Governor defends tight policy as cash-strapped firms struggle

Bangladesh Bank Governor Ahsan H Mansur said tightening monetary policy is the only globally practised remedy to heal inflationary pain, as businessmen opposed interest rate hikes for obstructing business expansion and job creation.

"Our aim is to bring stability to the macroeconomy. If it is not ensured, stability in inflation will not be guaranteed. We have to fight to this end," said the central bank governor at the "3rd Bangladesh Economic Summit 2024: Inequality, Financial Crimes, and Healing Bangladesh's Economy" in Dhaka yesterday.

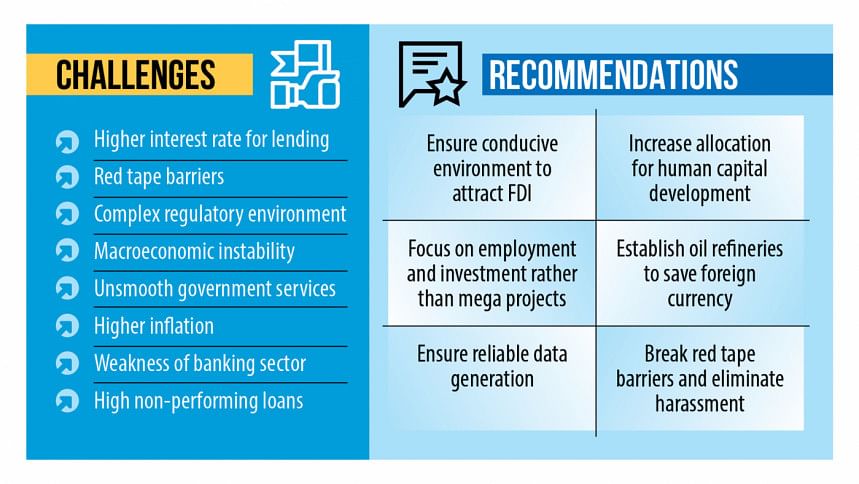

At the same event organised by Bangla daily Bonik Barta, several businessmen earlier said that the hike in interest rates has become a barrier to business expansion and employment generation.

"One thing that should be kept in mind is that if macroeconomic stability is not ensured, there will be no investment," Mansur said in reply.

"It will not yield any good results if we become impatient. If you say that investment must be revived right now, it is not possible," he added.

"We analysed many countries, including the UK, the USA and Thailand. No country has decreased inflation in less than 12 months," said the central bank governor.

He said they started the fight against more than 9 percent inflation -- which has been persistent since March last year -- basically in June 2024. "We need at least eight more months to bring it down to 5-6 percent."

After a two-month pause following August's 11.66 percent price pressure, Bangladesh's inflation rose to 10.87 percent in October, thanks to soaring food prices, especially for staple rice and vegetables, show statistics bureau data.

Amid the crushing price pressure affecting lives and livelihoods, the central bank governor said they are not relying solely on monetary policy to blunt the inflation curve.

"On the supply side, taxes on every essential good were either made zero or significantly reduced. The aim is to keep the price level of goods comparatively low, even if only temporarily, although prices of all products will not come down," he said.

Mansur said the government has already taken most of the required measures from the supply side. "So it requires time. We have to keep patience."

Hinting at good days ahead for the business community, he said their ultimate goal is also economic growth and investment. "Now I have to keep an eye on macro stability, reduce inflation and stabilise the exchange rate for the next months and years."

He said there is no possibility of a recession in Bangladesh. "But our growth will be slowed down. That is inevitable."

"We have not been like Sri Lanka. Our growth has not been negative. Our economy has not collapsed. We have already stabilised the economy," said the BB governor.

Addressing the event prior to Mansur, Abdul Awal Mintoo, chairman of Multimode Group and National Bank, said that although monetary policy has been tightened to curb higher inflation, it is not the only function of monetary policy.

Mintoo argued that inflation may rise for at least 17 to 18 reasons, while excess money supply is one of them, which requires policy tightening.

"But in the name of reducing inflation, if you follow such a tightened monetary policy, it would strangle the whole economy. Rather, it is also the responsibility of monetary policy to generate employment by increasing investment," said the business leader.

He added that if monetary policy does not encourage investment and generate employment, then it works in the opposite direction.

Mustafa Kamal, chairman of Meghna Group of Industries, said they are suffering from bureaucratic complications while doing business. Highlighting various examples of harassment due to bureaucratic barriers, he said that if it takes seven days to process a file in Vietnam, it takes around seven months in Bangladesh.

Kamal also alleged that different government departments involved in processing business files lack accountability.

Highlighting various steps taken by the government, Finance Adviser Salehuddin Ahmed said they will try to maintain their footprint through short-term reforms for the next political government.

"We don't have any personal agenda. Our agenda is the interest of the country. We're trying to do it," he said. "We will implement such reforms that will compel the next government to follow them as a good step," he added.

Zaved Akhtar, chairman of Unilever Bangladesh, said that uneven or non-smooth fields and complex regulatory environments are major barriers to foreign direct investments.

He gave an example that his company had to wait for 30 months to acquire land for expansion.

Hossain Zillur Rahman, an adviser to the former caretaker government, stressed the country's macroeconomic stability, investment and employment generation and taming inflation at the same time.

He also said a political-economic approach is needed to overcome macroeconomic weaknesses and solve the country's employment and investment problems.

National Board of Revenue (NBR) Chairman Md Abdur Rahman Khan said they have already stopped the manual audit selection process and submitted the documents to the value-added tax (VAT) office to reduce the hassle for taxpayers.

Mustafa K Mujeri, former chief economist of the central bank, Sayema Haque Bidisha, pro-vice chancellor of Dhaka University, Selim RF Hussain, chairman of Association of Bankers, Bangladesh, Mashrur Arefin, managing director of City Bank, Azam J Chowdhury, chairman of East Coast Group, Nihad Kabir, former president of Metropolitan Chamber of Commerce & Industry, Dhaka (MCCI), also spoke at the event.

Dewan Hanif Mahmud, editor of Bonik Barta, moderated the event.

For all latest news, follow The Daily Star's Google News channel.

For all latest news, follow The Daily Star's Google News channel.

Comments