Fixing boards of ailing banks is first step for good governance

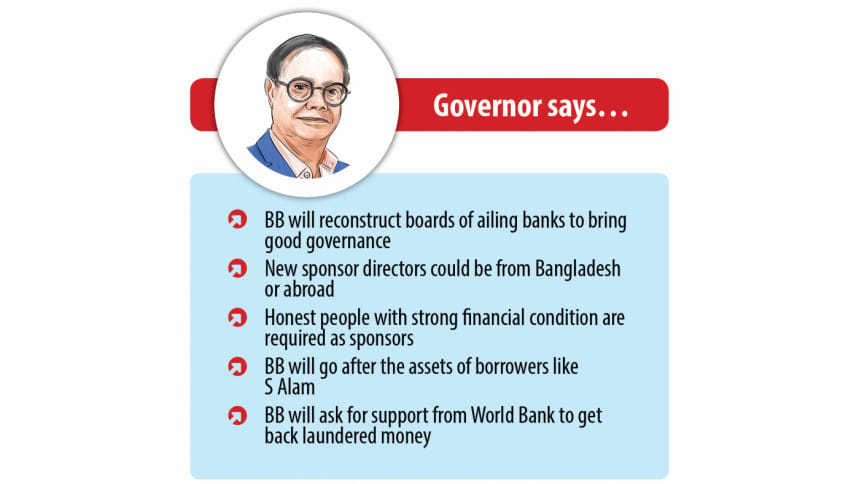

Reconstituting the board of directors of ailing banks is the first step towards bringing good governance and discipline to the banking sector, according to Bangladesh Bank Governor Ahsan H Mansur.

The country's central bank has already reconstituted the board of some banks in which S Alam Group held a majority stake, Mansur said in a recent interview with The Daily Star.

The eminent economist was appointed as governor of the Bangladesh Bank on August 14. He replaced Abdur Rouf Talukder, who stepped down from the post following the ousting of the Sheikh Hasina-led Awami League government on August 5.

Of the banks with reconstituted boards, S Alam Group held a roughly 80 percent stake in Islami Bank Bangladesh, Social Islami Bank, Global Islami Bank and Union Bank.

The central bank governor said they will take over the shares of S Alam Group against its liabilities to these banks in order to sell them and return depositors' funds.

The boards of two other lenders -- National Bank and United Commercial Bank -- were also reformed.

Mansur informed that, in most cases, they are reconstituting the preliminary board of ailing banks. Regarding the selling of S Alam's shares, he said this would allow new sponsor directors to come to the boards.

"The new sponsor directors could be from home or abroad. Shares will be available for all investors," Mansur added.

However, the central bank governor also said they will ensure that only fit and proper people assume the post.

"Honest people with strong financial condition are needed as sponsor directors for ailing banks," he said. "We will go after the assets of borrowers or directors like S Alam if needed."

Regarding the recovery of laundered money, Mansur said the Bangladesh Bank and other related authorities will speak with counterparts abroad to bring back the funds.

"We will also seek support from the World Bank," he added, informing that the US government was interested in helping in this regard.

"We will not give up anything we can recover."

Furthermore, Bangladesh is already in talks with the International Monetary Fund (IMF) and other multilateral agencies for additional loans.

"We are thinking about foreign loans to create some breathing space and have discussed with the IMF to access their funds," Mansur said.

Bangladesh is also holding discussions with the World Bank for additional budget support, sectoral support lending or programme lending.

"Additionally, we have started talking with the Asian Development Bank (ADB) and are hopeful that the multilateral lenders will allow funds to help rebuild our forex reserves," Mansur added.

The country's foreign exchange reserves stood at $20.48 billion as per the IMF calculation on August 21, showed central bank data.

The forex reserves have been falling for the last three years as the outflow of foreign currencies exceeded inflow.

Regarding the country's economic situation, the Bangladesh Bank governor said the first problem is cost disruption while the second is flooding across the country.

"The country is facing lots of supply chain disruptions that we cannot control. We can only try to control the demand side. And the new government is trying to do that."

Mansur also said bank interest rates have been market-driven since May as prescribed by the IMF and various economic experts.

The former government was forced to remove the single-digit ceiling on interest rates and allow them to be market-driven while also doing the same for foreign exchange rates.

The forex market has become more stable since then, he said. "I am hopeful that exchange rate stability will prolong as global commodity price shocks are not there."

Regarding remittances, Mansur said the inflow is positive and they will see if it sustains in coming days.

"Remittance inflow in the first 20 days of this month is much higher compared to the same period last year," he added.

For all latest news, follow The Daily Star's Google News channel.

For all latest news, follow The Daily Star's Google News channel.

Comments