FBCCI seeks policy support to restore business confidence

The Federation of Bangladesh Chambers of Commerce and Industry (FBCCI) yesterday urged the government to provide policy support to restore confidence in trade and commerce in the fiscal year 2025-26.

The apex trade body said it expects the government will frame an investment- and business-friendly budget that enables it to face the challenges stemming from the country's graduation from the least developed country (LDC) club in November 2026 and the global economic uncertainty.

"We believe the government will make a sincere effort to formulate an industry- and investment-friendly budget in order to face the challenges," said FBCCI Administrator Md Hafizur Rahman.

He made the proposals at the consultative committee meeting jointly organised by the National Board of Revenue (NBR) and the FBCCI at the Pan Pacific Sonargaon Dhaka.

The NBR holds the meeting every year to listen to the issues and recommendations from businesses as part of its exercise to frame tax proposals for the next fiscal year.

At the event attended by different businesses, Finance Adviser Salehuddin Ahmed and Commerce Adviser Sk Bashir Uddin, the apex trade body said the government should give attention to restoring business confidence through policy support.

At the discussion, businesses demanded expansion of the tax net to increase revenue collection and ensure an uninterrupted supply of gas and electricity. Some expressed concern over the spike in production costs following the increase in gas prices.

Taking part in the discussion, Mostafa Kamal, chairman and managing director of Meghna Group of Industries, said his company invested $600 million in the Cumilla Economic Zone but has not received gas and electricity connections in the last two years.

"We are inviting foreign investors while local investors are suffering from the gas crunch. This should be given importance because investment in electricity and gas is needed," he said.

The businessman said regular taxpayers face higher tax scrutiny.

Kamal, citing incidents of bank detail scrutiny by taxmen after the August political changeover, appealed to the NBR that no business should be harassed without specific allegations.

Meanwhile, Showkat Aziz Russel, president of the Bangladesh Textile Mills Association (BTMA), complained about mounting hassle in doing business.

He said the BTMA once issued clearance for the import of spare machinery parts. Complexity has increased after the NBR took over the issue, he said.

"It now appears that Tk 50,000 in bribes has to be paid to pay Tk 30,000 in customs duty," he said.

In his proposal for the next fiscal year, FBCCI Administrator Rahman said there should be a focus on ensuring price stability and the supply of essential commodities.

Rahman said budgetary measures should be taken to reduce economic disparity among people through appropriate tax policies and job creation.

The FBCCI administrator said the government has taken various measures to restore discipline in the banking sector and overall financial system.

"A stable interest rate should be maintained to encourage investment and help businesses retain competitiveness," he said, suggesting that the government refrain from taking unnecessary and unproductive projects.

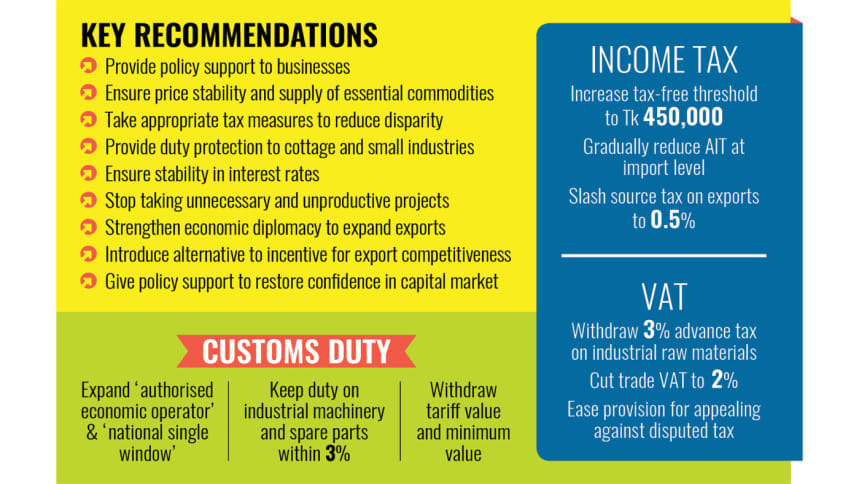

In its recommendations, the FBCCI proposed increasing the tax-free income limit to Tk 450,000 from the present Tk 350,000, and a gradual reduction in advance income tax (AIT) on imports to reduce the operational costs of industries.

The apex trade body demanded a reduction in the cost of doing business to improve Bangladesh's position in the global competitiveness index.

In this regard, Rahman suggested attracting investments, increasing port and customs efficiency, and reducing shipping and transportation costs.

The FBCCI chief demanded affordable and quality fuel and, above all, a business-friendly tax system by eliminating harassment and complications in taxation.

At the event, Finance Adviser Salehuddin Ahmed said the government will prepare an implementable budget.

"We will not make a shopping list or wish list that we will not be able to deliver. We will try to implement the budget we formulate," he said.

And during the framing of the fiscal measures, the government will try to address the concerns of businesses.

"Some are legal issues while some are procedural. We aim to simplify those," he said.

"But I am in the mood to eliminate most exemptions. We are under a lot of pressure, we need to increase revenue, run the government, and also provide incentives to you. For that, money is needed."

The finance adviser cited his meetings with officials of the International Monetary Fund (IMF), the World Bank, and the US administration on the sidelines of the World Bank-IMF Spring Meetings in Washington, DC, at the end of April and said, "Please, rest assured that your concerns are always taken into consideration."

Commerce Adviser Sk Bashir Uddin said that in the past, the budget used to be prepared for lavish spending.

The aim of the interim government is to make a realistic budget. "We are planning to formulate a target-oriented, not an expenditure-oriented one," he said.

NBR Chairman Abdur Rahman Khan said his office will rationalise some previous tax measures and offer relief to compliant taxpayers to some extent in the next fiscal year.

"We should reflect on ourselves — how compliant we are," he said.

For all latest news, follow The Daily Star's Google News channel.

For all latest news, follow The Daily Star's Google News channel.

Comments