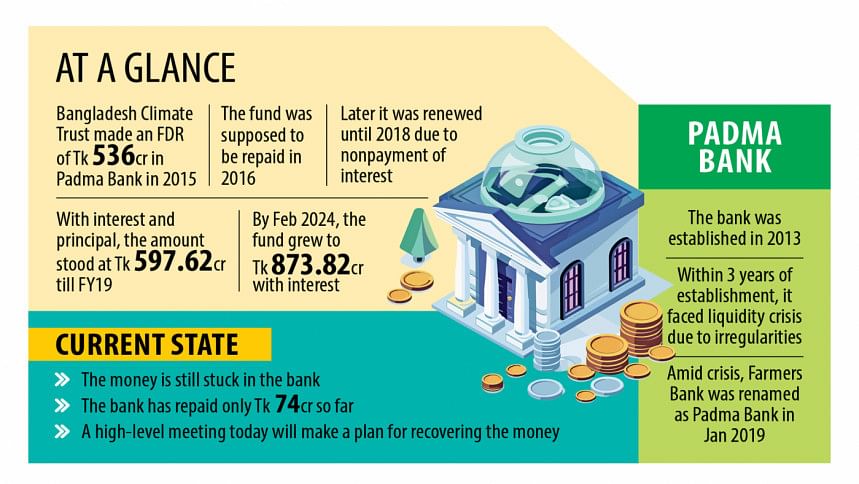

Govt to devise plan to retrieve Tk 873cr climate fund from Padma Bank

The interim government is going to formulate a specific roadmap to recover funds of the Bangladesh Climate Change Trust (BCCT), amounting to Tk 873.82 crore, that have been held up in Padma Bank since 2016.

To formulate the roadmap, high-level representatives of different ministries and departments, including the Finance Division, Financial Institutions Division, and Ministry of Environment, Forest and Climate Change, are scheduled to hold a meeting with Padma Bank officials at the Bangladesh Bank today.

According to finance ministry sources, apart from the BCCT's funds, the meeting will also determine plans to recover other government funds stuck at ailing Padma Bank, which had its board of directors reconstituted after the political changeover on August 5.

In 2015, the BCCT, which operates under the environment ministry, created a Fixed Deposit Receipt (FDR) account of Tk 536 crore, then known as Farmers Bank, for a period of one year.

The money was deposited at the bank's Motijheel, Gulshan and Gulshan Avenue branches.

Upon maturity, the FDR was renewed until 2018 as Padma Bank had managed to return only Tk 74 crore in several phases.

In September 2023, an official of the BCCT said that the bank had not made any further payments.

The principal and interest climbed to Tk 597.62 crore at the end of the 2018-19 fiscal year.

By February this year, the amount owed to the trust had ballooned Tk 873.82 crore.

The wait to retrieve the investment got longer as Padma Bank was given eight more years by the Ministry of Environment to repay the money in December 2022.

Despite this, on December 31, 2023, BCCT officials sent a letter to the Bangladesh Bank governor and secretary of the Financial Institutions Division seeking their advice on potential legal action.

But no visible measures were taken to this end at that time, BCCT officials added.

On January 21 this year, Padma Bank converted Tk 760.09 crore of the funds into preference shares of the bank with an 8-year tenure at an interest rate of 6 percent without seeking the consent of the BCCT, according to officials of the trust.

Only three years after its establishment in 2013, Padma Bank became mired in a liquidity crisis due to significant irregularities.

Yet, due to political interference and the lure of high interest rates, government agencies such as the BCCT continued to invest significantly in the bank.

During a special investigation in 2015, the central bank uncovered significant violations of banking rules by the bank's management in its loan disbursement process.

The central bank found the involvement of the bank's former directors in sanctioning loans.

After the news made headlines, people rushed to withdraw their deposits, crippling the bank's ability to conduct its daily operations.

In January 2019, Farmers Bank was renamed Padma Bank as the troubled lender looked to sweep the gross irregularities and loan scams under the carpet and get an image makeover.

As of September 2018, default loans at the private commercial bank stood at Tk 3,071 crore, up from Tk 723 crore in 2017.

The issue of recovering the money owed to the BCCT resurfaced at a meeting of the Advisory Council on September 12.

At the meeting, it was decided to prioritise the issue of liquidating this money and formulate a specific roadmap on a priority basis after discussing it with representatives of all parties concerned, including the central bank.

Speaking to The Daily Star, Bangladesh Bank Executive Director Saiful Islam, who will preside over today's meeting, confirmed that the meeting would likely be held as scheduled.

"At the meeting, we will listen to representatives from the BCCT and Padma Bank. We will then decide on the next course of action," he added.

Md Rafiqul Islam, managing director of the BCCT, said they will seek ways to recover the money from the Bangladesh Bank.

"Apart from that, we will also urgently try to get as much money as possible initially."

For all latest news, follow The Daily Star's Google News channel.

For all latest news, follow The Daily Star's Google News channel.

Comments