Falling food prices ease inflation

Falling food prices over recent months have helped cool inflation further in April, according to the Bangladesh Bureau of Statistics (BBS), with economists attributing the easing of price pressures to post-festival effects.

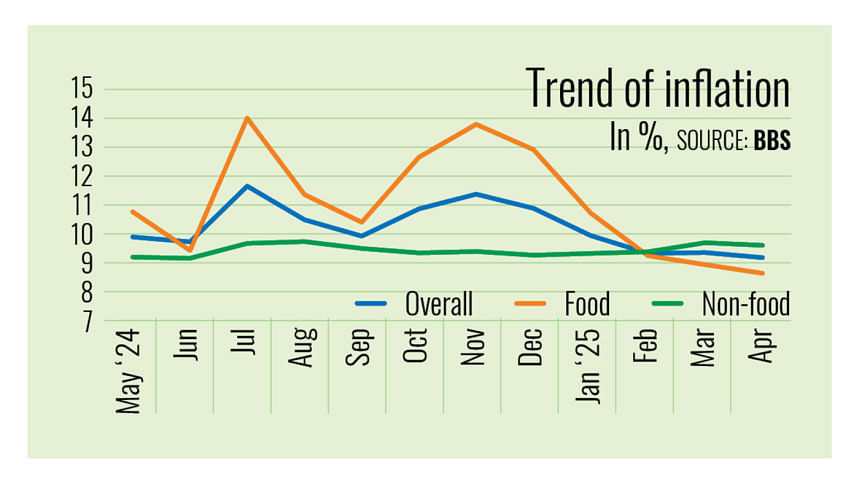

The overall inflation rate stood at 9.17 percent in April, down from 9.35 percent in March, BBS data showed yesterday.

Both food and non-food inflation edged down during the month. Food inflation fell to 8.63 percent in April from 8.93 percent a month earlier, signalling some relief in the cost of essentials. This marks the fifth consecutive monthly drop in food inflation since December.

Non-food inflation also slipped slightly, falling to 9.61 percent in April from 9.70 percent the previous month.

"The decline in overall inflation is certainly a good sign," said Zahid Hussain, former lead economist at the World Bank's Dhaka office.

He said it points to slower demand growth, likely influenced by the Bangladesh Bank's tight monetary policy, reduced post-festival spending, or a mix of both.

Eid-ul-Fitr was celebrated on March 31 in Bangladesh, following Ramadan — the month of fasting during which consumption of certain food items usually increases.

"We will probably get a clearer picture in May, as the post-festival effects will no longer impact the data," Hussain added.

However, he noted that food prices did not fall in April as they had in February. While commodity prices rose compared to March, the pace of increase had slowed, he said.

Selim Raihan, a professor of economics at Dhaka University and the executive director of the South Asian Network on Economic Modeling (Sanem), reacted cautiously to the latest figures.

"Although overall inflation has reduced slightly, it is still high," he said. Inflation has remained above 9 percent for 26 consecutive months, according to BBS.

"I don't think this slight drop reflects any substantial improvement. When prices start rising again within a week, we must ask how sustainable this decline really is. The structural problems behind our inflation remain unaddressed," he said.

Raihan pointed to Ramadan as an example of how inflation eased when market supply was adequate. "That showed clearly that supply-side issues are just as important, if not more so, than demand-side factors in our case."

"Monetary policy mainly targets demand, but what we saw in March and April is that increasing supply can bring prices down effectively," he commented.

In its October–December quarterly report, the central bank described inflation as a key concern, driven mostly by rising food prices.

"Headline inflation (point-to-point) rose gradually from 9.92 percent in September 2024 to 11.38 percent in November 2024 before easing slightly to 10.89 percent in December," said Bangladesh Bank.

It attributed the increase to the disruption in Aman rice production caused by floods between August and October 2024, as well as higher production costs and supply chain problems that disproportionately affected low- and middle-income households.

On Saturday, Bangladesh Bank Governor Ahsan H Mansur said the central bank might consider cutting the policy rate to 7 percent by next March if inflation falls to 5 percent.

But Raihan challenged this view. "Next March is a long way off. I don't think there's room to cut the policy rate yet," he said.

"Even if the rate is reduced, I doubt it would significantly boost investment. The real obstacles are structural, and the prevailing economic and political uncertainty makes investors hesitant to take risks."

"From a monetary policy standpoint, it may be wiser to stick with the current rate for now," he added.

The economist also pointed out serious flaws in the domestic market, including extortion and price manipulation.

"During Ramadan, we saw that when these issues were tackled, when more importers were allowed in, prices remained stable. That intervention worked."

"If we can address market distortions, sort out tax issues and improve supply chains, we may start seeing more sustainable and meaningful progress in controlling inflation," he added.

For all latest news, follow The Daily Star's Google News channel.

For all latest news, follow The Daily Star's Google News channel.

Comments