Govt borrowing through bonds, bills rises fivefold

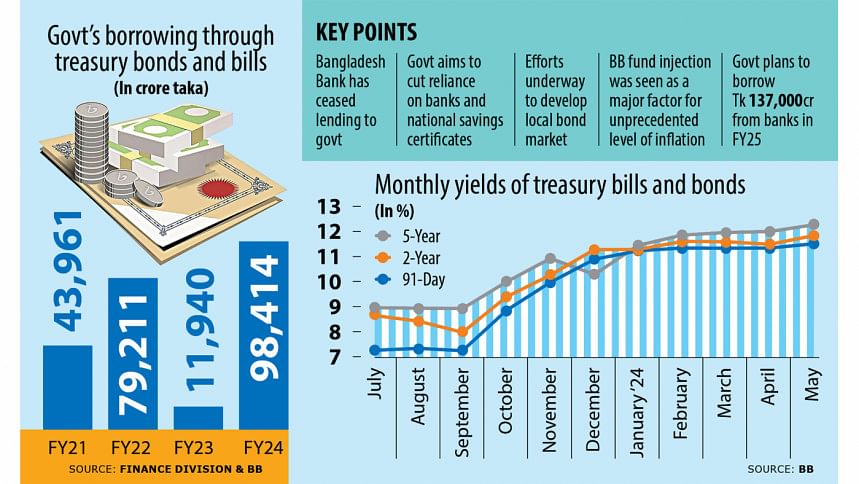

The government's borrowing through the sales of treasury bonds and bills jumped fivefold in the last fiscal year, which raised its debt servicing cost compared to the level projected initially.

It mobilised Tk 62,812 crore by issuing bills and bonds in 2023-24, which ended on June 30, provisional data from the Bangladesh Bank showed, up from Tk 13,456 crore a year earlier.

A finance ministry official said the actual figure could be known once the final calculation for the entire fiscal year's budget expenditure is made.

The government's reliance on the two securities is on the rise as it drastically cut its dependence on the banking sector and the central bank to meet its expenses amid lower-than-expected revenue collections.

The shift came as the higher borrowing from the banking sector had been described as one of the key factors for the unprecedented long spell of escalated inflation, which stayed at more than 9 percent for the past two years.

According to the central bank, the government secured Tk 21,129 crore through the auction of treasury bonds in FY24. In contrast, it did not borrow any money through the tool in 2022-2023. Rather, such debts went down by Tk 615 crore compared to the previous fiscal year.

In FY24, the state borrowing through treasury bills was Tk 41,683 crore compared to Tk 14,072 crore in FY23.

In Bangladesh, treasury bills with three tenures are available, namely 91-day, 182-day and 364-day. They are issued at a discount and redeemed at face value at maturity.

Treasury bonds are coupon-bearing debt instrument, and the maturities range from two years to 20 years. It carries half-yearly coupon payments, and the principal is repaid on maturity.

Both bills and bonds are traded on the secondary market.

A finance ministry official said although the cost of state borrowing went up last fiscal year, the good thing was the government did not take any money from the BB since fund injection from the central bank would have stoked inflation further.

The zero borrowing from the BB was also part of the government's process to support the central bank's contractionary monetary policy.

In June last year, the interest rate against borrowing through treasury bills was a minimum of 6.8 percent to a maximum of 8.9 percent. It surged to 12-13 percent in May this year. The interest rate against treasury bonds rocketed from 8-9 percent to 12-13 percent during the period.

Subsequently, the country's costs for borrowing from the banking system increased by 28 percent in the first half of FY24, according to a finance ministry report.

In FY24, the government also launched special bonds to pay arrears for electricity and gas as it raised Tk 34,651 crore.

It cleared arrears of Tk 9,753 crore for fertiliser importers and Tk 10,599 crore for power producers through special bonds in the last fiscal year.

While the bonds and bills witnessed higher sales, the net borrowing from the banking system declined in FY24.

The government set a target to take up loans of Tk 1,32,395 crore from the banking system in FY24, and the figure was reset at Tk 1,55,935 crore in the revised budget.

The borrowing finally stood at Tk 94,281 crore at the end of the year, down from Tk 1,19,465 crore in FY23.

In recent years, borrowing from the central bank has been one of the much-talked-about issues since it directly sees an injection of funds into the economy, a debt that fuels inflationary pressures.

The central bank lent Tk 97,646 crore to the government in FY23. Such credits were absent in the last fiscal year. Rather, the government repaid Tk 6,456 crore.

In June, the government's outstanding net credit from the banking system was Tk 4,88,059 crore, up from Tk 3,93,778 crore a year ago.

The government plans to borrow Tk 137,000 crore from banks to finance the deficit in the budget for the ongoing fiscal year.

The overall budget deficit is expected to stand at Tk 251,600 crore, which is 4.5 percent of the country's gross domestic product.

For all latest news, follow The Daily Star's Google News channel.

For all latest news, follow The Daily Star's Google News channel.

Comments