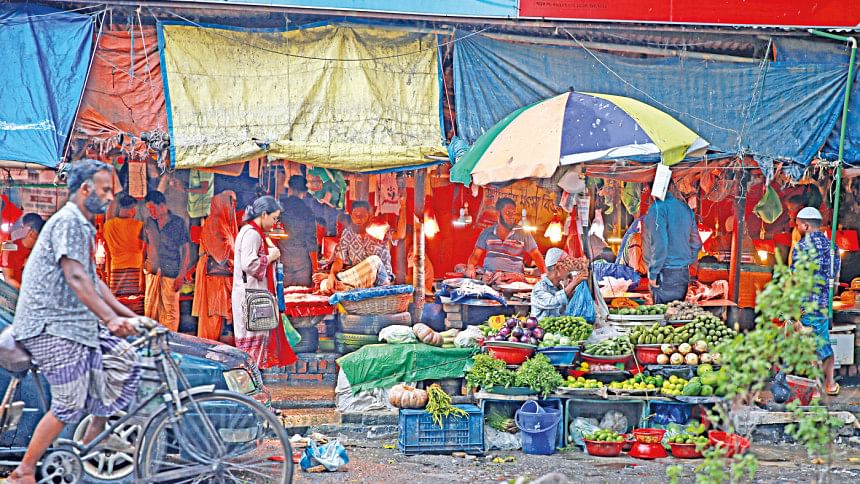

How life is like when prices go through the roof

Fatima Khatun, dressed in a washed-out kameez, came to Muslim Bazar in Mirpur 12 to shop with her four-year-old son on August 16.

After roaming around the entire kitchen market, she stood in front of a shop that fish traders had decorated with pre-cut pieces of pangas and other fishes.

After bargaining with the seller, she purchased 500 grammes of fish for Tk 125.

Fatima, in her thirties, is part of a five-member family, the breadwinner of which is her husband, a rickshaw puller. Her children are aged four, six and eight.

"We had a tough time recently because few people were out in the streets seeking rickshaw rides due to the students' protests," she told this newspaper.

"Basically, my family depends on my husband. If his income falls, we struggle to make ends meet," she added.

The mother of three opined that the initiative to sell portions of a fish instead of the usual practice of selling the whole fish by weight had made the source of protein more accessible for daily wage earners.

She said they usually avoid purchasing high-priced fish or meat and the portions were more affordable, enabling them to often have fish in their meals.

Fatima's story lays bare the extent of low-income people's struggles to meet their basic requirements for protein in the wake of unprecedented price hike of essential food commodities over the last couple of years.

In July, food inflation hit 14.10 percent, a 13-year high, according to the Bangladesh Bureau of Statistics (BBS).

In fact, since May 2023, food inflation has hovered above 9 percent, crossing 9.5 percent every month of fiscal year 2023-24 except February.

The overall consumer price index, which includes food and non-food inflation, rose 1.94 basis points to 11.66 percent in July from the month prior.

Speaking to The Daily Star, Idris Ali, a fish trader at Muslim Bazar, said he is selling pieces of pangas at Tk 300 per kilogramme and tilapia at Tk 250.

Middle and low-income families are key customers. It is extremely beneficial for the poor and ultra-poor because they do not have the means to buy a kilogramme of beef for Tk 750 or a whole hilsa fish for Tk 800-900, he said.

"But when it comes to pieces of meat or fish, they can choose whatever they can afford," he said.

Amjad Hussain, another fishmonger, said the culture of selling pieces of fish or meat has only recently gained popularity.

"We hardly saw this culture in our country but we saw it on Facebook and YouTube. Initially, it was really tough to sell all the pieces of fish. But it has gradually become a normal practice," he said.

"Now, all types of people, especially low-income people, come to purchase these pieces," he said.

Aminul Islam, a middle-aged employee at a private company in Khilgaon, was buying pre-cut pieces of chicken from a shop in Khilgaon Railgate.

Chicken breasts were selling for Tk 350 per kilogramme whereas thighs, wings and drums were fetching anywhere from Tk 150 to Tk 300.

Islam said he usually purchases groceries in amounts that last one week but it had become very difficult for him to make ends meet as wages are failing to keep pace with rising prices.

Wage growth in Bangladesh has lagged behind the inflation rate for the past two and a half years, according to the Wage Rate Index (WRI) of the BBS.

In July, the gap between inflation and wage growth hit 3.73 percentage points, a record in at least the last decade.

This widening gap is forcing low-income and unskilled workers to cut down on consumption amid falling real incomes.

"The price of everything has gone up. Everyone has had to buy everything, from daily essentials to commodities, at higher prices for the last few years," he lamented.

"That pushed up family expenses. Alongside that, house rent has increased. Children's educational expenses have also edged up," he said.

Unable to contend with the incessant pressure, Islam was forced to send his family to his ancestral home and move into shared accommodations.

He added that he had been cutting out some food items from his diet due to the high prices.

"I have been unable to deposit money in the bank for my children's future. Instead, I had to give up my DPS (deposit pension scheme)," he said.

"I don't know when I can save some money," he said, forlornly adding that he has not been able to provide as much money as he would have liked to his parents in recent times.

According to a survey by think tank South Asian Network on Economic Modeling (Sanem), as many as 70 percent of households in Bangladesh changed their food habits involuntarily to cope with the high prices.

The survey, which interviewed 9,065 households across the country between April and November last year, measured food insecurity following the Food and Agriculture Organization guidelines on a Food Insecurity Experience Scale.

SM Nazer Hossain, vice-president of the Consumers Association of Bangladesh, said inflation started to rise gradually as the Covid-19 pandemic receded.

"Faced with elevated inflation, people were trying to cope by eating less food or cutting down on sources of nutritious food," he said.

"Many have had to borrow to cope with the extra pressure. The situation won't end soon. Consumers are still seeking some relief," he said.

On top of that, the recent floods in the eastern part of the country have emerged as a new challenge. It has a huge economic impact as many people had to abruptly flee to higher ground, leaving behind their residences, agricultural land and businesses.

Mustafa K Mujeri, executive director of the Institute for Inclusive Finance and Development (InM), expressed concern over the low wage growth.

"Higher inflation and slowing wage growth have jointly cornered low and limited-income groups," he said, adding that when high inflation persists for a long time, it definitely has an impact on the poverty rate and food intake habits.

High inflation, especially high food inflation, reduces coping strategies and gradually narrows opportunities for low-income and low-skilled people, he said.

Echoing those sentiments, Prof Mustafizur Rahman, a distinguished fellow at the Centre for Policy Dialogue, said living standards have declined due to the heightened food inflation.

"Informal sector workers, especially those in urban areas, are the biggest victims," he said.

About the persisting inflation, Mujeri said, "Adopting a contractionary monetary policy can't fight inflation alone. There is a need to integrate multiple policies."

"The previous government could not take the right policy decisions at the right time and place," he said.

Monzur Hossain, research director at the Bangladesh Institute of Development Studies (BIDS), said the interim government would have to send a signal to the markets as well as businessmen.

The government can restore the supply chain by warning stakeholders to refrain from market manipulation, he said.

"There is also the issue of dwindling confidence among businesses," Hossain said.

After Sheikh Hasina resigned from her post as prime minister and fled the country following a 15-year tenure in the face of a mass uprising, many factories were vandalised and set ablaze.

The interim government should ensure good governance to stabilise the market and take short and mid-term initiatives soon, Mustafizur suggested.

Bangladesh Bank is also taking steps to curb inflation.

Recently, the central bank hiked the policy rate or repo rate, at which commercial banks borrow from the central bank, by 50 basis points to 9 percent.

The policy rate was last increased by 50 basis points to 8.5 percent on May 8.

However, Monzur of the BIDS believes the conventional method of hiking the repo rate is not enough by itself.

"Policy rates have already been increased from about 5.5 percent to 9 percent in one year or so, but we did not see any positive impact on inflation," he said.

"My understanding is that supplementary measures were not taken properly. As the new governor hinted, he will raise the policy rate up to 10 percent in the next two months. Now, we have to observe its impact," he said.

Monzur also cautioned that there was a risk of micro, small and medium enterprises (MSMEs) being disproportionately affected by the rate hike.

"We need to be careful to ensure that the agriculture and SME sectors are not affected by the interest increase," he said.

"Also, it is necessary to review the channels through which the policy rate hike works. A policy rate of more than 10 percent is not desirable for Bangladesh's economy," he said.

Instead of being overly reliant on policy rate hikes, an accommodative monetary policy with supportive fiscal policy is needed to contain inflation, Monzur added.

For all latest news, follow The Daily Star's Google News channel.

For all latest news, follow The Daily Star's Google News channel.

Comments