Four steelmakers control 53% of the market: study

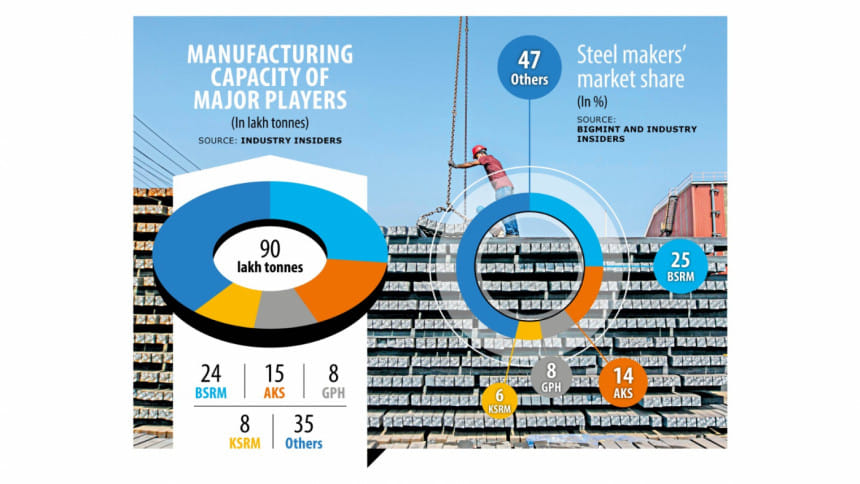

Although there are around 40 steelmakers in Bangladesh, just four based in Chattogram are currently catering to 53 percent of the total demand, according to market studies and industry insiders.

The four major steelmakers are Bangladesh Steel Re-Rolling Mills (BSRM), Abul Khair Steel (AKS), GPH Ispat and Kabir Steel Re-Rolling Mills (KSRM).

According to BigMint, a platform for commodity price reporting, market intelligence and consulting, the BSRM caters to around 25 percent of the domestic demand while AKS contributes 14 percent, GPH 8 percent and KSRM 6 percent.

At present, the 40 steelworks active in Bangladesh have a combined capacity to produce 90 lakh tonnes of steel each year against an annual requirement of around 85 lakh tonnes.

Individually, the BSRM has an annual production capacity of about 24 lakh tonnes while AKS 15 lakh tonnes. Meanwhile, the GPH and KSRM can each produce around 8 lakh tonnes of steel annually.

"We expanded our production capacity while maintaining quality, which was helpful in increasing our market share," said Tapan Sengupta, deputy managing director of the BSRM.

He said steelmaking is a basic industry that provides essential products for infrastructure development.

"So, the demand for steel will keep growing for the next 30 years as Bangladesh is moving toward higher income status, with peoples' purchasing capacity growing despite the ongoing economic stress," he said.

Regarding the BSRM's commanding market share, he ruled out the possibility of there being a monopoly in the steel industry as even many small units are trying to develop their capacity.

Besides, some big companies are entering the industry as well.

Sengupta also attributed the BSRM's significant hold on the market to the company's enduring legacy in the industry.

Having entered the domestic steel industry in 1952, the BSRM has vast experience in the sector and a renowned brand image, for which the company controls a big market share, he said.

Sumon Chowdhury, secretary general of Bangladesh Steel Manufacturers Association, echoed him.

He said there is no scope for major manufacturers to monopolise the market as small units remain competitive by offering quality products at lower prices.

However, he said market demand has slightly reduced due to ongoing economic pressure.

Additionally, the government reduced its steel consumption to around 45 percent from 55 percent of the total production last fiscal year amid a slowdown in development activities.

Chowdhury, also managing director of Rani Re-Rolling Mills, said his company holds around 3 percent market share.

According to him, a number of small companies have now entered the market, leading to overcapacity in production compared to existing demand.

However, BigMint projects that steel consumption in Bangladesh will rise by 25 percent to around 1.06 crore tonnes in 2027 from 85 lakh tonnes at present due to growing infrastructure development projects and individual consumption.

As such, Bangladesh's steel production capacity is expected to rise to 1.30 crore tonnes by 2027.

BigMint also said Chattogram accounts for 62 percent of the country's overall steel-melting capacity while Dhaka can only meet 32 percent.

Shahriar Jahan Rahat, deputy managing director of the KSRM, said the steel industry in Chattogram was established around six decades ago and has greatly developed since then as access to the Chattogram port is convenient for importing raw materials.

According to him, major steel manufacturing plants set up in Chattogram have been contributing to the country's infrastructure development by providing the necessary steel products.

For all latest news, follow The Daily Star's Google News channel.

For all latest news, follow The Daily Star's Google News channel.

Comments