Debt servicing costs outweigh incoming loans

Bangladesh's cost to service loans from multilateral and bilateral lenders surpassed the amount received from them during the first two months of fiscal year (FY) 2024-25, indicating that the country's already fragile foreign exchange reserves may be stressed further.

External debt servicing costs soared 47 percent year-on-year to $589 million in the July-August period amid rising global interest rates and a heavier foreign loan portfolio.

In the same period, the country received $458 million from global financiers, down 38 percent year-on-year.

Overall, loans disbursed by foreign lenders were around $131 million lower than the money spent by the government on debt servicing.

"The July-August period was one of the most eventful periods in Bangladesh's history, marked by significant changes and uncertainty," said Md Deen Islam, an associate professor of economics at the University of Dhaka.

"As a result, it was expected that loan and grant commitments and disbursements would be low during this period."

The Economic Relations Division (ERD) said overall commitments from financiers dipped drastically to only $20 million in the first two months of FY25 compared to $1.14 billion a year ago.

This situation has arisen at a time when Bangladesh is struggling to increase its foreign exchange reserves and contain exchange rate volatility.

"The finance ministry must expedite access to foreign loans and grants that multilateral partners have committed to providing," said Ashikur Rahman, principal economist at the Policy Research Institute of Bangladesh.

The ministry should do that so the pressure of these international payments on our foreign reserves is minimised, he said.

Rahman said the interim government should also try to renegotiate bilateral loans taken under government-to-government frameworks to reduce medium-term pressure on the balance of payments.

Asked whether this situation is a matter of concern right now, Rahman said: "Nothing major, but we must be watchful."

He suggested that the ERD formulate a five-year projection to help policymakers understand how much is expected in debt repayments annually over the next five years.

"It can help improve economic planning," he said.

In the July-August period, Japan disbursed the highest amount, releasing $130 million. The Asian Development Bank (ADB), which provided $117 million, followed closely behind.

However, the ADB, World Bank, Japan and the Asian Infrastructure Investment Bank did not make any further commitments during the period.

On a positive note, Islam said the interim government's focus on transparency and accountability, as demonstrated by recent reform initiatives, meant that development partners are now more willing to provide assistance.

For example, the World Bank has committed to providing an additional $2 billion in loans, while other development partners, including the ADB and the International Monetary Fund (IMF), are also stepping forward with financial and technical support for ongoing reforms, according to Islam.

"These efforts are expected to boost foreign investor confidence, placing Bangladesh in a better position to attract more foreign direct investment, which had stagnated in recent years," Islam said.

He termed the rising debt servicing costs a consequence of indiscriminate borrowing by the previous regime.

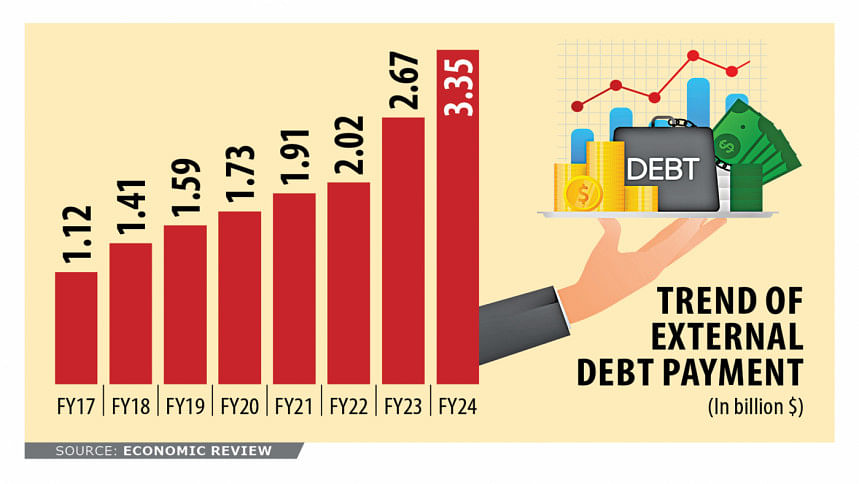

Bangladesh's foreign debt servicing costs have been growing steadily, but overall payments have soared since FY23.

The nation paid $3.35 billion in FY24 to service its debts, a 25.73 percent jump compared to the $2.67 billion it had cost the year prior.

"The continued positive trends in remittance inflows, along with renewed support from development partners, could help Bangladesh manage pressure on its foreign exchange reserves," he added.

"This would mitigate potential negative impacts on key macroeconomic indicators such as inflation and GDP growth."

However, if the newly borrowed funds are not utilised properly and a significant portion is lost to corruption, imbalances in the foreign exchange market could deepen, exacerbating inflationary pressures, said Islam.

"Therefore, effective use of these resources is critical for maintaining economic stability."

For all latest news, follow The Daily Star's Google News channel.

For all latest news, follow The Daily Star's Google News channel.

Comments