Government debt now in uneasy territory

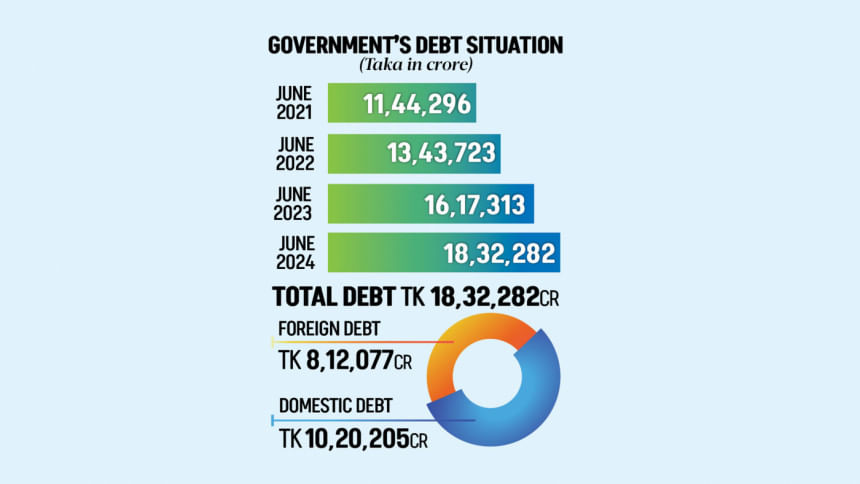

Government debt increased 13.3 percent last fiscal year to a record Tk 18.3 lakh crore, raising concerns about repayment amid the low revenue mobilisation.

Domestic debt accounted for 55.7 percent of the total debt stock and foreign debt the rest, according to the quarterly debt-bulletin report of the finance division, which was released yesterday.

This takes the debt-GDP ratio to 36.3 percent, still in the safe territory as per the International Monetary Fund's calculations.

However, economists said the total volume of debt is concerning when compared with the revenue earnings and dollar stockpile.

The main concern now is the liquidity shortage in both local and foreign currency, said Zahid Hussain, a former lead economist of the World Bank's Dhaka office.

On one hand, the government's revenue collection is weak while the interest payment has increased significantly.

"On the other hand, the government is getting fewer foreign loans, which has become an issue for interest repayment and some outstanding bills from those loans. As a result, the government is in trouble," he said.

The white paper on the state of the Bangladesh economy, submitted to the chief adviser last month, echoed the same.

"The trends in debt intensity appear much less comfortable. Debt distress can arise even at low levels when debt servicing competes for domestic and foreign currency liquidity in a shortage situation. Such an experience is still not in the rearview in Bangladesh. A spike in already increasing debt servicing burden is imminent," the report said.

The debt-bulletin report showed government expenditure in interest payment increased by 21 percent in the last fiscal year to Tk 1.1 lakh crore, which is one-sixth the national budget.

In fiscal 2023-24, foreign interest payments increased by 60 percent and domestic interest payments by 17 percent.

The then-government could not bear the huge expenditure and they had to pay Tk 36,586 crore arrear bills to some power, energy and fertiliser supplying companies through special treasury bonds, the report added.

"If that much interest payments were not needed, the government could spend the money on welfare sectors like health or education," Hussain said.

The domestic debt is no less problematic as the revenue growth is weak, interest rates higher and budget deficits have crawled up, said the White Paper.

"The cost of domestic debt is rising," it said.

Interest payments on such debt relative to revenue increased from 17.6 percent in fiscal 2017-18 to 22.5 percent in fiscal 2022-23, thus shrinking fiscal space.

"It may shrink even more as tighter monetary policy necessitated by high inflation is increasing interest rates on treasury bills and bonds," it said.

About the foreign loan, the principal and interest payments are projected to expand in the near term. Grace periods of several big loans have ended and many more will end in the near future.

"Maturity of new loans, including grace periods, has become shorter. An examination of active loans to assess the increase in amortisation payments shows sharp increases are imminent."

These include repayments for 213 loans, including the Rooppur nuclear power plant, the Padma Bridge rail link, the Karnaphuli Tunnel and the Dhaka Mass Transit projects.

The white paper said the politicians in charge of the government have used the government's borrowing power recklessly for their own benefits in the past.

They tended not only to take whatever foreign currency loans were on offer but also to incur even larger implicit obligations via unfunded, off-balance sheet liabilities.

"Our most living nightmares of such borrowing are in, but not limited to, energy, transport and banking. Both external and domestic borrowings add to macro vulnerabilities when they do not come with value for money," it added.

For all latest news, follow The Daily Star's Google News channel.

For all latest news, follow The Daily Star's Google News channel.

Comments