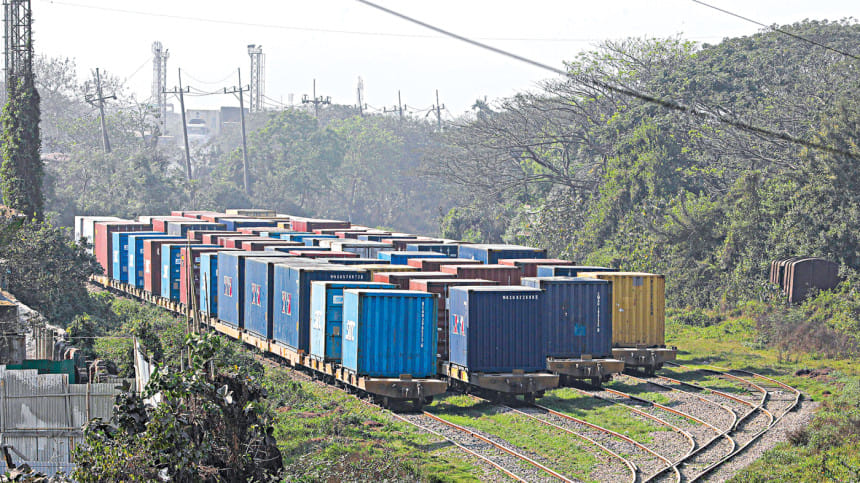

Container transport by train falls amid engine crisis

The transportation of containerised goods via freight trains across the country declined by more than 9 percent year-on-year in the fiscal year 2023-24 due to a shortage of locomotives and railway staff.

This has impacted Bangladesh Railway's (BR) revenue, further underscoring the ongoing challenges in its transport sector.

Some 84,811 containers were transported domestically in 2023-24, down from 92,908 in the previous fiscal year, according to BR data.

The state-owned rail transport agency introduced container services in 1986-87 on the Dhaka-Chattogram route, mainly targeting Chattogram Port.

Currently, the state transport agency has scheduled four pairs of freight trains for container transport, mainly carrying raw materials, marble, stone, food grains, and fertiliser.

Some 84,811 containers were transported domestically in 2023-24, down from 92,908 in the previous fiscal year

However, officials said a shortage of engines and staff has forced the BR traffic department to run only one or two pairs of loaded container trains per day.

Abdul Malek, chief master of the Chattogram Goods Port Yard, said, "We need at least 13 engines per day to run scheduled freight trains. But we now get only three to four engines regularly."

Compared to road transport, businesses prefer freight trains for their lower cost, greater security, and reduced logistical hassle.

According to several shipping line operators, transporting an import container from Chattogram Port to Kamalapur ICD in Dhaka by rail costs around Tk 28,000 ($245), while an export container costs around Tk 25,000 ($219).

In contrast, a prime mover charges up to Tk 35,000 ($292) to transport a 20-foot container on the Dhaka-Chattogram highway to industrial units in Dhaka, Narayanganj, Gazipur, and Ashulia, according to clearing and forwarding (C&F) agents.

The delays in rail transport are not only affecting traders financially but also contributing to congestion at Chattogram Port.

"The cost of rail transport is lower than road transport, but congestion at the port means containers have to be left there, incurring storage fees and ultimately causing losses for us," said Imran Jahid, a businessman from Dhaka's Keraniganj area.

The port's designated yard has a storage capacity of 876 TEUs (twenty-foot equivalent units) for import containers transported by rail.

However, as of January 27, a backlog of containers at the yard had exceeded capacity, with 1,049 TEUs waiting for transport, according to the Chittagong Port Authority (CPA) traffic department.

"We are waiting at least 8 to 10 days to load containers onto trains after unloading them from ships," said Khairul Alam Suzan, vice-president of the Bangladesh Freight Forwarders Association (BAFFA).

Contacted, Md Sabuktagin, general manager of BR's eastern zone, said, "Freight train operations are profitable for us. But the engine crisis has made us helpless."

He said BR has now decided to repair some inoperative engines to streamline freight train services. "Hopefully, we will be able to overcome this crisis soon and return to our earlier operations," he added.

For all latest news, follow The Daily Star's Google News channel.

For all latest news, follow The Daily Star's Google News channel.

Comments