Exports to EU may fall 20%

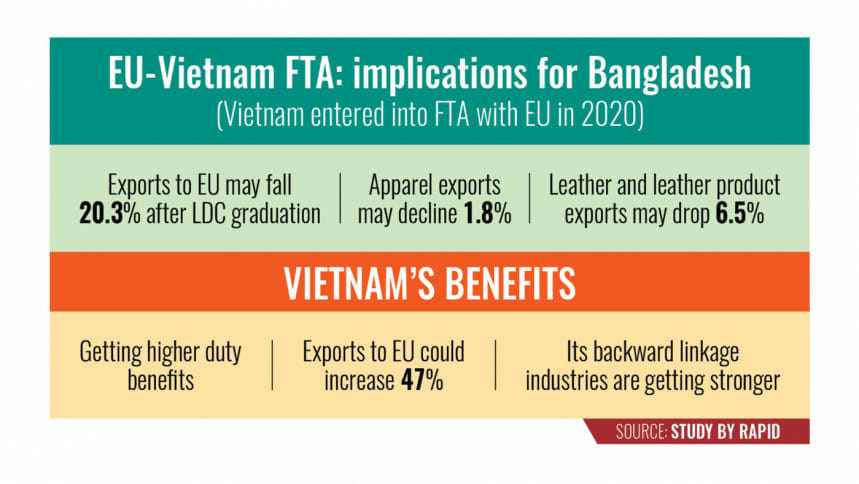

Bangladesh's overall exports to the European Union (EU) may fall by as much as 20 percent due to the combined impacts of the nation's graduation from least developed country (LDC) status and the EU-Vietnam Free Trade Agreement (EVFTA), according to a study.

Mohammad Abdur Razzaque, chairman of Research and Policy Integration for Development (RAPID), presented the study, conducted jointly by the think-tank and German political foundation Friedrich-Ebert-Stiftung, at a seminar in Dhaka yesterday.

"Bangladesh's apparel exports to the EU are projected to decline by 1.8 percent and leather and leather products by 6.5 percent due to trade diversion caused by the EVFTA," Razzaque said.

By 2023, Vietnam's exports to the EU more than doubled Bangladesh's, despite both countries having similar shipments in 2002, he added.

"Vietnam has made significant investments in its garment industry's backward linkages while Bangladesh has yet to implement visible policies, thereby failing to fully capitalise on the opportunity."

The EVFTA, which came into effect in 2020, grants Vietnam significant trade advantages, including zero-duty access to the EU market, replacing its earlier standard Generalised Scheme of Preferences (GSP).

In addition to tariff eliminations, the EVFTA addresses non-tariff barriers, opening the market for services and investment, and aligns Vietnam with the EU's labour and environmental standards, collectively strengthening its competitiveness and investment appeal.

Currently, Bangladesh's exports enjoy duty-free access to the EU under the "Everything but Arms (EBA)" programme. This, alongside relaxed rules of origin, has been instrumental in expanding the country's apparel exports to the EU.

But the benefit is only extended to LDCs, meaning Bangladesh may lose the privilege after graduation.

At the same time, while Bangladesh has been lagging in policy implementation, Vietnam has effectively streamlined its business environment and opened up trade and investment, taking timely and strategic policy actions, the study said.

"If Bangladesh wants to remain competitive, especially as global trade rules evolve, it must prioritise investments in backward integration and infrastructure development," Razzaque said.

He added that Bangladesh relies heavily on apparel exports while Vietnam's export basket is more diversified.

Razzaque also said Bangladesh and Vietnam are filling the void of China's declining market share in the global apparel market at a similar pace.

"Bangladesh has captured China's market share in the EU while Vietnam has done so in the US."

Echoing Razzaque, Fazlee Shamim Ehsan, executive president of the Bangladesh Knitwear Manufacturers and Exporters Association, said the total export volume is unlikely to drop after LDC graduation.

However, he hoped that labour-related difficulties in China and Vietnam, along with a rising unwillingness among their workers to regard RMG professions as prestigious, could result in a movement of orders from these nations to Bangladesh.

He also mentioned challenges facing Bangladesh, including the labour unrest, energy deficit and turmoil in the banking sector.

Among others, Policy Exchange Bangladesh Chairman M Masrur Reaz and Economic Relations Division Secretary Md Shahriar Kader Siddiky spoke at the event.

For all latest news, follow The Daily Star's Google News channel.

For all latest news, follow The Daily Star's Google News channel.

Comments