Directors’ assets may be sold to settle policyholder dues

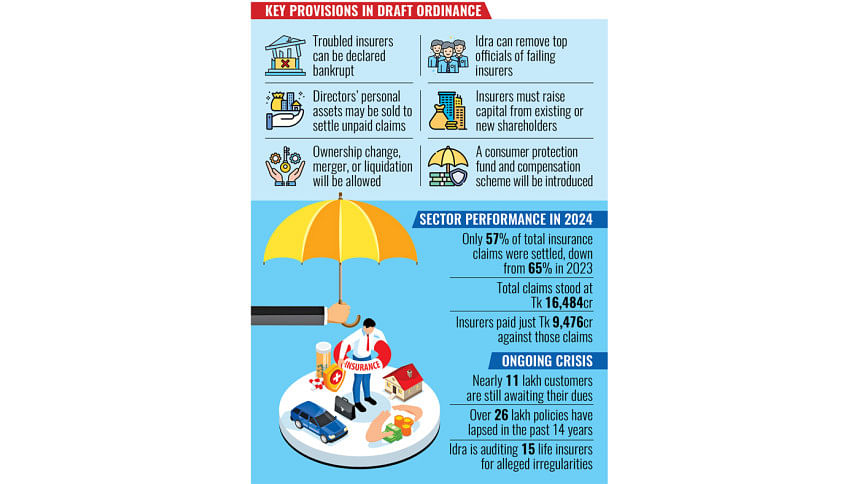

The Insurance Development and Regulatory Authority (Idra) has finalised a draft of the Insurance Resolution Ordinance 2025, which would grant the regulator sweeping powers to declare financially troubled insurers bankrupt.

If necessary, it could even liquidate the personal assets of directors to clear dues owed to policyholders.

Industry experts say the move, on one hand, shows the regulator itself is acknowledging the fragile state of the sector. This is because the proposed ordinance mainly focuses on distressed insurers, strategies for their recovery, and punitive measures for wrongdoing.

But on the other hand, according to experts, this is the first time in nearly 15 years since Idra's inception that the regulator is preparing to implement bold clean-up measures.

In the long run, they say such a move could help restore public confidence, bring discipline to the industry, and protect the interests of policyholders.

The draft outlines procedures for restructuring troubled insurers, including changes in ownership, mergers, or liquidation.

"The main goal of the ordinance is to protect policyholders, especially by making sure their claims are paid on time," said Saifunnahar Sumi, spokesperson for Idra.

"The process of merging weak companies under the Insurance Act 2010 is not broad enough. This ordinance will help expedite that," she told The Daily Star.

The spokesperson said Idra will make the draft public soon to invite feedback from stakeholders.

The country has 82 insurance companies — 36 life insurers and 46 non-life.

For years, the country's insurance sector has been marred by mismanagement, fund embezzlement, and weak oversight.

More than 26 lakh policies have lapsed over the past 14 years, according to Idra data. Besides, nearly 11 lakh policyholders are currently unable to recover their dues.

Against this backdrop, the government has recently moved to amend the existing insurance law, expanding Idra's authority to dissolve and restructure insurer boards, limit family ownership concentration, and impose hefty fines for violations.

But why is Idra finalising the draft of the ordinance now, even after the proposed amendments to the insurance law?

"This has been a long-overdue step," said Md Main Uddin, a professor and former chairman of the Department of Banking and Insurance at the University of Dhaka.

Back in 2011, the authorities set up the insurance regulatory body but failed to give it the teeth to act effectively, he said. "This should have been done immediately after the formation of Idra."

Meanwhile, Barrister Khan Mohammad Shameem Aziz, an advocate at the Supreme Court, said, "The purpose of a separate ordinance is to allow the regulator to independently make any decision regarding troubled insurers within a legal framework."

While the Insurance Act 2010 sets general rules for regulation and supervision, it falls short when it comes to outlining specific procedures for crisis scenarios, he told The Daily Star.

Regulatory data show that 15 life insurance companies largely failed to settle policyholder claims last year due to alleged irregularities and corruption.

Idra appointed audit firms to conduct special audits of 15 life insurers covering the 2022-2024 period, as unpaid claims at that time continued to rise.

By the end of 2024, these companies owed policyholders Tk 4,615 crore but had paid only Tk 635 crore, according to regulatory data.

In another move, the regulator recently directed six of the struggling life insurers to submit recovery plans, leaving policyholders anxiously awaiting resolution.

According to Prof Uddin, Idra often hesitated to take action against certain companies accused of corruption and irregularities under the previous government.

That reluctance, he said, left several firms to deteriorate beyond repair.

Prof Uddin believes the proposed ordinance could finally help clean up the sector and restore some long-lost order.

FINE UP TO TK 1CR, 7-YR JAIL

The draft ordinance includes provisions for removing or replacing top officials, including chairpersons, directors, chief executives, and key personnel.

It also allows for raising capital through existing or new shareholders.

To ensure continuity, the draft proposes setting up one or more bridge insurance companies, which could later transfer the assets or shares of troubled firms to third parties.

Although the term "bridge insurance" is more commonly associated with covering physical damage to bridges caused by disasters, the draft uses it to describe temporary firms that will manage failing insurers before offloading them to stable entities.

Idra will also have the authority to temporarily place ownership of insurance companies under government control if needed.

The draft sets up a consumer protection fund and outlines compensation for affected shareholders and creditors.

If a company is found to have misused funds or assets, those responsible will be deemed embezzlers, with both their permanent and temporary assets subject to seizure.

Offenders could face fines of up to Tk 1 crore, seven years in jail, or both, under the current legal provisions, says the draft.

Adeeba Rahman, first vice-president of the Bangladesh Insurance Association and sponsor director of Delta Life Insurance Company Limited, said they had not yet received any formal communication from the government regarding the merger or dissolution of weak insurers.

She said if companies in serious financial trouble fail to repay policyholders even after being given a fair chance to respond, they should be merged.

"Given their state, there is no other option but to merge them," she added.

Rahman said Idra has yet to make the draft ordinance public. Once it does, the association will review the proposal with its members and submit detailed feedback.

For all latest news, follow The Daily Star's Google News channel.

For all latest news, follow The Daily Star's Google News channel.

Comments