Current account deficit narrows in Jul-Oct

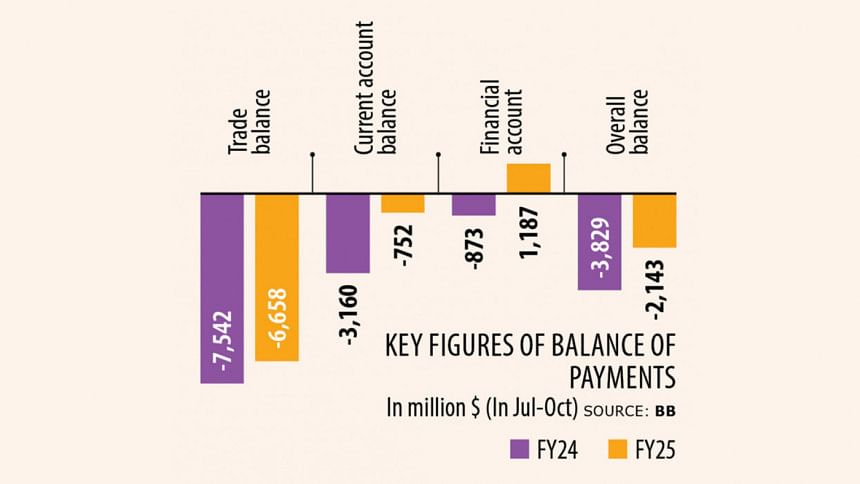

Bangladesh's current account deficit narrowed 76.20 percent year-on-year to $752 million in the first four months of the current fiscal year on the back of growing export earnings and remittance inflows, reflecting reduced pressure on the country's external accounts.

Bangladesh Bank data showed that the current account deficit was $3.16 billion in the four months to the end of October a year ago.

Remittances sent home by Bangladeshis living abroad rose 14 percent year-on-year to $2.2 billion in November, according to central bank data.

Year-on-year remittance fell 3.2 in July, but increased 39 percent in August, 80 percent in September and 21 percent in October.

Export earnings also increased in the four months this year, rising 8.3 percent to $14.29 billion. In the same period, import expenditure rose only 1 percent to $20.95 billion. As a result, the trade deficit narrowed by 11.72 percent to $6.65 billion at the end of October.

However, industry insiders said slow growth in import payments is not a good sign for the economy as it means that industrial expansion and investment are stagnant.

Another significant development in the balance of payments came is the financial account, which turned positive at the end of October.

The financial accounts surplus reached $1.18 billion compared to a deficit of $873 million in the same period last year, data showed.

The financial account includes components such as direct investment, portfolio investment, and reserve assets, broken down by sector. On a negative note, foreign direct investment showed a 19.8 percent year-on-year decline to $388 million at the end of October this year, data showed.

The overall balance stood at a $2.14 billion deficit at the end of October, down from $3.82 billion in the same period last year.

The current account records a nation's transactions with the rest of the world -- specifically net trade in goods and services, net earnings on cross-border investments, and net transfer payments.

For all latest news, follow The Daily Star's Google News channel.

For all latest news, follow The Daily Star's Google News channel.

Comments