Home textile exports bounce back

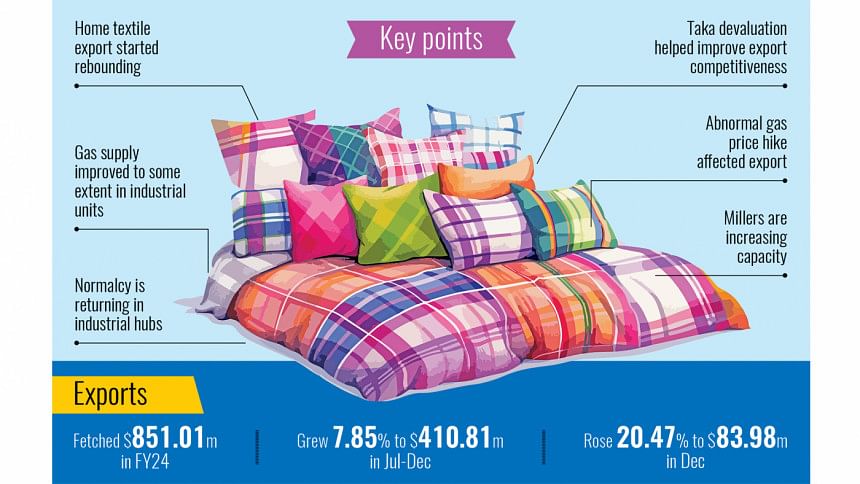

The export of home textiles is on the path to recovery after nearly one year because of the devaluation of the local currency, increased production capacity and improvement in gas supplies to some extent.

Home textile exports grew by 7.85 percent year-on-year in the July-December period of the current fiscal year to $410.81 million while it was in the negative even two to three months ago.

Apart from garment items, home textile is one of the three new sectors whose exports crossed $1 billion recently. The two other sectors are jute and jute goods and leather and leather goods.

Home textile exports showcased strong growth of 20.47 percent year-on-year in December to reach $83.98 million, according to data from state-run Export Promotion Bureau (EPB).

Home textile mainly refers to carpets, rugs, floor coverings, curtains, cushion covers, napkins, towels, bedspreads, furnishing fabric, table linen, bed linen, sheets and pillowcases, blankets, shower curtains, aprons, and wallpapers.

Its export fell sharply almost year-round in 2023 and 2024 as the local exporters did not book new work orders for an abnormal price hike of gas.

The Bangladesh government suddenly hiked gas prices by 150.41 percent in February 2023, from Tk 11.98 per unit to Tk 30 per unit, and a good volume of work orders shifted to Pakistan.

Work orders for home textile are booked for one or two seasons in bulk quantities.

With the abnormal gas price increase, exporters could not manage the cost of production, and they did not run their units at full capacity and refused some work orders, which went to Pakistan.

However, the devaluation of the local currency against the US dollar, increased spinning capacity and improvement in gas supplies to some extent helped pull back the business confidence of local exporters.

The shipment of home textile is also returning to its previous volumes gradually.

Also, the fall of inflation in Europe and the US has also been helping to recover home textile exports, said Md Shahidullah Chowdhury, executive director of Noman Group, which accounts for more than 70 percent of Bangladesh's home textile exports.

"We also increased our capacity to an extent with the improvement of gas supply, and exports from the company are growing now," Chowdhury said.

Last month, total home textile exports from his group reached nearly $27 million while it was worth $22 million in the previous month.

He also said the gradual restoration of normalcy in Bangladesh and political unrest in Pakistan also played a role in the restoration of home textile exports.

The country's home textile exports had crossed $1 billion in FY21, registering a whopping 49.17 percent year-on-year growth.

That momentum continued the following year, with exports rising by another 40-odd percent to $1.62 billion.

However, the gas crisis upended that trend the following year, with home textiles fetching $1.09 billion, down by almost a third.

Bangladesh was struggling to recover lost work orders in the home textile segment, a significant volume of which was shifted to Pakistan nearly two years ago.

This shift occurred mainly due to the sudden doubling of gas prices in Bangladesh and significant devaluation of the Pakistani rupee against the US dollar.

More recently, labour unrest in industrial belts and months of political unrest in Bangladesh have contributed to lower receipts.

Moreover, Pakistan possesses some inherent advantages, such as being the world's seventh-largest producer of cotton, according to Statista.

Pakistan also enjoys benefits under the EU's Generalised Scheme of Preferences Plus (GSP+) while Bangladesh only enjoys standard GSP facilities.

The number of home textile mills has also increased, especially smaller units, said Monsoor Ahmed, former chief executive officer of the Bangladesh Textile Mills Association (BTMA).

For instance, previously six to seven major textile mills used to export home textile, but the number of home textile exporters is more than 25 now, including the small units, he added.

Khorshed Alam, chairman of Little Group, a textile miller, said the production of home textile increased and exports also grew.

At the same time, a few mills stopped production as they were losing work orders during the shifting of work orders to Pakistan.

BTMA President Showkat Aziz Russell said the devaluation of the Taka against the US dollar was the main factor for the improvement in the home textile sector, which helped the exporters to be more competitive.

Moreover, more than 9 million new spindles have been installed over the last few years, which boosted the production in the textile sector.

The target is to install 15 million spindles, and it is expected that the installation of more than six million more spindles can be completed by the end of this year, which will also boost the production of primary textile, including home textile, he added.

"The gas supply improved to a bit, but it is not consistent yet," Russell said, adding that if the gas supply was restored at an adequate pressure, the primary textile sector's investment and production would also grow.

For all latest news, follow The Daily Star's Google News channel.

For all latest news, follow The Daily Star's Google News channel.

Comments