Expansion of tax net should be a top priority

Bangladesh has an estimated population of more than 16 crore, but the number of registered taxpayers (e-TIN holders) is roughly 38 lakh and the number of taxpayers who filed returns is about 18 lakh. These figures obviously are not satisfactory. So, the expansion of the tax network has been one of the priority items on the action plan of our tax administration for the last few years. The ultimate goal of the plan is to bring all or most of the potential taxpayers within the fold of tax assessment. This is clearly a long as well as continuous process.

The agenda of expanding the tax network is approached mainly in two ways. The first thing is the tax administration gathers relevant information about potential taxpayers through enquiry, formal survey or other dependable source and initiates necessary action on the basis of the gathered information. Some positive result from this process is coming regularly. But this is not enough nor very remarkable. These efforts have to be continued more vigorously.

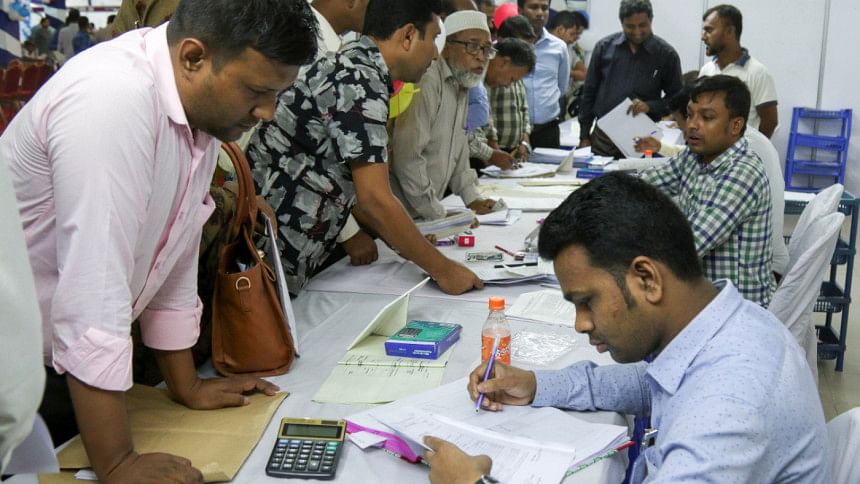

The second way is to create an awareness and motivation among the potential taxpayers so that they spontaneously file tax returns when they have a taxable income. This awareness-building programme is carried out by the National Board of Revenue (NBR) through holding of tax fairs and tax week in the month of November each year.

During the fair, tax-related service is offered by the tax officials and public response to these efforts of the NBR is also quite good. A large number of tax returns, including new ones are filed every year during the fair. But when it comes to assessment in a tax circle, the situation is quite different. The taxpayers do not encounter a friendly atmosphere in a tax circle. The actual progress of assessment is also often unjust and arbitrary. The assessee is discouraged and wants to keep a distance from the tax office. This is one of the main reasons for a low rate in voluntary registration or voluntary submission of tax return by new taxpayers.

The NBR should take effective measures to create a taxpayer-friendly atmosphere in tax circles so that taxpayers feel assured of getting a just treatment in tax circles. Only then the existing and the potential taxpayers will be genuinely motivated for voluntary compliance, which will contribute to the expansion of the tax net.

Discussions are underway on how to present a unique and overwhelming budget in 2019. The important focus is to widen the tax net and keep the pressure on taxpayers at a tolerable level. While doing this, the tax assessment, payment and related procedures have to be simplified. The tax fair obviously raises awareness and encourages taxpayers to submit return in simple form, but this is probably not enough.

If we revisit the background of the “Universal Self-Assessment” system introduced in 2007, we will come to know that this was introduced to motivate taxpayers to pay tax voluntarily.

According to the present system, all tax returns filed under section 82BB as “Universal Self-Assessment” system are subject to audit and in reality, some of them are picked up by choice for audit although presumably at random. But steps have been taken to keep some of the returns out of audit if certain conditions are met.

First of all, the condition of 15 percent higher income than the total income assessed in the immediately preceding assessment year is obviously too stiff when 5 percent growth in any business is a big challenge in recent time. So, majority of the taxpayers are not able to enjoy the facility of audit exemption. The conditions could be liberalised more to extend the facility to a large section of taxpayers.

In fact, the power to audit the tax returns is being misused by tax authorities in many cases causing unnecessary harassment to taxpayers. Moreover, according to the amendments made to this section in 2017, processing of self-assessment returns has become very lengthy and complicated. In reality, a very large number of the returns are subjected to scrutiny each year. This is against the basic principles of self-assessment and acts as a discouraging factor for the taxpayers.

It was also expected that if the taxation system can be simple and modern, the existing limited manpower can devote more attention to bringing potential new taxpayers under the tax net. If the existing manpower is bogged down with existing taxpayers, the tax evaders will get the advantage of it or the entire efforts for improving the direct tax collection will be less rewarding and failing to meet the government’s ultimate revenue collection target.

Similarly, under the section 82C, tax deducted at source in specific cases would have been the final discharge of tax liabilities as per the original design of the section. But the latest amendments to the section, through the Finance Act 2016 have changed this concept altogether. The section now provides that the tax deducted at source, in case of specific source of income, would be the minimum tax. There will be normal assessment for that source of income and if the assessed tax exceeds the tax deducted at source, the excess has to be paid. But if assessed tax is lesser than the tax deducted at source, there will be no refund. This is obviously discouraging for the taxpayers.

If the finance minister, according to his judgment, thinks that these systems of “Universal Self-Assessment” and special provision of assessment under section 82C are not workable and not bringing the expected results, these systems should be completely deleted.

In general, tax returns are filed together with audited accounts (in case of corporate taxpayers), evidence of tax payments and other relevant information and supporting evidence. If the return is selected for audit, more information, documents and evidences are asked from taxpayers to satisfy the assessing officer. If the audited accounts submitted are reliable in the judgment of assessing officer, assessments are completed. But in most of the cases, what happens in reality is the audited accounts are rejected under some pretext or otherwise and the assessing officer by using his discretionary power estimates the income at his will and deducts the expenditure also at his will and concludes the assessment raising a huge tax demand.

Many officers argue that this is the general procedures and insist the taxpayers to resort to such practices. Then the negotiation starts for arriving at the conclusion putting the taxpayers in uncertainty. This is really unfair, unrealistic and not conducive to a friendly tax environment.

Well, such a practice of estimating income and expenses can be resorted to when there is sufficient and clear-cut evidence of tax evasion and the assessee does not maintain any books and records. The possibility of involvement of corruptions cannot also be ruled out in any way. Some income tax practitioners also extend their support to such practices distorting the spirit of fair and transparent assessment process.

To be fair, in some cases, appeals results can make some remedies but sufferings of the taxpayers are still a lot. This needs to be revisited to ensure a tax-friendly environment for the sake of improving the overall collection of revenue.

The author is a chartered accountant and senior partner of Hoda Vasi Chowdhury & Co.

For all latest news, follow The Daily Star's Google News channel.

For all latest news, follow The Daily Star's Google News channel.

Comments