How some non-banks tamed bad loans

When most non-bank financial institutions (NBFIs) in Bangladesh are in hot water with high ratios of non-performing loan (NPL), a handful have been successfully able to keep the rate low.

Good governance, selection of diligent borrowers and proper risk management have helped secure the low ratio, according to top executives of the NBFIs.

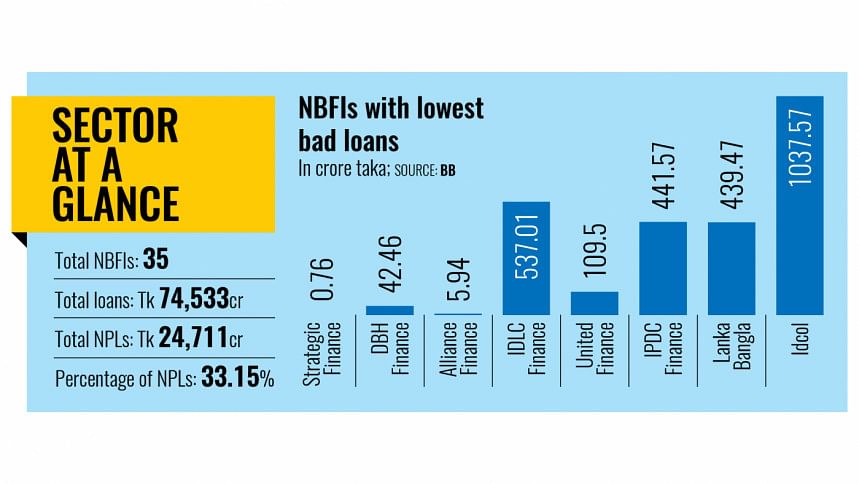

While the average NPL ratio of the country's 35 NBFIs rose to over 33 percent as of June this year, it was around or less than 10 percent for eight, according to Bangladesh Bank data.

Furthermore, five of these NBFIs registered NPL ratios of around or less than 5 percent.

For example, the NPL ratio of Strategic Finance was 0.67 percent.

Besides, the NPL ratio of DBH Finance and Alliance Finance, which was previously known as Lankan Alliance, stood at 0.96 percent and 1.22 percent respectively.

Alliance Finance's loan portfolio was to the tune of Tk 488 crore while that of DBH Finance was Tk 4,443 crore.

Meanwhile, IDLC Finance and United Finance had NPL ratios of 4.71 percent and 5.13 percent respectively.

The IDLC and United's loan portfolios amounted to Tk 11,403.83 crore and Tk 2,133.75 crore respectively.

IPDC Finance registered an NPL ratio of 6.41 percent with a total outstanding loan of Tk 6,893.21 crore.

Lanka Bangla had an NPL ratio of 7.42 percent with outstanding loans of Tk 5,926.7 crore.

The NPL ratio of Infrastructure Development Company Limited was 10.55 percent while it loan portfolio stood at Tk 10,176.98 crore.

The important factors are the selection of diligent borrowers, proper risk management, adequate industry knowledge, robust compliance culture and, most importantly, well-trained employees, said Kanti Kumar Saha, vice chairman of the Bangladesh Leasing and Finance Companies Association (BLFCA).

For example, Alliance Finance, a joint venture finance company between Bangladesh and Sri Lanka, hired professional people in the top management, he said.

These people have experience working in multinational organisations, and they try to bring the global best practices in their work culture, he said.

In addition, the company continuously arranges trainings for employees to improve their skill sets in order to cope with the ever-changing challenges of businesses as well as the financial sector, Saha said.

Besides, the directors are highly educated and financial sector specialists at home and abroad.

They put the highest priority on good governance and refrained from interfering in the management process in order to build up a premier and sustainable finance company with the help of innovation and technology, he added.

Talking to The Daily Star, Anis A Khan, a distinguished banker and financial professional, reflected on his experience as managing director and CEO of IDLC for six years and chairman of the BLFCA.

He highlighted the importance of good governance.

"In those days, NBFIs such as IDLC and IPDC demonstrated strong governance practices," he said.

Khan, also a former chairman of the Association of Bankers Bangladesh, emphasised that effective corporate governance was the cornerstone of their success.

First and foremost, the board members must avoid issues that lead to a conflict of interest, such as taking loans under their names or supporting dubious business proposals, he said.

Secondly, Khan stressed on the significance of a robust credit administration, drawing from his experience at Standard Chartered Bank in Dubai.

He pointed out that strong credit risk management, strict loan appraisal processes, and regular borrower monitoring, including site visits, are critical for ensuring proper use of loans.

Thirdly, he suggested that the NBFIs support borrowers facing genuine difficulties due to external factors, such as commodity price fluctuations or unforeseen events, helping them recover and sustain their businesses.

"These three ingredients are very important," he said.

Fourthly, Khan urged the NBFIs to take strict measures against wilful defaulters, including legal measures and asset sales.

For defaulting companies that remain operational, he proposed facilitating mergers or acquisitions with other businesses in the same industry in order to recover the NPLs.

However, he acknowledged the challenges, such as lengthy periods required, in recovering the NPLs through courts.

Still, he urged for the NBFIs to engage skilled lawyers and persistently pursue their cases.

For all latest news, follow The Daily Star's Google News channel.

For all latest news, follow The Daily Star's Google News channel.

Comments