Govt likely to retreat from its quest for higher growth

The economy is perhaps slowing, not sprinting. And the government is likely to lower its economic growth target by one percentage point for the fiscal year ending in June, veering from its quest for a higher trajectory in times of austerity.

The fiscal coordination council under the finance ministry may revise the ambitious GDP and inflation targets that were fixed in the national budget in June, considering the existing economic trend. The council will meet tomorrow.

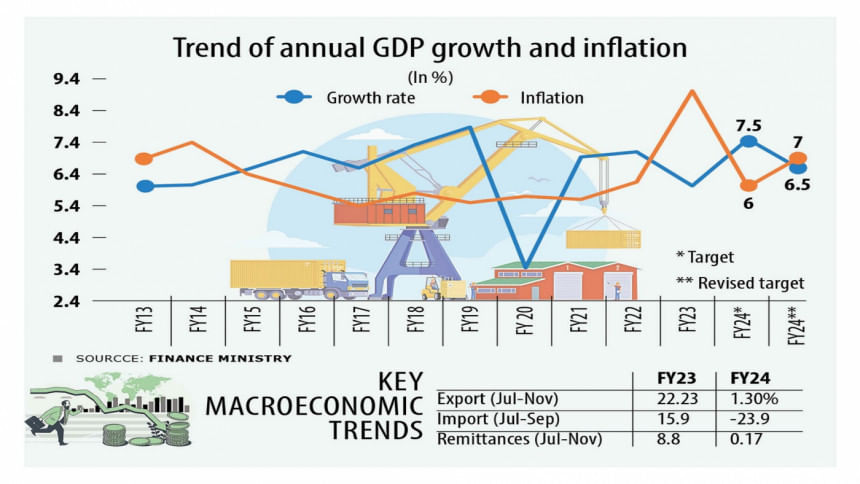

Despite the raging Russia-Ukraine war, the instability in the foreign exchange market and dwindling forex reserves, a GDP growth goal of 7.5 percent and an inflation target of 6 percent were set for 2023-24.

Now, the economic expansion target may be revised down to 6.5 percent while the inflation target may be revised upward to 7 percent as the economy continues to face major challenges while consumer prices show no sign of cooling down.

The economy grew at a pace of 6.03 percent in 2022-23 against the goal of 7.5 percent while the Consumer Price Index rose 9.02 percent against the government's revised target of 7.5 percent.

Both Zahid Hussain, a former lead economist of the World Bank's Dhaka office, and Selim Raihan, executive director of the South Asian Network on Economic Modeling (SANEM), said the targets set in the budget were ambitious and unrealistic and they should be revised.

Their suggestions come as key indicators show a disappointing trend.

For example, imports declined 23.73 percent year-on-year in the first quarter of FY24, Bangladesh Bank data showed.

Capital machinery import, which signals the economic growth trend, dropped 40.99 percent in the first four months of FY24, according to the letters of credit settlement figures of the BB. Industrial raw material import was down 35.72 percent.

The LC opening trend showed that capital machinery imports fell 21 percent in July-October while industrial raw materials imports decreased 16 percent.

The growth in overall export earnings from merchandise shipments decelerated to 1.30 percent in July-November. In November alone, the receipts fell 6.05 percent year-on-year.

A sluggish growth trend is also noticed in other sectors such as the private credit growth as the central bank is following a contractionary monetary policy and has taken steps to lower the demand for loans.

Also, the finance ministry has taken various austerity measures to reduce the pressure on the foreign currency reserves, whose level has more than halved in the past two years.

"Under the circumstances, the growth target may be revised," said a finance ministry official.

The International Monetary Fund said the GDP growth is projected to stay at 6 percent in FY24, while inflation is projected to moderate to 7.25 percent by the end of the fiscal year.

The World Bank said the real GDP growth is expected to slow to 5.6 percent and inflation is likely to remain elevated in the near term absent policy tightening, and gradually subside if import prices stabilise.

Zahid Hussain said: "Adequate reform steps were not taken in the budget for achieving the higher GDP and lower inflation targets."

"Earnings from exports are declining and remittance is falling. The tax-revenue collection has slowed compared to the previous financial year. The same is true for the private sector credit growth."

The economist said only the agriculture sector is doing well on the back of higher production.

"Still, the agricultural sector's growth alone can't send the GDP growth beyond 7 percent."

Hussain said power consumption has increased a bit but it is not enough to pull off the economic expansion target.

Raihan, also a professor of economics, echoed Hussain.

He said the sluggish trend of private investment is also standing in the way of achieving the economic growth target.

"Inflation stayed above 9 percent in the first five months of the fiscal year. If the government wants to attain the inflation goal, it will have to limit it to 4 percent in the next six months, but that's not possible."

For all latest news, follow The Daily Star's Google News channel.

For all latest news, follow The Daily Star's Google News channel.

Comments