Fund diversion fuelled non-performing loans

Diversion of funds by borrowers is the major reason for the higher non-performing loans in Bangladesh, according to Anis A Khan, a career banker who retired a few days ago after serving the industry for nearly four decades.

To him, the NPL is the scourge of the banking system and a war should be waged against the curse. Too many banks and their weak fundamentals are another major concern, which, he thinks, should be addressed through merger and consolidation.

“Borrowers divert funds to buy land and start new businesses which are not their core competency,” said Khan, one of the most respected bankers of his time.

He blames corporate borrowers for 95 percent of the country’s bad loans.

“Small borrowers pay banks and if they fail, they come to the lenders. On the other hand, big ones go to courts and delay payments.”

“What do they [defaulters] do with the money? Banks are the mere custodian of public money. Borrowers should also be considerate and diligent,” Khan said, while giving his farewell interview with The Daily Star recently.

There are few CEOs in the banking industry in Bangladesh who are as brilliant and successful as Khan. When he began his banking career at ANZ Grindlays Bank in 1982, there was no private bank in the country.

But at the time of his retirement from Mutual Trust Bank (MTB) as its managing director and CEO, 59 banks are in operation, of which 41 are private lenders.

Wherever he worked, he made the institution one of the best, no matter how fierce the competition was.

For example, when the industry’s average NPL was nearly 12 percent at the end of September, the MTB stands tall with only 5.5 percent. The MTB’s loans, deposits and assets witnessed double digit growth last year whereas its peers struggled with liquidity crisis.

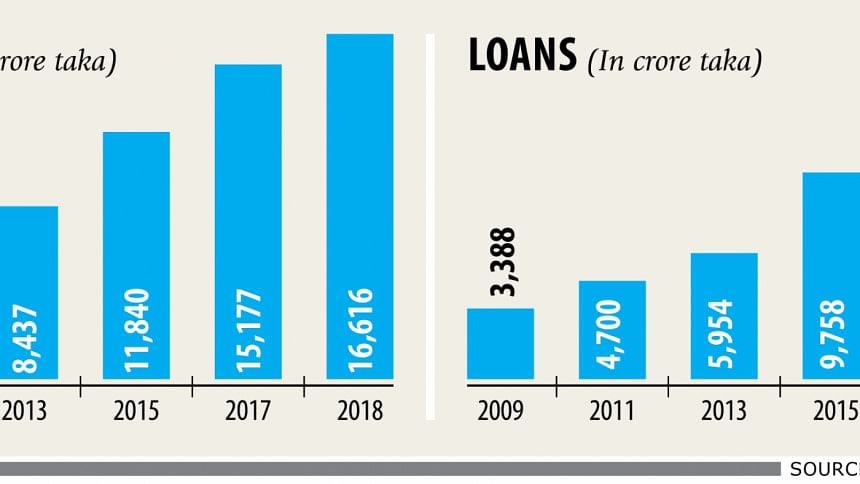

The number of customers neared nine lakh at the year’s end from just one lakh when Khan joined the bank 10 years ago. Loans and deposits soared by four and a half times to Tk 18,000 crore each during the period.

When he joined the bank as CEO in 2009, its monthly profits were Tk 12 crore and it has gone up to Tk 50 crore by this time.

Under his management, the number of branches rose by 100 to 136 and he introduced ATMs, banking booths and agent banking. The MTB is now the sixth largest remittance recipient bank, leapfrogging from 26th in 2009.

All these speak volumes of his class as a leader.

Customers’ trust and continued expansion and diversification have also helped the MTB become a choice for investors, both at home and abroad.

Norfund, owned by the Norwegian government, bought 10 percent equity shares in the bank at more than Tk 173 crore last year. This is the first time the Norfund has purchased equity in a bank in Bangladesh. The Asian Development Bank and the Netherlands’ development finance company FMO also gave low-cost funds to the MTB.

Khan’s commitment and dedication helped the bank become a respected lender in just two decades since its inception. A professional board of directors led by the country’s legendary entrepreneurs such as Samson H Chowdhury of Square Group and Syed Manzur Elahi of Apex Group has complemented his works.

The board empowered him with an authority to lend Tk 25 crore without taking any approval, an amount no other CEO in Bangladesh could think of.

Known for his professionalism and ethics, the flamboyant banker had the experience of working abroad. He worked for Standard Chartered in Dubai in 2001-03 where he got first-hand knowledge on product development. He was in the legal and control division, from where every product must be vetted before commercial launching.

“That was an exciting period of my career,” Khan recalled.

But his first banking job at Grindlays, where he went on to take on an array of senior roles over a period of 21 years, shaped his career and helped achieve higher positions.

After returning from Dubai, he took the helm of IDLC Finance in 2003 and served the country’s finest financial institution for six years.

Khan said his successor at the MTB is capable of keeping up the growth momentum of the bank.

The veteran banker also talked about technologies that are reshaping banking services and the prospects of the Bangladesh economy.

Bangladesh’s economic growth and per capita income is one of the highest in the world and banks have an important role there.

“Banks prosper when a country prospers,” said Khan.

He said banking business models are changing very fast riding on rapid technological advancement. Customers are becoming tech-savvy and their demand for services is changing.

“Banking services are now wrapped around technologies and banks have to embrace latest reliable technologies to provide seamless services to customers,” he noted.

Khan feels that consolidation of financial institutions in Bangladesh is an urgent issue.

“Consolidation can make smaller banks a big one with a strong balance sheet. We have to bite the bullet.”

Although merger among banks and NBFIs in the US, Europe, China and India is common, the concept is yet to gain traction in Bangladesh.

“Merger can help financial institutions pool resources and improve technology to render better services,” said Khan, a former chairman of the Association of Bankers, Bangladesh, and currently vice-president of the Bangladesh Association of Publicly Listed Companies.

He also shed lights on the condition of NBFIs and the struggling stock market.

According to him, the condition of NBFIs has deteriorated because of bad corporate governance, insider-lending and interference. “The industry should be salvaged soon.”

Bangladesh’s market doesn’t have enough trading stocks, Khan said, adding that sound companies are also not interested to go public. He also lamented the absence of a bond market.

Though he has officially ended his 37-year banking career, he doesn’t intend to slow down anytime soon. He will sit on the board in a number of organisations to guide them with his vast knowledge and experience.

“Also, I will be involved in teaching,” the 65-year-old concluded.

For all latest news, follow The Daily Star's Google News channel.

For all latest news, follow The Daily Star's Google News channel.

Comments