Default loans surpass Tk 200,000cr for first time

Default loans in the banking system surpassed Tk 200,000 crore for the first time, underlining the fragile condition of the sector that fell prey to rampant scams and irregularities under the tenure of the Awami League government over the past 16 years.

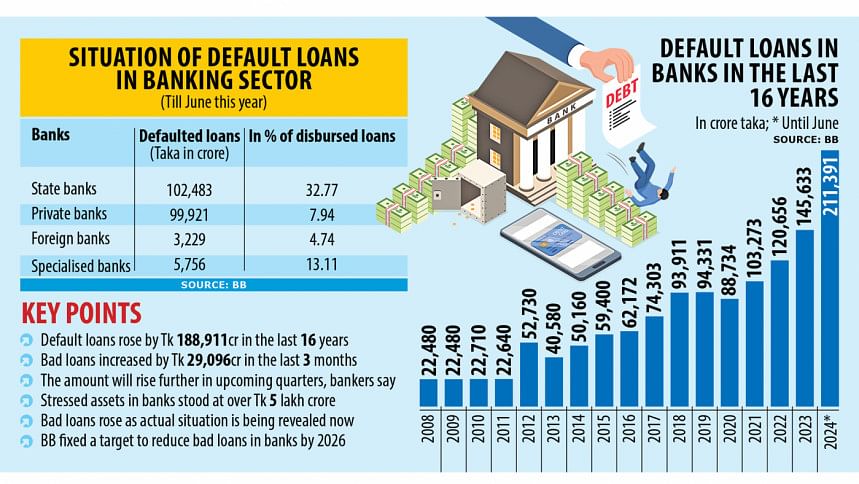

At the end of June this year, bad loans in the sector climbed to Tk 211,391 crore, which accounts for 12.56 percent of the total disbursed loans of Tk 1,683,396 crore, as per the latest Bangladesh Bank data. This is the highest ratio of non-performing loans to total disbursed loans in the past 16 years.

Till June last year, default loans stood at Tk 156,039 crore, BB data showed.

Soured loans increased by Tk 29,096 crore in the past three months from Tk 182,295 crore as of March 30.

Industry insiders said that the actual information regarding the health of banks, which had been meticulously swept under the rug by vested quarters, began to trickle out due to pressure from the International Monetary Fund (IMF).

Their actual condition started to be fully uncovered after Sheikh Hasina, who led the Awami League government during its 15-year tenure, was ousted on August 5 by a mass uprising.

Bad loans in the banking sector stood at Tk 22,480 crore when the Awami League won the first of four consecutive general elections in 2008. However, the volume began to grow thereafter due to a growing trend of irregularities and scams.

Selim RF Hussain, chairman of the Association of Bankers, Bangladesh (ABB), told The Daily Star yesterday that they did not believe the figures provided by the central bank as they doubted whether the BB had conducted audits sincerely for the past several years.

Hussain, also managing director of BRAC Bank, said bad loans were likely to be far higher in reality.

He added that Bangladesh has not been following international standards in terms of the classification of loans or provisioning. "If we had followed international standards, the sector would not be bleeding."

He also alleged that former finance minister AHM Mustafa Kamal had changed the provisioning system, which was a significant setback for the banking sector.

There have been huge irregularities and scams over the past few years in the sector and the central bank has only motivated and encouraged them, he lamented.

Hussain suggested measures to urgently stem the bleeding in the banking sector before imposing rules and regulations properly.

"The government must promise to bring good governance to banks. Hopefully, the sector can be restored in four to five years."

As of the end of June, default loans at state-run banks stood at Tk 102,483 crore, which accounts for 32.77 percent of their disbursed loans.

Meanwhile, bad loans at private banks stood at Tk 99,921 crore or 7.94 percent of their total outstanding loans. Soured loans at foreign banks amounted to Tk 3,229 crore, or 4.74 percent of disbursed loans, while it stood at 13.11 percent for specialised banks, whose bad loans amounted to Tk 5,756 crore.

Industry insiders said bad loans were certain to increase in the July-September quarter.

This is because they expect a large volume of loans to rapidly sour after the downfall of the AL government as those loans were taken by influential business groups through fake documents and irregularities using their political clout.

S Alam and its associates alone took out more than Tk 95,000 crore from six banks. Those loans are likely to turn sour in the coming months, they added.

Bankers also say that a tendency among borrowers to refrain from repaying loans citing unfavourable economic conditions may add to the burden of bad loans.

Most loans disbursed by state-run banks were also availed through irregularities and scams, which makes it difficult to recover those loans.

Moinul Islam, a former professor of economics at Chittagong University, recently told The Daily Star that the actual volume of bad loans is more than Tk 500,000 crore if written-off loans, rescheduled loans and loans with court injunctions are considered.

He said the issue had become a major problem.

"The former government did not take adequate action against loan defaulters. That is why their numbers are continuously rising."

Stressed assets, including written-off and rescheduled loans, stood at Tk 377,922 crore till December 2022, central bank data showed.

The figure has increased sharply, industry insiders said. The central bank has refrained from publishing data on written-off and rescheduled loans since.

The former government had set a target to reduce the volume of bad loans as prescribed by the IMF with its $4.7 billion loan programme.

As per the previous government's directive, the BB fixed a target to reduce bad loans at state-run banks to 10 percent by 2026. The target for private commercial banks was set at 5 percent.

For all latest news, follow The Daily Star's Google News channel.

For all latest news, follow The Daily Star's Google News channel.

Comments